W.W. Grainger Inc. (NYSE:GWW) is a leading business-to-business (B2B) distributor of maintenance, repair and operations (MRO) products and services. These are necessary for the upkeep and maintenance of various types of facilities, machinery and equipment.

The company was founded in 1927 by William Grainger, and nearly 100 years later this industry continues to be a vital part of society. Grainger’s clientele mainly consists of large enterprises with intricate procurement processes. These companies typically appreciate Grainger’s expertise in handling their extensive, complex accounts and offering inventory management solutions with a high-touch approach distinguishes it from smaller industrial distributors and online competitors like Amazon (NASDAQ:AMZN) Business.

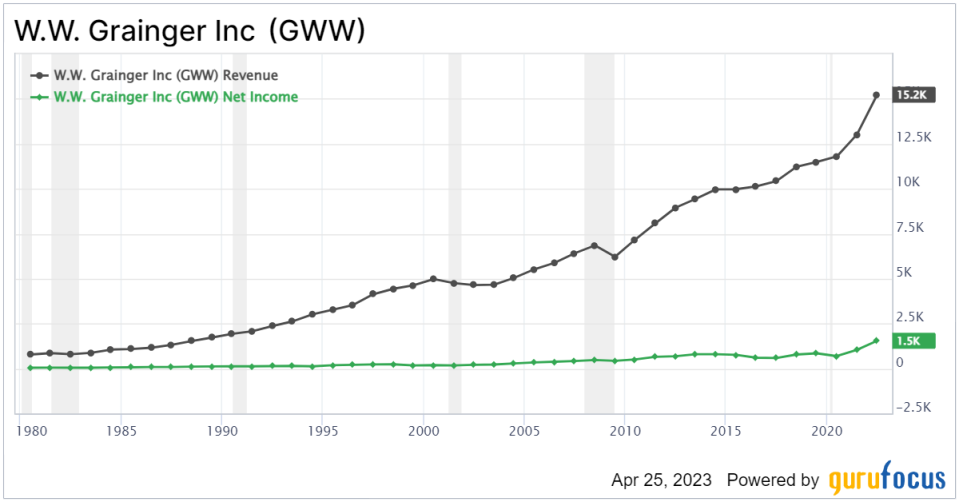

Importantly for shareholders, Grainger has done a great job of achieving steady long-term growth, and it passes Warren Buffett (Trades, Portfolio)’s $1 retained earnings test with flying colors.

Grainger has evolved

Grainger’s business model centers around providing a convenient, one-stop-shop experience for its customers. The company leverages its vast product catalog, efficient supply chain and robust e-commerce solution to facilitate seamless transactions and customer satisfaction. Its online platform has grown in importance in recent years, accounting for a significant portion of the company’s sales.

The rapid expansion of e-commerce has heightened competition due to increased price transparency and access to a broader range of suppliers. As consumers increasingly preferred online and electronic purchasing methods, Grainger made significant investments to enhance its online capabilities and reorganize its distribution network. In fact, the new Zoro.com by Grainger surpassed $1 billion in sales in 2022 even though it has zero Grainger branding.

According to Morningstar, Grainger is now the 11th-largest e-retailer in North America, offering offered more than 1.7 million SKUs in its product catalog. In fact, between 2010 and 2021, the company reduced its U.S. branch network from 423 to 246 while adding distribution centers in the U.S. to accommodate the growing volume of direct-to-customer shipments. This has helped curb operating costs, which is good because the company has needed to become more competitive on pricing, which was offset by an increase in volume. So, while the gross margins have fallen a few percentage points over the last decade, Grainger still maintains a healthy 38% gross profit margin versus the sector median 30%

Slow and steady growth

Over the past decade, W.W. Grainger experienced consistent revenue growth, with only a few minor slowdowns. The company concluded 2022 on a strong note, with sales rising by 13.2% and 17.0% over the three- and 12-month periods, reaching $3.8 billion for the fourth quarter of 2022 and $15.2 billion for the full year, up from $9.4 billion in full-year 2013. In fact, Grainger has increased sales every year since 2013. Net income did slightly better, rising 95% cumulatively in the last decade from $797 million to over $1.5 billion, equating to $30.06 per share.

GWW Data by GuruFocus

More importantly, retained earnings grew from $5.8 billion to $10.7 billion, adding $3.38 in market value for every dollar retained. In his 1983 shareholder letter, Warren Buffett (Trades, Portfolio) described his retained earnings test as follows: ?”We test the wisdom of retaining earnings by assessing whether retention, over time, delivers shareholders at least $1 of market value for each $1 retained.” As we can see, Grainger breezes past this hurdle.

Grainger’s profitability also showed positive trends during this period, with an increase in both gross and net profit margins. The company’s gross margin was north of 44% in 2011, and it remained relatively stable until 2018. Since then, Grainger has focused more on top line growth while remaining lean on operating costs. So, net profit as a portion of gross profit has actually increased from 19% to over 26% in 2022.

Risks to the business

Amazons B2B platform has undoubtedly experienced significant growth over the past decade, but not at the expense of Grainger so far. In contrast to Grainger’s vast product assortment, Amazon Business primarily targets small businesses, whereas Grainger’s approach is designed to cater to the requirements of large enterprises. Furthermore, Grainger offers supply chain solutions for its customers, whereas Amazon mainly concentrates on order fulfillment. Amazon has achieved substantial growth in the MRO market without needing to make considerable investments in building a high-touch business, but it does show a lot of Fortune 500 logos on its website, indicating it may be starting to gain traction in that area as well. Thats a big risk to Grainger.

Modeling future growth potential

Grainger’s management has set 2025 sales targets in the $19 to $20 billion range with a 14.5% operating margin estimate. These could change if Amazon really is encroaching on Grainger’s market share.

Grainger produced $8.476 billion in net income between 2013 and 2022, pushing $4.88 billion through to retained earnings. The companys market capitalization grew from $17.1 billion in April 2013 to more than $33.6 billion today. If all Grainger did was continue to retain 57% at zero growth, it would tack on $8.8 billion to retained earnings. If the company continued to enjoy that ratio, it could create nearly $30 billion in market value in the next decade If that rate came down to a one-to-one ratio, it might not be worth it, but Id be shocked if the company didnt grow earnings at similar rates in the next decade as the last. At the very least, I would expect it to have a higher ratio than one-to-one.

This article first appeared on GuruFocus.