Under Armour on Monday reported quarterly earnings and sales that topped analysts’ estimates, but the company trimmed its revenue outlook for the full year, citing “traffic challenges.”

The lowered guidance and Under Armour’s confirmation of a federal probe of its accounting practices sent the retailer’s shares plunging more than 14% in premarket trading.

Here’s what Under Armour reported for its third quarter ended Sept. 30 compared with what analysts were expecting, based on Refinitiv estimates:

- Earnings per share: 23 cents vs. 18 cents expected

- Revenue: $1.43 billion vs. $1.41 billion expected

Under Armour said it now expects revenue to be up roughly 2% in fiscal 2019, compared with a prior range of up 3% to 4%. Analysts had been calling for annual revenue growth of 3.1%.

Net income during the quarter grew to $102.3 million, or 23 cents per share, compared with $75.3 million, or 17 cents a share, a year ago. That beat analyst expectations of 18 cents.

Net revenue dropped about 1% to $1.43 billion from $1.44 billion a year earlier. That beat expected sales of $1.41 billion.

Sales in North America, a trouble spot for the company, were down about 4%, totaling $1.01 billion.

The athletic apparel and sneaker maker has been struggling to grow sales on its home turf, in a crowded market with Nike, Adidas and Lululemon. Ahead of Monday’s earnings report, it was still calling for sales to decline slightly in North America in 2019. Last quarter, North American sales dropped 3%.

Under Armour said apparel sales overall dropped 1% during the third quarter, while footwear revenues plunged 12%, and accessories sales fell 2%.

On Sunday night, the athletic-leisure clothing-maker said it has been cooperating with the Securities and Exchange Commission and Justice Department into whether the company used bad accounting practices to make its finances look healthier.

“The company began responding in July 2017 to requests for documents and information relating primarily to its accounting practices and related disclosures, and the company firmly believes that its accounting practices and disclosures were appropriate,” a company spokesperson told CNBC in an email.

The company issued the statement after The Wall Street Journal revealed the probes on Sunday.

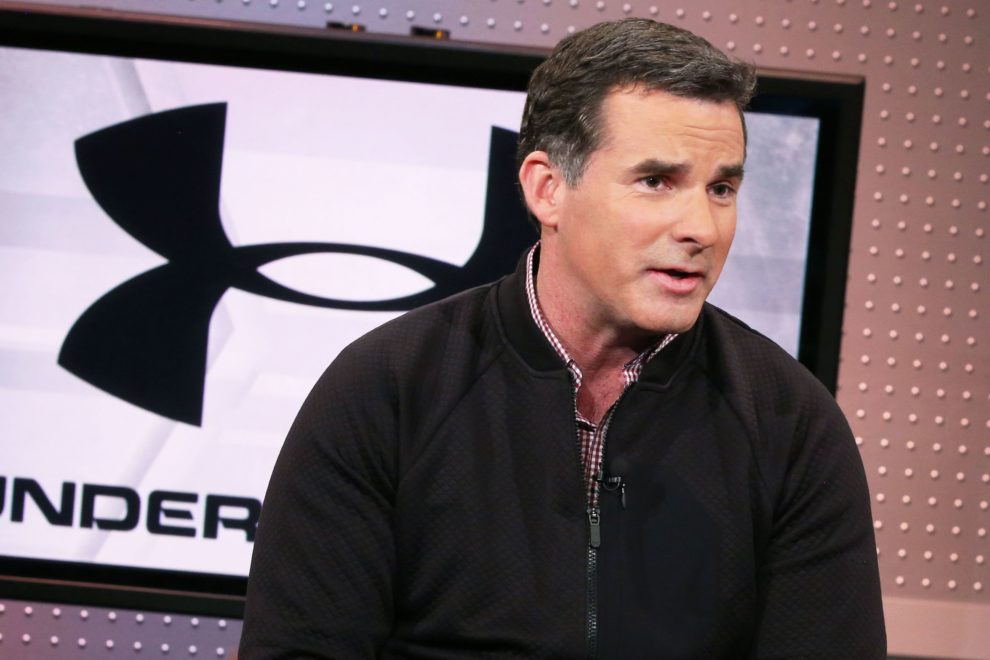

Word of the federal probe came after CEO Kevin Plank, in a surprise move last month, announced he will step aside from the chief executive role on Jan. 1, to be succeeded by COO Patrik Frisk. Plank is expected to transition to executive chairman and brand chief. A decision Plank said had been planned by the company.

Meantime, Under Armour says it has been responding to requests for documents related to its accounting practices since 2017, which is about when an incredible sales streak came to an end. Until the end of 2016, it had reported more than 20 consecutive quarters of sales growth topping 20%, making it one of the fastest growing retailers in the U.S.

On Jan. 31, 2017, after missing sales expectations during the holiday quarter, Under Armour said its then-finance chief, Chip Molloy, was leaving after about a year on the job, citing “personal reasons.”

Brad Dickerson had previously been CFO, from 2008 to February 2016. David Bergman, who had been holding various other finance roles, was named permanent CFO in December 2017, taking over after Molloy.

Under Armour shares as of Friday’s market close were up about 19.6%. The stock, which once hovered around $50, closed Friday at $21.14. The company is valued at roughly $9.5 billion. Nike shares are up about 20% this year, while Lululemon shares have surged 65%.