Go ahead, have that latte.

That’s probably not the thing that’s breaking the bank for you.

When Matt Kelly and his wife Cheri faced debts of roughly $65,000 in 2005, they decided something must be done. So they cut food costs from about $500 to $300 a month, and pared down entertainment and extras from their budget. But the big thing that tipped the scales in their financial favor: Slashing their housing costs, the Portland, Ore.-residents tell MarketWatch.

The Kellys, who lived in Colorado at the time, moved from a three-story condo to an 850-sq.ft pad. That cut their monthly housing costs from $1,300 to $685, allowing them to save more than $7,300 a year. (Had they just cut a $4-a-day latte habit, their annual savings would have been less than $1,500.) By 2007, the Kellys were debt free, and to this day, they save roughly 25% of their income, Kelly says.

“Cutting housing costs is a huge help in allowing us to live the life we want,” Kelly says.

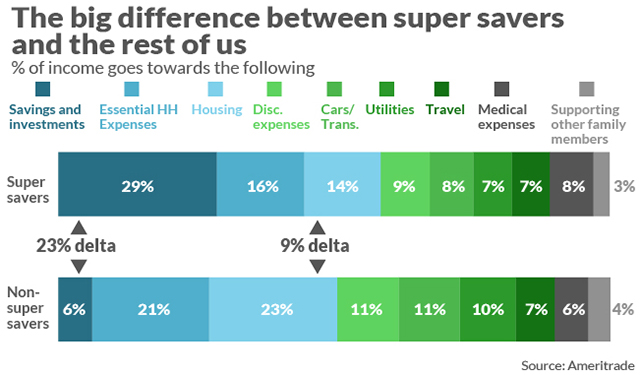

New research from TD Ameritrade — which looks at people who save 20% or more of their incomes, called “super savers” — shows that they may be onto something: The single biggest difference between what super savers spent less on, as compared to the rest of us, was housing. Super savers spent just 14% of their incomes on housing, while regular folks dropped 23%.

One reason super savers may scrimp on housing? “They may see expensive mortgage payments as a liability. Our data shows that they value freedom to do what they want as well as financial security and peace of mind,” explains Dara Luber, senior manager of retirement at TD Ameritrade.

In some ways, it may be easier to cut housing costs than make smaller conscious choices all day to cut out the things you love, like those lattes. After all, you move once, and your monthly mortgage or rent payments are slashed every month following.

Meanwhile, making choices frequently can lead to something called decision fatigue, which research shows can impact our ability to make the “right” choices as the day goes on.

And because housing is the biggest part of most Americans’ budgets, it’s extra important to save on it. Indeed, the average American household spends a total of roughly $60,000 per year; nearly $20,000 of that spending is on housing, government data shows.

Of course, it’s often easier said than done. Households often pay more for housing so they also get into a good school district or because an area is safer. And, it’s also possible that many of the savers interviewed in the TD Ameritrade study had lower housing costs because they put more down on their home when they bought.

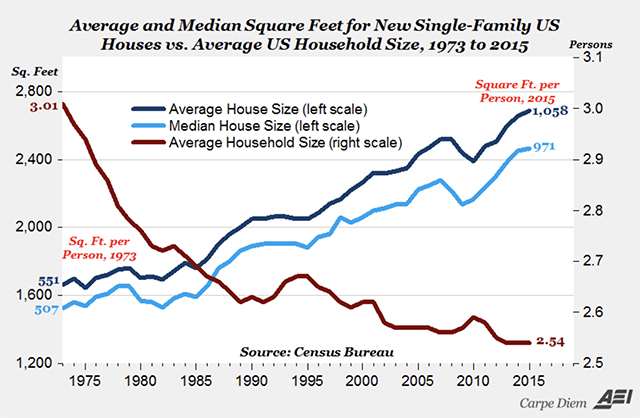

Still, it’s important to note that there’s plenty of room to downsize: New homes built in America today on average have 1,000 more square feet than they did in the 1970s, and living space per person has doubled.

And though you may think you need that space, it’s likely you don’t. As Kelly puts it: “I thought we would miss the larger space, but we didn’t. In fact, we felt more connected as a family. We have more conversations and more spontaneous interactions.”

Add Comment