Insights into Viking Global Investors’ Q2 2024 Portfolio Adjustments

Andreas Halvorsen (Trades, Portfolio), a notable figure in the investment world and founding partner of Viking Global Investors LP, has recently made significant changes to his portfolio according to the 13F filing for the second quarter of 2024. Under the leadership of CIO Ning Jin, Viking, established in 1999 and based in Greenwich, Connecticut, continues to implement a research-intensive, long-term investment strategy. The firm focuses on fundamental analysis to select equities across various industries and regions. Halvorsen, who previously held prominent roles at Tiger Management (Trades, Portfolio) LLC and Morgan Stanley, emphasizes a meticulous evaluation of business models, management quality, and market trends in his investment approach.

Summary of New Buys

Andreas Halvorsen (Trades, Portfolio) added a total of 24 stocks to his portfolio this quarter. Noteworthy new additions include:

-

Netflix Inc (NASDAQ:NFLX), purchasing 932,867 shares, making up 2.42% of the portfolio valued at $629.57 million.

-

JPMorgan Chase & Co (NYSE:JPM), acquiring 3,009,822 shares, which represent 2.34% of the portfolio, totaling $608.77 million.

-

DoorDash Inc (NASDAQ:DASH), with 5,535,921 shares, accounting for 2.31% of the portfolio, valued at $602.20 million.

Key Position Increases

Halvorsen also increased his stakes in several companies, including:

-

Adobe Inc (NASDAQ:ADBE), with an additional 1,714,079 shares, bringing the total to 2,276,627 shares. This adjustment marks a 304.7% increase in share count and a 3.66% impact on the current portfolio, valued at $1.26 billion.

-

Amazon.com Inc (NASDAQ:AMZN), adding 2,391,262 shares, resulting in a total of 9,293,613 shares. This represents a 34.64% increase in share count, with a total value of $1.80 billion.

Summary of Sold Out Positions

Significant exits from the portfolio include:

-

Visa Inc (NYSE:V), where Halvorsen sold all 6,327,962 shares, impacting the portfolio by -6.57%.

-

Advanced Micro Devices Inc (NASDAQ:AMD), liquidating all 3,952,088 shares, which had a -2.66% impact on the portfolio.

Key Position Reductions

Reductions were made in several holdings, notably:

-

UnitedHealth Group Inc (NYSE:UNH), reduced by 919,412 shares, a -67.54% decrease, impacting the portfolio by -1.7%. The stock traded at an average price of $490.13 during the quarter.

-

Workday Inc (NASDAQ:WDAY), reduced by 1,328,621 shares, a -25.12% reduction, impacting the portfolio by -1.35%. The stock traded at an average price of $240.75 during the quarter.

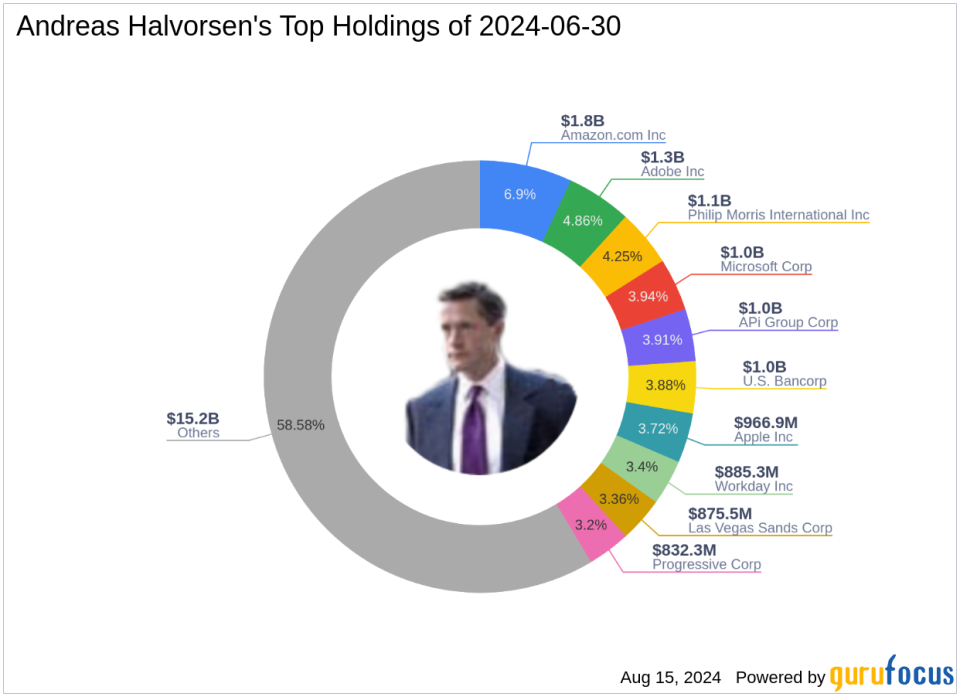

Portfolio Overview

As of the second quarter of 2024, Andreas Halvorsen (Trades, Portfolio)’s portfolio included 82 stocks. Top holdings were:

The investments span across 10 of the 11 industries, with significant concentrations in Technology, Healthcare, and Financial Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.