(Bloomberg) — U.S. equity futures jumped and stocks in Asia looked set for a steady start Thursday after a surge in Facebook parent Meta Platforms Inc. in late trading helped to soothe investor sentiment.

Most Read from Bloomberg

Contracts for the tech-heavy Nasdaq 100 rose over 1%, while those for the S&P 500 also climbed. Futures for Japan, Australia and Hong Kong advanced. The U.S. stock market posted a modest gain at the close Wednesday.

Meta surged about 18% in extended trading after Facebook’s main social network added more users than projected. That brightened the mood toward megacap U.S. tech stocks.

Treasury yields jumped across the curve as investors continue to grapple with concerns about the impact of high inflation and aggressive Federal Reserve policy tightening. The dollar extended its advance and gold slid.

Meanwhile, Chinese stocks traded in the U.S. climbed the most since early April after Beijing stepped up pledges of economic support amid Covid lockdowns.

The latest development came from China’s cabinet, which vowed to stabilize employment. Officials have already committed to boosting infrastructure construction, while the People’s Bank of China has said it will step up monetary policy support.

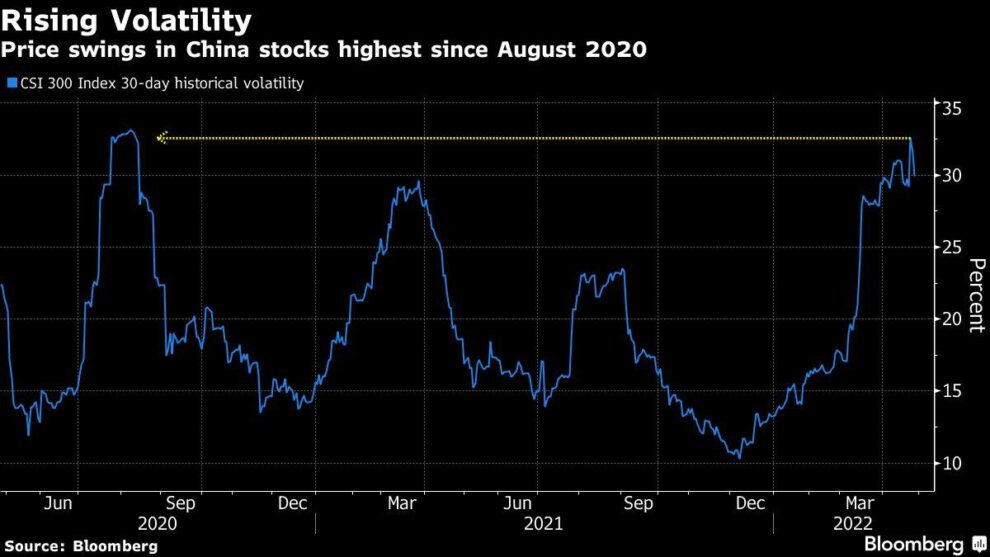

China’s struggle to suppress Covid, Russia’s war in Ukraine and worries that the Federal Reserve may tip the world’s largest economy into a recession are continuing to whipsaw markets. At the same time, there are lingering hopes that robust U.S. corporate earnings so far could improve the mood.

“The uncertainty factor is some of the highest we’ve seen in the course of the last number of years,” Kate Moore, BlackRock global allocation team head of thematic strategy, said in a Bloomberg Television interview. “There are so many crosscurrents. And against that backdrop, it’s hard to see volatility come down dramatically.”

Elsewhere, the Bank of Japan is expected to keep its main monetary settings unchanged at its meeting Thursday, even as the yen’s rapid weakening to a two-decade low fuels market speculation about a possible adjustment to policy or messaging.

In commodities, oil was close to $102 a barrel. The market is struggling to find direction amid Germany’s support for a gradual ban on Russian crude and bearish headwinds created by China’s lockdowns.

What will be the 2022 peak in U.S. 10-year yields and in which quarter will it happen? And what rock or pop song best encapsulates Fed monetary policy? Get involved in this week’s MLIV Pulse survey by clicking here. Participation takes one minute and is anonymous.

Events to watch this week:

-

Tech earnings include Amazon, Apple

-

EIA oil inventory report, Wednesday

-

Bank of Japan monetary policy decision, Thursday

-

U.S. 1Q GDP, weekly jobless claims, Thursday

-

ECB publishes its economic bulletin, Thursday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.7% as of 7:18 a.m. in Tokyo. The S&P 500 rose 0.2%

-

Nasdaq 100 futures rose 1.2%. The Nasdaq 100 was little changed

-

Nikkei 225 futures rose 0.1%

-

Australia’s S&P/ASX 200 Index futures gained 0.7%

-

Hang Seng Index futures rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.5%

-

The euro was at $1.0556

-

The Japanese yen traded at 128.37 per dollar

-

The offshore yuan was at 6.5887 per dollar

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $101.72 a barrel

-

Gold was at $1,885.58 an ounce

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.