Insights from the Latest 13F Filing for Q2 2024

ValueAct Capital (Trades, Portfolio), a seasoned investment firm with over two decades of experience, recently disclosed its 13F filing for the second quarter of 2024. The firm is known for its long-term investment approach, often holding stakes for 3-5 years, and sometimes even longer. ValueAct prides itself on working closely with management teams to enhance business models and strategies, ensuring sustainable growth and value creation. This quarter’s filing reveals some significant adjustments in its portfolio, including major increases and reductions in key holdings.

Key Position Increases

During the second quarter, ValueAct Capital (Trades, Portfolio) increased its stakes in two prominent stocks:

-

Salesforce Inc (NYSE:CRM) saw an addition of 428,000 shares, bringing the total to 3,914,309 shares. This adjustment marks a significant 12.28% increase in share count and a 3.09% impact on the current portfolio, with a total value of $1,006,368,840.

-

The Walt Disney Co (NYSE:DIS) also experienced a notable increase with an additional 715,000 shares, bringing the total to 6,133,631. This represents a 13.2% increase in share count, with a total value of $609,008,220.

Summary of Sold Out Positions

ValueAct Capital (Trades, Portfolio) completely exited two holdings in the second quarter of 2024:

-

CBRE Group Inc (NYSE:CBRE): The firm sold all 2,470,748 shares, resulting in a -5.29% impact on the portfolio.

-

Illumina Inc (NASDAQ:ILMN): All 243,777 shares were liquidated, causing a -0.74% impact on the portfolio.

Key Position Reductions

ValueAct Capital (Trades, Portfolio) reduced its position in six stocks, with the most significant changes noted in:

-

Fiserv Inc (FISV) saw a reduction of 2,551,882 shares, resulting in a -69.81% decrease in shares and an -8.98% impact on the portfolio. The stock traded at an average price of $151.37 during the quarter and has returned 6.73% over the past three months and 23.48% year-to-date.

-

Insight Enterprises Inc (NASDAQ:NSIT) was reduced by 450,000 shares, resulting in a -9.97% reduction in shares and a -1.84% impact on the portfolio. The stock traded at an average price of $194.36 during the quarter and has returned -4.26% over the past three months and 10.86% year-to-date.

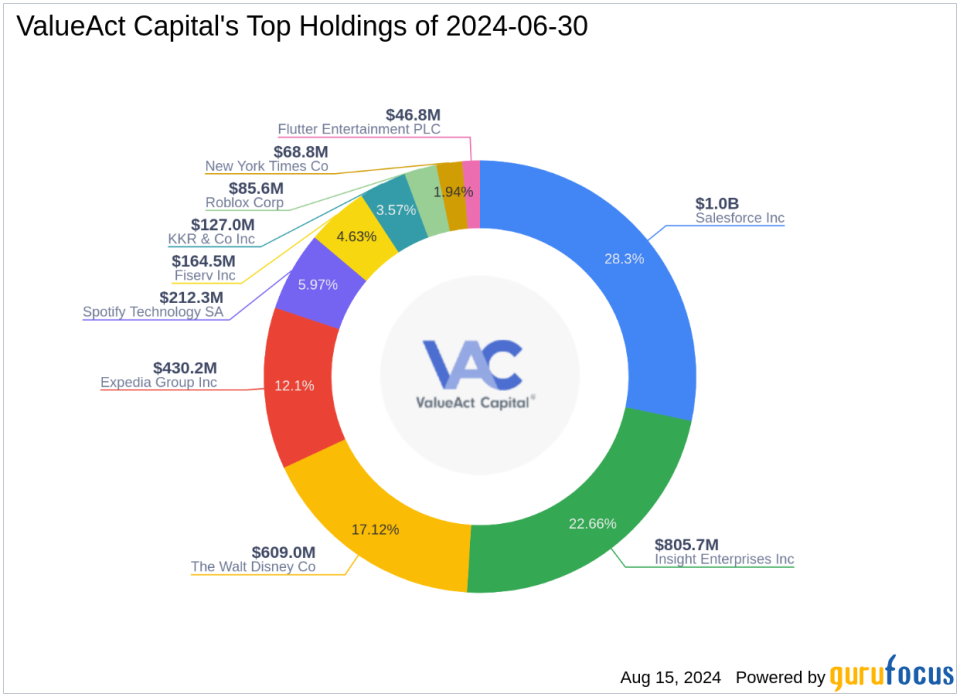

Portfolio Overview

As of the second quarter of 2024, ValueAct Capital (Trades, Portfolio)’s portfolio included 10 stocks. The top holdings were 28.3% in Salesforce Inc (NYSE:CRM), 22.66% in Insight Enterprises Inc (NASDAQ:NSIT), 17.12% in The Walt Disney Co (NYSE:DIS), 12.1% in Expedia Group Inc (NASDAQ:EXPE), and 5.97% in Spotify Technology SA (NYSE:SPOT). The holdings are mainly concentrated in four industries: Technology, Communication Services, Consumer Cyclical, and Financial Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.