(Bloomberg) — A top-performing fund manager who bought Amazon.com Inc. and Alphabet Inc. more than a decade ago is betting on winners from the Covid-19, believing the pandemic will fundamentally change people’s lifestyles.

Mark Urquhart, who helps manage Baillie Gifford & Co.’s Long-Term Global Growth Equity Fund, says he’s picking up companies that may benefit from the growing trend of online and stay-at-home services, as the prolonged spread of the coronavirus will eventually alter consumer behavior.

“We’ve been looking at companies that can benefit in the long-term from changes,” said Urquhart, who works at the $245 billion Edinburgh-based firm. “What the virus has done is accelerated some of the changes, perhaps open people’s minds, to consuming in different ways. And they realize the convenience. The economy is being more flexible. We see these companies will be larger in 10 years.”

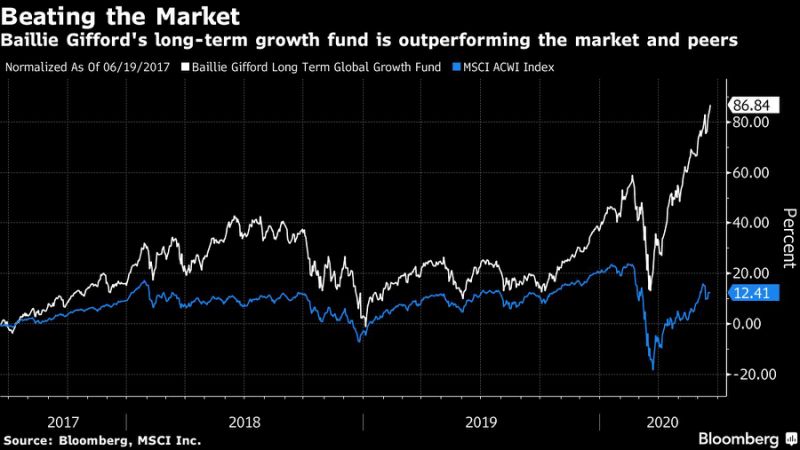

The fund is beating 99% of peers in three-year annual returns and is ahead of 62% of them year to date with a gain of 37%, according to Bloomberg-compiled data.

Along with Netflix Inc. and Tencent Holdings Ltd, the fund has bought Netherlands-based payments platform Adyen NV. Tencent-backed Chinese food delivery giant Meituan Dianping is also a favorite, as is interactive exercise firm Peloton Interactive Inc.

Adyen is “a company that we think benefits from many of the ongoing trends of people shopping more remotely,” Urquhart said. “Consumers won’t recognize the brand, but it’s very important.”

The fund’s high returns come from its bottom-up investing, with managers looking for industry disruptors. Top holding Amazon, which makes up 8.46% of the fund, was one of its initial picks when the fund was first initiated in 2005. The stock has risen 5,892% since then. Alphabet was added in 2008, followed by Tencent and Baidu Inc. in 2010, with Alibaba Group Holding added in 2015.

In South Korea, Urquhart says he’s watching Softbank Group-backed e-commerce giant Coupang Corp., which is reported to be preparing an initial public offering as soon as 2021, rather than industrial stocks or conglomerates like Samsung Electronics Co.

“I’m interested in Coupang, it’s a classic disrupting company,” he said. “We had held Samsung in the past, at the moment we don’t find growth prospect as attractive.”

(Adds a super tout)

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”51″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”52″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.