Uber shares dropped as much as 12% in extended trading Thursday after the company delivered disappointing second-quarter results.

Shares remained down roughly 8% in premarket trading Friday.

It was a miss on both top and bottom lines for Uber. Net losses for the ride-hailing company soared to $5.24 billion, largely owing to stock based compensation.

Here’s how the numbers stacked up otherwise versus analysts’ expectations (according to consensus estimates compiled by Refinitiv):

- Loss per share: $4.72, versus $3.12 expected

- Revenue: $3.17 billion versus $3.36 billion expected

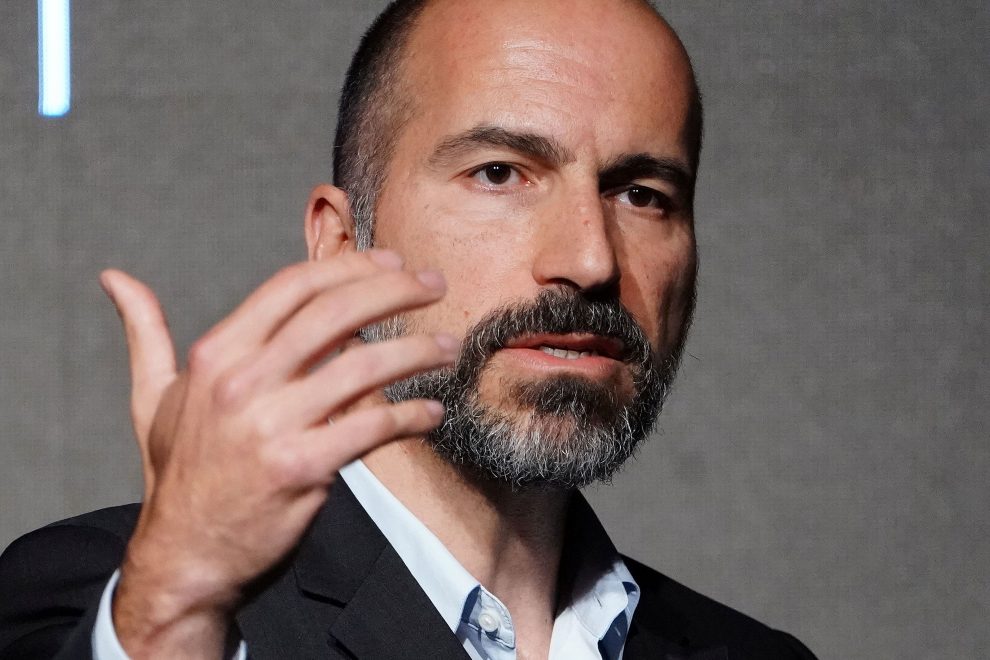

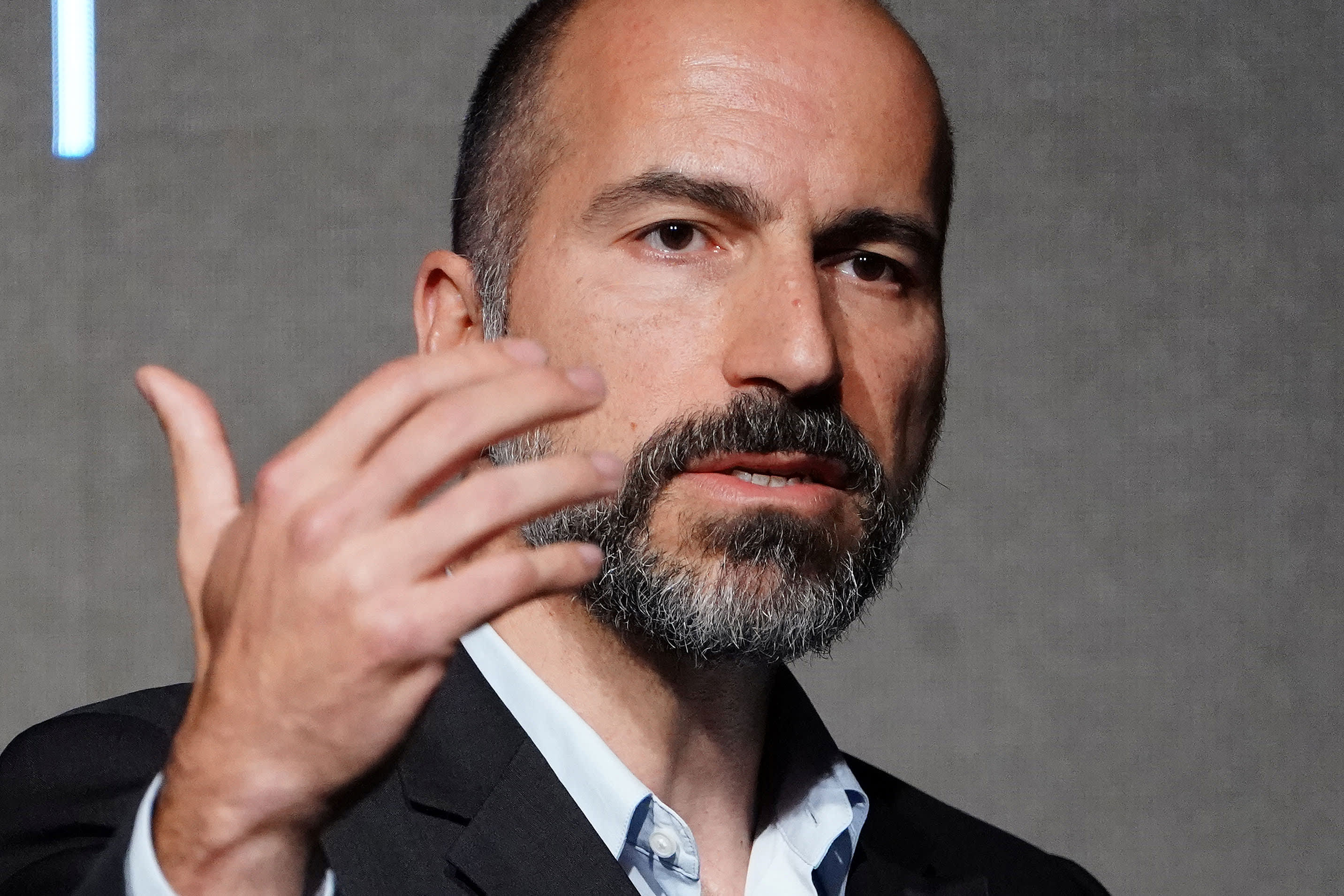

“We think that 2019 will be our peak investment year and we think that 2020, 2021, you’ll see losses come down. I think our break even is something that we can push the company to break even if we really wanted to frankly,” said CEO Dara Khosrowshahi in a conversation with CNBC’s Deirdre Bosa. “No doubt in my mind that the business will eventually be a break even and profitable business.”

Excluding stock-based compensation, Uber’s losses were around $1.3 billion, roughly 30% worse than in the preceding quarter.

While Uber helped establish ride-hailing in markets all over the world, over the past decade, the company has been investing in and operating myriad “on-demand” businesses including food delivery, bike-sharing and a freight service that matches shippers with carriers who can haul their goods.

Uber’s core ride-hailing business generated $12.19 billion in gross bookings during the second-quarter of 2019, beating analysts’ estimate of $12.11 billion in gross bookings. But the newer, Uber Eats business generated $3.39 billion in gross bookings falling short of analysts’ expectations of $3.51 billion in gross bookings.

