(Bloomberg) — Walmart Inc. already sells more TVs than anyone. Now it wants to make the shows you watch on them, too.

The retailer plans to bankroll at least a half-dozen original programs over the next year, and will unveil the first few to advertisers in New York this week, people familiar with the plans said. Walmart has talked with several Hollywood studios about rebooting family-friendly projects from years ago, said the people, who asked not to be identified because the plans aren’t public yet.

Walmart’s slate is supposed to lure more viewers to Vudu, a company-owned streaming service that already offers free programs with commercials, along with online rentals and sales of movies and shows. The strategy has worked for Netflix Inc., Amazon.com Inc. and Hulu LLC.

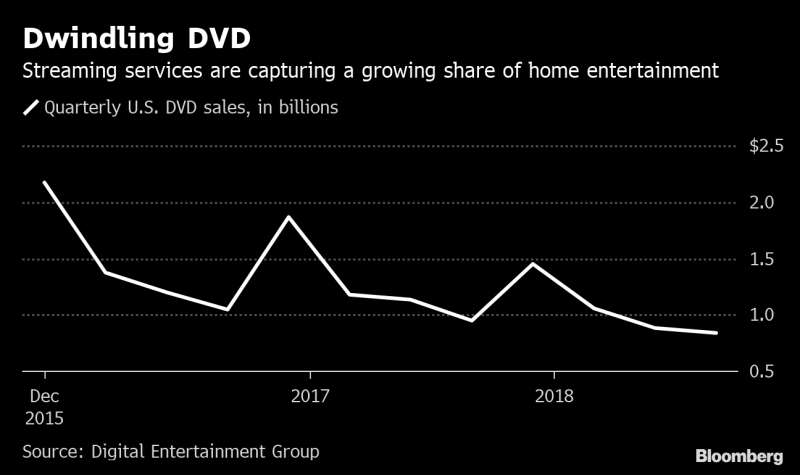

The world’s largest retailer, Walmart sells the most TVs of any chain and ranks among the biggest marketers of movies and TV shows. With streaming starting to supplant DVDs, Walmart acquired Vudu in 2010 to gain a foothold in the burgeoning market for online entertainment. But the service has been an also-ran, while Netflix, Google, Apple Inc. and Amazon built global audiences in the tens of millions.

“They’ve struggled to figure out their role in the new streaming environment,” said Edward Yruma, an analyst at KeyBanc Capital Markets. “Walmart sells almost 50 percent of all TVs in the U.S., so clearly they have some opportunities to better leverage the purchase.”

‘Shoppable’ Content

While some aspects of Walmart’s plans have trickled out over the past few months, many details are being reported here for the first time.

Unlike Netflix and Amazon, Walmart isn’t going to sell its customers a subscription. It sees an opportunity to generate cash by using shows on Vudu to advertise products. The Bentonville, Arkansas-based retailer has been pitching advertising agencies in recent weeks, eager to line up deals in time for its presentation this week.

The company will tout new advertising technology at the event, and has already convinced some of its biggest suppliers to commit tens of millions of dollars in upfront advertising sales, the people said.

The new shows will test the potential of “shoppable” content — programming that can directly lead to sales in stores or online. Not only will viewers see ads, they will have the option to buy products seen in the shows, such as paper towels or soft drinks.

“A lot of our advertisers haven’t worked with Vudu before, but having a new name out there, and having that name connected to Walmart, should spark interest,” said Alex Stone, a vice president at Horizon Media, whose clients have included Corona beer and Geico insurance. “Vudu is much more popular in the Midwest and middle of the country than the coasts.”

Measured Approach

Walmart signaled its intent to venture deeper into entertainment last year when it invested in Eko, an interactive media company, and struck a deal with Metro-Goldwyn-Mayer, the studio behind “Ben-Hur” and “The Handmaid’s Tale.”

Their first collaboration is “Mr. Mom,” based on the 1983 movie written by John Hughes. In the original, Michael Keaton starred as dad who stays at home to care for his young children after he gets laid off and his wife gets a high-paying job at an advertising agency. The reboot will debut on Vudu in June, one of the people said.

The show is typical of what Walmart has told Hollywood executives it wants — programs that families can watch at home together. The company wants to appeal to kids, parents and couples on date night. It’s close to deals for a science-fiction show and a procedural program like “CSI.’’

With just days to go before its presentation, Walmart was still scrambling to get deals done, and had yet to reach agreements on at least a couple shows that it wanted to announce, according to the people.

While Walmart’s strategy looks similar to Apple’s and Amazon’s — investing in media to support the company’s main business — it’s not in the running to produce the next “Game of Thrones.”

The retailer is taking a relatively measured approach by spending just a couple of million dollars per episode — at most — suggesting budgets that are more in line with original programming on basic cable channels.

To contact the reporters on this story: Lucas Shaw in Los Angeles at [email protected];Matthew Boyle in New York at [email protected]

To contact the editors responsible for this story: Nick Turner at [email protected], Rob Golum, Virginia Van Natta

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”60″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.