The earlier you start saving for retirement, the less painful it’s going to be.

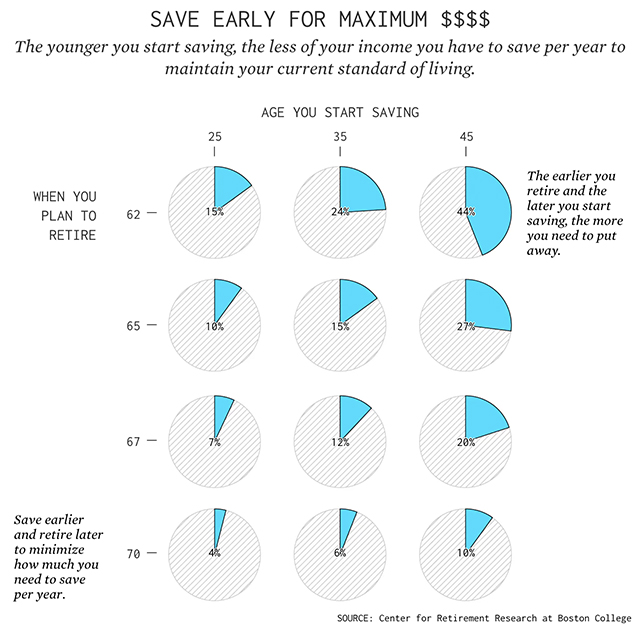

That’s one of the simple, but important, lessons illuminated in a new chart posted by data visualization site FlowingData.com — which revealed that many of us would need to save as little as 4% of our income, or as much as 44%, for retirement, depending on when you start saving and when you plan to retire.

FlowingData.com

FlowingData.com For example, if you start saving at 25 and plan to retire at 70, you’ll need to save just 4% of your income; meanwhile, if you start saving at 45 and plan to retire at 62, that percentage is 44%. The visualization uses data collected by the Center for Retirement Research at Boston College, which assumed you had a real rate of return of 4%, earned an average wage and were saving enough to replace 70% of your preretirement income in retirement (which includes Social Security benefits), among other assumptions.

By the way, if you’re thinking that barely anyone waits until their 40s or later to save for retirement, you’d be mistaken: Data show that more than 1 in 5 people don’t start saving until their 40s or older.

Other thought leaders think of the retirement savings calculations differently. Fidelity, for example, uses this guideline: “Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67,” it writes on its website. Others have thrown out numbers like $1 million (though MarketWatch points out that many of us will need far more than that) or calculations like 80% to 90% of your annual preretirement income and 12 times your preretirement salary.

Also see: Want to make millennials mad? Talk about saving for retirement

Of course, exactly how much you need to save depends on factors such as the lifestyle you will want to live in retirement, where you plan to retire, how you invest and more.

But whatever you end up saving, one thing is clear: For many of us, it won’t be enough — at least if we want to maintain or improve our current standard of living.

“Currently, about half of working-age households are not saving enough to maintain their preretirement standard of living in retirement,” writes the Center for Retirement Research at Boston College in the report referenced by FlowingData.com.

Other data show a similar trend: A study by the Transamerica Center for Retirement Studies found that the median retirement savings by age in the U.S. is $16,000 for people in their 20s, $45,000 in their 30s, $63,000 in their 40s, $117,000 in their 50s, and $172,000 in their 60s. That is far less than most financial experts expect us to need.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment