Unions are coming back and it’s pretty obvious, (to most of us), why.

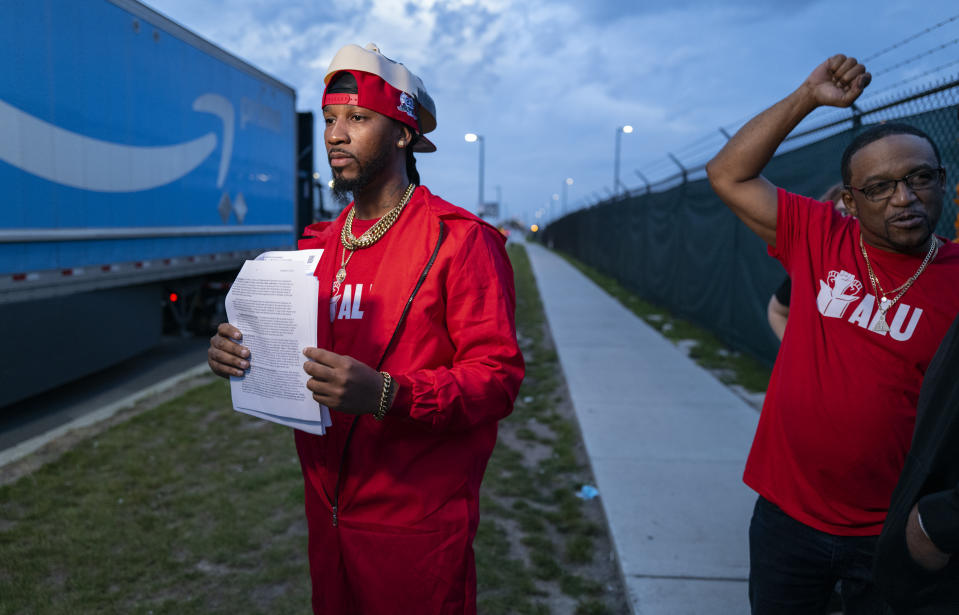

The numbers are pretty small, but because the organizing has been at companies like Starbucks (SBUX), Amazon (AMZN), Google (GOOG, GOOGL), Activision Blizzard (ATVI), Etsy (ETSY) and even Apple (AAPL), the optics and implications are huge.

“Starbucks was a company that everybody thought could not be organized. Amazon was a place people thought you didn’t even try to organize; digital media workers didn’t organize,” says Kate Bronfenbrenner, the director of labor education research at Cornell. “People thought that young workers didn’t want unions. All these myths are being exploded.”

What does this unionizing redux tell us?

For one thing, these companies aren’t exactly from your grandfather’s day when activists organized the steel, coal and auto industries. There isn’t much of that unionizing left to do in this country (excepting some foreign auto assembly plants in the South — and that has been tough going). The new surge is going after flagships of the tech and service economy.

Point two is that this activity signals employees at these companies feel they’re not getting a fair shake. That may sound axiomatic, but it’s worth stating for those who think this is some sort of left-wing plot. Sure, there is behind the scenes organizing, but workers are receptive only if they feel marginalized. Until recently, management of these newly iconic companies shared the spoils of their businesses equally enough to keep employees satisfied. Now income and wealth gaps have grown too wide.

Big tech companies and a few others have become massive wealth creation machines, with stock performance vastly exceeding the overall market, which benefits top executives disproportionately. Amazon has made Jeff Bezos one of the wealthiest people on the planet—worth $173 billion at last count. Apple is now the world’s most valuable company with a market value of some $2.7 trillion.

Starbucks, (like the video game giant Activision Blizzard), has lagged over the past half decade, but since its IPO in 1992, its stock has climbed 790% versus 177% for the S&P 500. Even Etsy, whose stock has fallen from a high of over $300 last fall to around $100 today, is still up some 10X over the past five years.

Matching these stratospheric gains in stock prices has been the rise in CEO compensation, most infamously measured by the ratio of CEO pay to the average worker.

According to the Economic Policy Institute, this gap is nearly as wide as ever: “CEO-to-worker compensation ratio was 21-to-1 in 1965. It peaked at 366-to-1 in 2000. In 2020 the ratio was 351-to-1.” And there’s this: “Compensation of the top CEOs increased 1,322.2% from 1978 to 2020 (adjusting for inflation). Top CEO compensation grew roughly 60% faster than stock market growth during this period and far eclipsed the slow 18.0% growth in a typical worker’s annual compensation.”

You may not agree with me when I say that’s just not right, but understand there are consequences.

A recent study from Bloomberg, (which notes that Senators Bernie Sanders and Elizabeth Warren recently proposed a tax on companies with outsize CEO-to-worker-pay ratios) shows: “The typical CEO among the 1,000 biggest publicly traded firms in the country receives 144 times more than their median employee. Around 80% of those companies would be subject to higher taxes because of the pay disparity.”

Who doesn’t agree with Bernie Sanders when he says anybody who works 40 hours a week shouldn’t have to live in poverty? “It has always been true, of course, that CEOs make more than their employees,” Sanders said at a recent Congressional hearing, as Bloomberg reported. “But what has been going on in recent years is totally absurd.”

According to Bloomberg’s math, Amazon, Starbucks, Apple and Activision Blizzard CEOs were all paid more than 1000 times the average workers. Google was 21-1. Etsy wasn’t tracked.

Speaking of Etsy, it’s not just the CEOs who are raking it in. It’s the entire C-Suite. This chart from Etsy’s most recent proxy shows the company’s NEOs (named executive officers) making many millions of dollars over the past three years.

I could say the same for other companies on this list. For example Apple’s NEOs make around $26 million a year, (though that company is far bigger, more successful and more complicated than Etsy, and as such, maybe the Apple execs are a bargain!) The point is that even at a company like Etsy, executives are making serious money, and seriously more money than employees, (and in the case of Etsy, more than sellers on its network).

Top executives of these companies have benefited from the stock market boom in two ways. One, they are often compensated in stock and two their compensation is often benchmarked based on their stock’s performance. Talk about a double dose!

Workers generally aren’t paid this way of course, or if they are, at far lower rates. Now they want a piece of the action. (I would caution everyone here to be wary of a possible flat or declining stock market going forward.)

BTW, I have to roll my eyes when I hear CEOs complain they can’t find workers to fill empty jobs. (“I don’t understand it. I gave them a raise four years ago from $7 an hour to $8.”) Duh.

A quote in this recent Insider article about the trucker shortage caught my eye:

“If you ask any trucker, it’s kind of like a broken record,” said Atkins, who’s been in the industry for three years. “It’s not a trucker shortage, it’s a pay shortage.’ Atkins said there’s a “major issue”: He can open up a job site, type in “truck driving job,” and see “a million ads” promising $100,000 to $120,000 a year. “But every trucker knows that is a 100% lie,” he said. As of 2020, the median pay for heavy and tractor-trailer drivers was $47,130 a year, according to the Bureau of Labor Statistics.

Bottom line: If employers keep paying their top execs more and holding down pay for everyone else, unions are going to keep rising up.

This article was featured in a Saturday edition of the Morning Brief on April 23, 2022. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

By Andy Serwer, editor-in-chief of Yahoo Finance. Follow him on Twitter: @serwer

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube