Jack Taylor/Getty Images

Jack Taylor/Getty Images

Uber Eats is devouring the delivery market, but it may eventually bite off more than it can chew.

Uber UBER, -7.62% had a lackluster IPO Friday with stock trading below its IPO price of $45. The success of Uber Eats is critical part of the company’s strategy going forward, Uber said in its IPO prospectus. The rideshare app’s Uber Eats platform, with a network of restaurants in over 500 cities globally, raked in $7.9 billion in gross bookings in 2018, according to the IPO prospectus filed with the Securities and Exchange Commission. Uber said it’s penetrated just 1% of the $795 billion meal-delivery market.

But it faces stiff competition from companies like GrubHub GRUB, -2.62% Postmates and DoorDash.

Consumers pay 42% more using third-party and restaurant delivery apps than when they buy takeout or even eat in the restaurant, The NPD Group said.

Nearly half (47%) of all dinner meals purchased from a restaurant are consumed at home, but most of those meals being picked up or carried out, said David Portalatin, an analyst with The NPD Group. Restaurant online orders have grown on average 23% annually since 2013 and will triple in volume by 2020, he said.

Consumers pay 42% more using third-party and restaurant delivery apps than when they buy takeout or eat in the restaurant, The NPD Group said. That’s largely due to the restaurant’s delivery fees and/or the fees charged to the restaurant by the app.

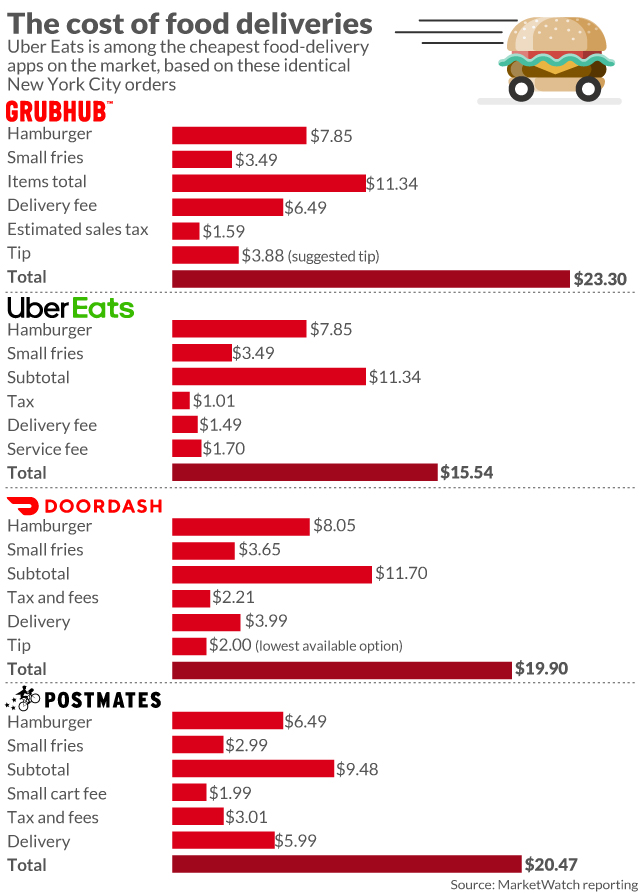

MarketWatch ordered the same meal to be delivered to the same location on four different delivery apps in New York City and found a $7.76 difference between the cheapest and most expensive options. UberEats was the cheapest.

Grubhub added a delivery fee ($6.49) and a suggested tip ($3.88), however, users can choose their preferred amount of gratuity. Postmates added “tax and fees” charge, plus a $3.99 delivery charge; and automatically added a tip ($2.00 was the lowest available option). Uber Eats charged the same standard menu price for the burger and fries, and a delivery fee of just $1.49 and a lower $1.70 service fee.

Grubhub disputed the finding that Uber Eats was the cheapest, and pointed MarketWatch to a recent report by Peter Saleh, an analyst at investment bank and equity research firm BTIG, that showed its meal delivery service was most cost effective.

DoorDash, PostMates and Five Guys did not immediately return a request for comment.

Uber Eats seems to be focused more on scale than profit ahead of the IPO, analysts said. The IPO prospectus said it does “a significant amount” of business with “a limited number of restaurant chains,” and charges a lower service fee for some of those restaurants.

Uber declined to comment on this story; it referred MarketWatch to the IPO prospectus.

Some restaurants are pivoting to delivery-only models

The demand for delivery has prompted some business owners to rethink their restaurant models. The Halal Guys, a Manhattan-based food cart turned brick-and-mortar global franchise, has seen a jump in delivery sales, which now account for 15% of its overall sales, it said.

The company, which started in the 1990s, has already made changes to the physical layout of its stores, providing more space for pickup orders and implementing more parking for delivery drivers.

Restaurants typically pay 20% to 30% per order to delivery apps. Many restaurants use multiple third-party platforms.

Restaurants typically pay 20% to 30% per order to delivery apps, and many restaurants use multiple third-party platforms.

“You can’t afford not to have them all,” says Stratis Morfogen, a New York City-based restaurateur who says he’s enlisted Seamless, Uber Eats, Caviar and Grubhub. “It’s four times the exposure,” he says.

Matt Sheppard, COO of mini chain Hummus & Pita Co., said delivery apps have been helpful for luring customers, but he plans to ultimately direct customers to its own proprietary delivery app and website. He will sweeten the deal on his own app with a reward program.

But some restaurant owners say delivery apps charge too much for their services. Chase Devitt, executive chef and partner at BriDer, a Denver-based American eatery, made a deal with Postmates to be the restaurant’s exclusive delivery service. That app, he says, takes 12% per check.

Other services were taking 25% to 30% from each check. “That, coupled with the increasing costs of to-go supplies makes it really hard to make any money,” he says.

Get a daily roundup of the top reads in personal finance delivered to your inbox. Subscribe to MarketWatch’s free Personal Finance Daily newsletter. Sign up here.