Ultra-low interest rates are putting eurozone housing markets at greater risk for a bubble.

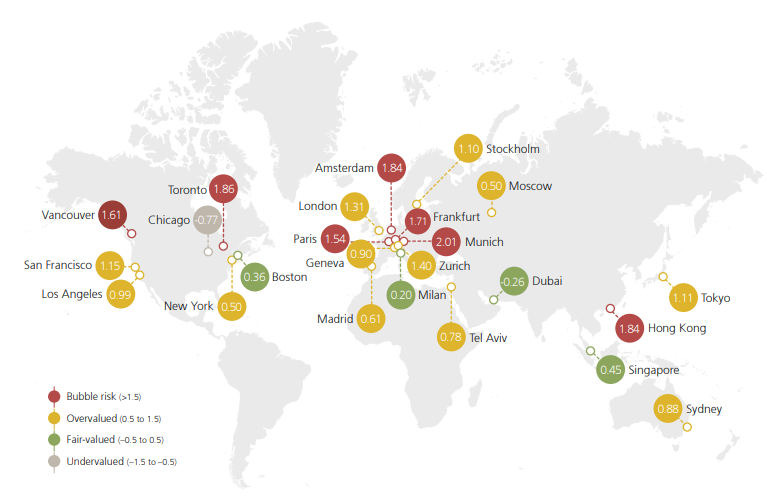

Munich is the most at risk of a bubble and Paris and Frankfurt entered the risk zone for the first time, UBS said as it released its annual global real estate index report. In fact index scores rose in all the cities in the eurozone UBS evaluated.

The European Central Bank this month further lowered its main deposit rate into negative territory.

“The expected economic slowdown – in particular in Germany – will test current price levels,” UBS said. Germany’s economy contracted in the second quarter, and many forecasters expect the same in the third quarter.

Affordability issues, political uncertainty and less favorable tax treatment are putting pressure on house prices in London, UBS said, as Britain’s capital city moved out of bubble risk territory.

By contrast, none of the U.S. cities — New York, Boston, Chicago, San Francisco and Los Angeles — rose in the bubble index, the first time that’s happened since 2011. UBS says Chicago is undervalued, but its increasing fiscal challenges have caused it to lag far behind.

The UBS index is a weighted average of price-to-income, price-to-rent, mortgage-to-GDP, construction-to-GDP and relative price-city-to-country indicators.