As federal lawmakers debate another relief package for the coronavirus pandemic that’s put approximately 35 million Americans out of work, a new study shows how generous (or not) the added unemployment benefits were in the initial stimulus bill addressing the crisis.

Two-thirds (68%) of jobless workers would bring home more money from their state unemployment insurance plus the $600 weekly supplement from the federal government than they would have on the job, according to University of Chicago researchers.

In fact, one in every five eligible workers would receive benefits that were double their lost earnings, added the researchers, who emphasized that they weren’t taking a position on whether the temporary benefits were too much or too little.

Key Words:Trump adviser Kudlow says administration is looking ‘very carefully’ at a ‘return-to-work bonus’

The median earnings-replacement rate was 134% of lost wages, they estimated. In every state, the median earnings-replacement rate exceeded lost wages, ranging from 129% in Maryland to 177% in New Mexico.

The supplemental $600 weekly benefit was one part of the $2.2 trillion CARES Act that also included direct $1,200 checks to most Americans, and potentially forgivable business loans. The additional jobless benefits expire at the end of July.

“ Approximately 40% of all jobs paying less than $40,000 per year in February were gone in March, according to Federal Reserve Chairman Jerome Powell. ”

The Chicago study, distributed by the National Bureau of Economic Research this week, said the benefit was a “substantial income expansion” for lower-income workers but pointed out that many workers might have also lost health insurance when they lost their wages.

Don’t miss:Expanded unemployment benefits: Who qualifies, how to apply

Lawmakers passed the Coronavirus Aid, Relief and Economic Security (CARES) Act in late March to quickly inject cash into the economy as the country reeled from the outbreak and its fast-moving fiscal consequences.

Approximately 40% of all jobs paying less than $40,000 per year in February were gone in March, according to Federal Reserve Chairman Jerome Powell. The country’s unemployment rate hit 14.7% in April as 20.5 million jobs vanished in that month alone, according to the Bureau of Labor Statistics.

The flat rate, however, could have uneven effects because the system “essentially pays bonuses to some workers who are laid off (which might lead to advantageous increases in social distancing) but provides no additional pay for otherwise similar frontline workers.”

For example, a janitor at a still-open business might not get hazard pay, but an unemployed janitor could get 158% of his or her prior wage, the study said. (Researchers looked at U.S. Census data on job salaries and plugged the numbers into an unemployment benefits calculator they built. They said they compared their own estimates on statewide average benefits from likely jobless claimants against average benefits from actual claimants, as reported by the Department of Labor.)

In 2018, median household income was $63,179, according to census figures.

