Fund managers are dubious about the current stock-market rally, according to a survey released on Tuesday.

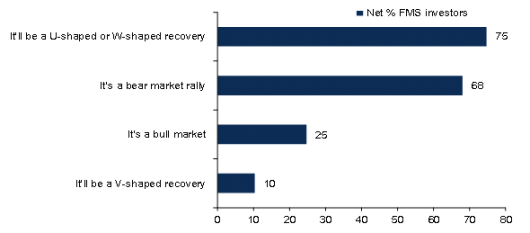

More than two-thirds say the rally that has sent the S&P 500 SPX, +3.15% up 32% from the lows of March is a “bear-market rally” rather than a new bull market, according to the Bank of America global fund manager survey. A quarter did say it was a bull market.

A bull market is commonly defined as a gain of at least 20% from its lows.

Three-quarters of the fund managers say they expect a U- or W-shaped economic recovery, with just a 10th expecting a V-shaped improvement.

That pessimism was reflected in their positioning.

Investors are short emerging markets for the first time since September 2018, and bond allocation was the highest since July 2009.

Investors are also underweight cyclical assets (energy, equities, Europe) and overweight defensive assets (health care, cash, bonds).

In fact, there is the widest spread between investors who are long U.S. equities — 24% overweight — and short eurozone SXXP, -0.99% stocks — 17% underweight — since June 2012, when the Continent was emerging from the debt crisis.

Cash levels were elevated at 5.7% in May, compared with 5.9% in April.