It’s taxing to live in this state.

Kiplinger’s

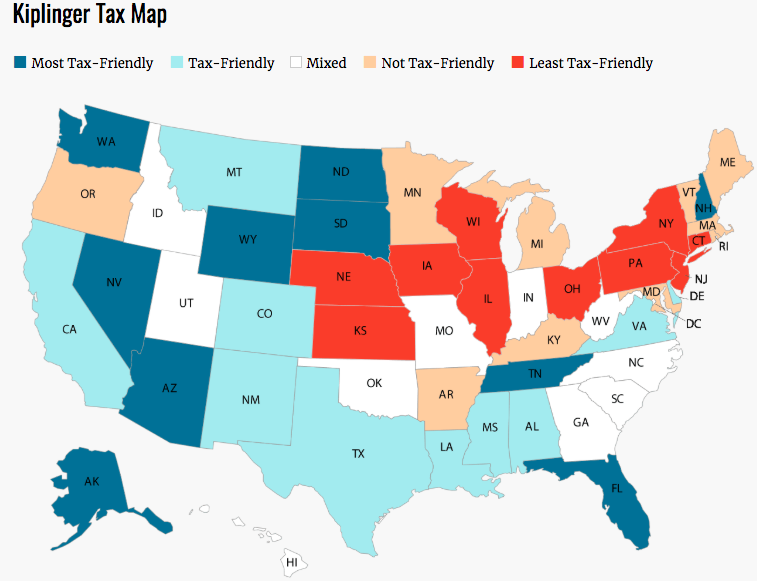

Kiplinger’s This week, the personal-finance publication Kiplinger’s released its list of the most — and least — tax-friendly states in America. To draw its conclusions, it used a hypothetical couple with two kids and $150,000 in income a year plus $10,000 in dividend income, and then looked at the income-, property- and sales-tax burden that family would face.

Illinois took the No. 1 spot on the list, thanks in large part to its high property taxes. The Land of Lincoln was followed by Connecticut and New York, both of which have pretty high-income taxes.

The 10 least tax-friendly states:

1. Illinois

2. Connecticut

3. New York

4. Wisconsin

5. New Jersey

6. Nebraska

7. Pennsylvania

8. Ohio

9. Iowa

10. Kansas

Meanwhile, the most tax-friendly states (in order) were Wyoming, Nevada and Tennessee. The first two don’t levy an income tax; Tennessee has an income tax, but it only applies to interest and dividends and not to salaries and other wages.

The 10 most tax-friendly states:

1. Wyoming

2. Nevada

3. Tennessee

4. Florida

5. Alaska

6. Washington

7. South Dakota

8. North Dakota

9. Arizona

10. New Hampshire

One surprise? California, widely considered a high-tax state, didn’t crack the top 10 least-friendly tax states. (Of course, it’s important to point out that this Kiplinger’s ranking would look different if the hypothetical family and its income and dividends were different.)

See: Three cities that ‘have it all’: Chicago, Porto and Melbourne

Rocky Mengle, the tax editor for Kiplinger’s, told MarketWatch that’s because many people “when they talk about California tax, they focus on the 13.3% [income tax] rate, which is the top rate — but that is for people making more than $1 million.” For many others, the rate is much lower, he said, adding that “California has a fairly progressive income tax, with nine brackets.”

Mengle added that these kinds of analyses are often useful to people looking to relocate, such as in retirement. He said retirees should “pay attention to what type of income they are going to be relying on in their golden years.” That’s because states can tax income, Social Security, money from an IRA or 401(k), rental-property income and other sorts of income differently.

For example, Social Security income is not taxed in most states, but 13 states do tax it: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. Even then, they don’t all tax it the same.

Retirees may also want to consider inheritance and estate taxes in the places they might consider moving to. Right now, 13 states and Washington, D.C., have an estate tax, and six have an inheritance tax. This NerdWallet guide can walk you through that.

Read on: What’s the worst city in the U.S. for flight delays?