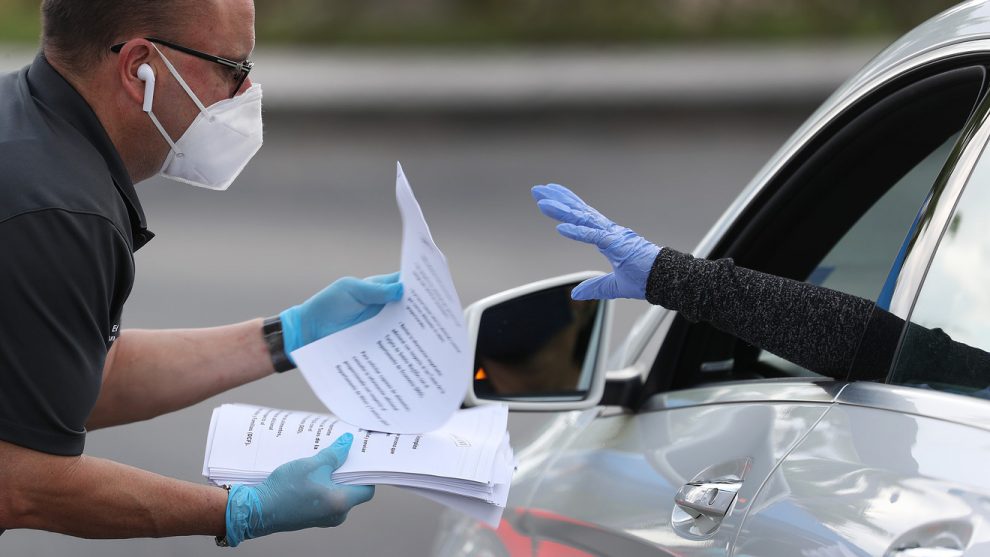

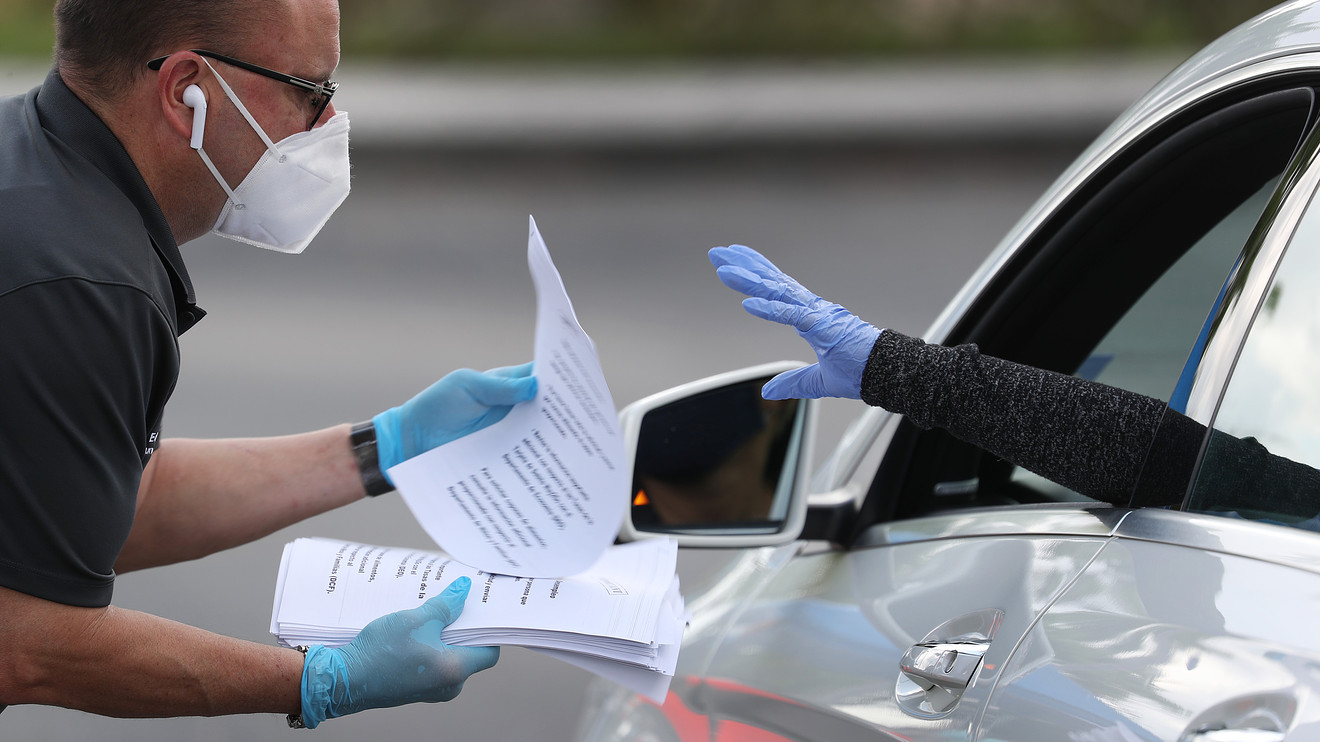

The CARES Act authorized extra payments, but observers say that, between the bureaucracy and the deluge in claims, the money might not be getting into the pockets of all eligible workers. Only 37 out of every 100 eligible workers have successfully made it through the unemployment application process, according to the left-leaning Economic Policy Institute.

The researchers emphasized they weren’t taking a position on how much the added unemployment benefits should offer. There are arguments for both sides, they said. On the one hand, the money provides much-needed liquidity, but, on the other hand, high payout rates could discourage some from moving back in the workforce.

Plenty of other people have opinions about the added unemployment benefits.

Several Republicans pointed out many workers could make more money through unemployment during the Senate debate on the CARES Act. They proposed an amendment that would pay workers their lost earnings, nothing more.

“Let’s give them that helping hand and not apologize about it for a minute,” Sen. Dick Durbin, a Democrat from Illinois, responded.

The amendment failed and senators unanimously approved the bill in late March. In a statement after the bill’s passage, Department of Labor Secretary Eugene Scalia noted the bill’s enhanced unemployment benefits and other measures “will put businesses and workers in a better position to resume work and re-boot the economy once the virus is contained.”

Since then, the Democratic-majority House of Representatives passed the HEROES Act, which would, among other things, extend the same $600 supplemental unemployment benefit to January. Sen. Mitch McConnell, the Republican majority leader, brushed off the bill as a Democratic “wish list.”

Treasury Secretary Steven Mnuchin said Congress will likely need to pass another relief bill but said unemployment benefit rates needed to be addressed. “We do need to fix the quirk that, in certain cases, we’re actually paying people more than they made,” he said.

Other studies suggests millions of people are struggling to make ends meet, and are using the government money for necessities. Nearly one-third of stimulus-check recipients (30%) say they are using the money to pay bills, according to a recent report by YouGov.