It is hard to read current trade negotiations with the Chinese.

The attitude toward China today resembles that of Japan in the 1980s. The negotiations reminded me of the best-selling novel and film “Rising Sun,” dedicated to the fears about the rise of Japan, where there are complications around the takeover of troubled U.S. semiconductor company Microcon by the Japanese conglomerate Nakamoto. This film may be about the way the Japanese negotiate, but it is my experience that there are similarities with other Asian nations.

Notable lines from the film:

“We are playing that most American of games.”

“What’s that?”

“Catch-up.”

“Business is war.”

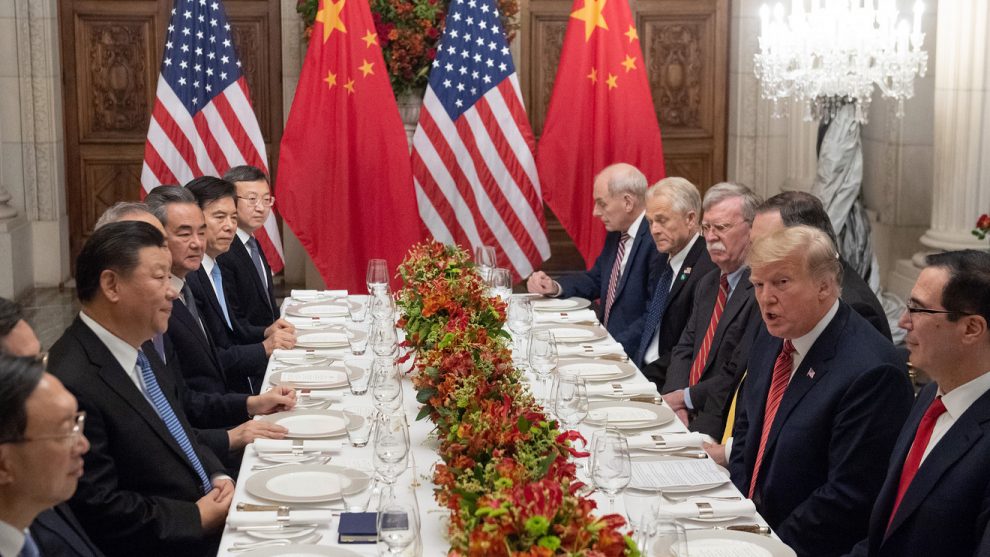

The S&P 500 SPX, +0.29% made an all-time high after the U.S.-China trade talks restarted and President Trump shook hands inside North Korea with Kim Jong Un. In the retail business, that is what they call “two for the price of one.” The bid in the stock market is because the potential for a trade deal with China and denuclearizing North Korea in President Trump’s first term are on the table again, which he accomplished with one diplomatic shuttle. If he manages to denuclearize North Korea, I think Trump could be awarded the Nobel Peace Prize. And he would deserve it a heck of a lot more than President Barack Obama, who got the prize in 2009. (For more, see “How to invest in North Korean denuclearization.”)

I suppose the Chinese stock market will rebound too, given that the Chinese have more to lose in the trade war, as Trump would say. In all honesty, both countries have a lot to lose if the trade war spirals out of control and creates a recession in the U.S. and China, which basically means a global recession. The global economy will have gross domestic product (GDP) of over $87 trillion in 2019, according to the International Monetary Fund. Of that, about a quarter ($21.3 trillion) will come from the U.S. and $14.2 trillion will come from China. In other words, out of $87 trillion, over 40% ($35.5 trillion) comes from the two countries in the middle of the trade dispute. That’s a lot. It is not hard to see how a trade situation spiraling out of control could cause a global recession.

Personally, I don’t believe that either The Donald or his counterpart — the Sun Tzu Disciple from Beijing — want to launch a global recession, but because of the spectacular debt overhang in the Chinese economy, it is also possible that the Chinese need political cover from a failed trade negotiation to devalue the yuan. In other words, I think Trump wants a trade deal, but I am not sure about the Chinese. (For more, see “China has a silver bullet in its trade-war arsenal.”)

It has to be stressed that it is not possible to eliminate the economic cycles in a pure capitalist economy, which is what the Chinese appear to be trying to do. In the U.S., the volatility of GDP growth has gone down since the creation of the Federal Reserve in 1913, and many Fed chairpersons have pointed that out over the years. Many critics of the Fed have said the volatility of GDP has fallen at the expense of increased debt in the U.S. economy, which is a function of suppressing short-term interest rates below the level of inflation to stimulate additional debt.

Some of those Fed critics over the years would probably be turning over in their graves if they knew of the innovative uses of the Federal Reserve balance sheet via the practice of quantitative easing (followed by present-day quantitative tightening), which former Chairman Ben Bernanke should be given credit for.

Be that as it may, the QE gymnastics performed by Bernanke prevented the U.S. economy from deleveraging. The total debt-to-GDP ratio did fall from 380% in 2009 to about 345%, but it has recently flattened out near that level, as of the end of 2018. (Enterprising minds can track the total level of debt in the U.S. economy via the TCMDO series symbol from the St. Louis Fed website and get the updated total leverage ratio in the U.S. economy by dividing it by the present level of U.S. GDP.)

China’s debt pile

The Chinese have engineered the same type of debt overhang as we have in the United States, but at a much faster pace. They borrow money as fast as a kung fu master wields a sword. It took from 1953 to 2009 for the total (public and private) U.S. debt-to-GDP ratio to move from 130% to 380%, with the Fed managing to stop a Great Depression-type of deleveraging post-2009, stabilizing the ratio near 350%.

If there is a Chinese trade deal — and that is a very big if — I do not believe that there will be four interest rate cuts by the Fed in the next 12 months, as currently discounted by the fed funds futures markets, although a July 31 rate cut has more or less been promised by the U.S. central bank. (For more, see “A China trade deal could cancel Federal Reserve interest-rate cuts.”)

I do not believe in the veracity of most Chinese economic statistics. One example is the high likelihood of the Chinese having suffered a bad recession in 1993 — never officially admitted but evidenced by reported loan losses of major banks (which prompted the 34% devaluation of the yuan). I think that better indicators for where the Chinese economy is going will be commodity prices, which are traded on global exchanges and cannot be doctored by Chinese authorities.

The LME (London Metals Exchange) Index has rebounded somewhat, but over the past year it has been weaker than the price of crude oil, which is the most important commodity, representing over 80% of the total value of global commodity trading. Unfortunately, crude oil is also the most political commodity and its price recently has been affected by Persian Gulf tensions and exploding tankers. If there is no military escalation and/or supply disruption in the Gulf, crude oil will be a good barometer for China’s economy as they are the biggest importer of crude oil, but one should also keep an eye on industrial metals (see chart).

The biggest producer of crude oil is the good old USA, which has tripled production in the past 10 years, thanks to shale exploration (see chart). I always wonder how shale producers managed to hit an all-time record of production with half the rigs from the previous peak, but shale oil is a case-by-case business, as different wells can have two to three times the costs of others. It would appear that high-cost wells have been shut off and lower-cost well production has expanded, as would happen in a true capitalistic economy (not like China’s).

Ivan Martchev is an investment strategist with institutional money manager Navellier and Associates.

Add Comment