Khosrowshahi said in the call with CNBC, “The Eats business is still a business that carries very significant growth going forward and that continues to attract a lot of capital. Not just in the US, but all over the world. With the eats business there’s a lot of capital chasing a lot of growth and we’re the leader on a global basis. So, I don’t expect that business to be profitable in the next year or year after frankly.”

In recent weeks, Uber cut approximately 400 jobs from its marketing team.

The company boasted over 30 million riders in 2018. In July, the Uber platform reached over 100 million “Monthly Active Platform Consumers” for the first time, the company reported on Thursday.

Still, Uber has been working to keep riders, and drivers, loyal to its app with membership offerings and loyalty rewards, while battling formidable competitors including Lyft in North America, and Grab and Didi in Asia.

Uber previously recorded a $1 billion loss on $3.1 billion in revenue in its first report as a public company in May 2019.

Now, Uber must convince investors that, under CEO Dara Khosrowshahi’s leadership, it is on a path to profitability with a realistic long-term plan for generating returns for investors. That’s no easy feat since Uber, like other ride-hailing providers, has long subsidized its rides.

Uber priced its IPO shares at $45 in its market debut, and shares closed on Wednesday ahead of the second-quarter update at $39.15, trending higher after hours after its chief U.S. competitor, Lyft, reported lower than expected losses, higher than expected revenue, and gave a rosier outlook for the rest of 2019.

—Paayal Zaveri contributed to this report.

Follow @CNBCtech on Twitter for the latest tech industry news.

This is breaking news. Please check back for updates.