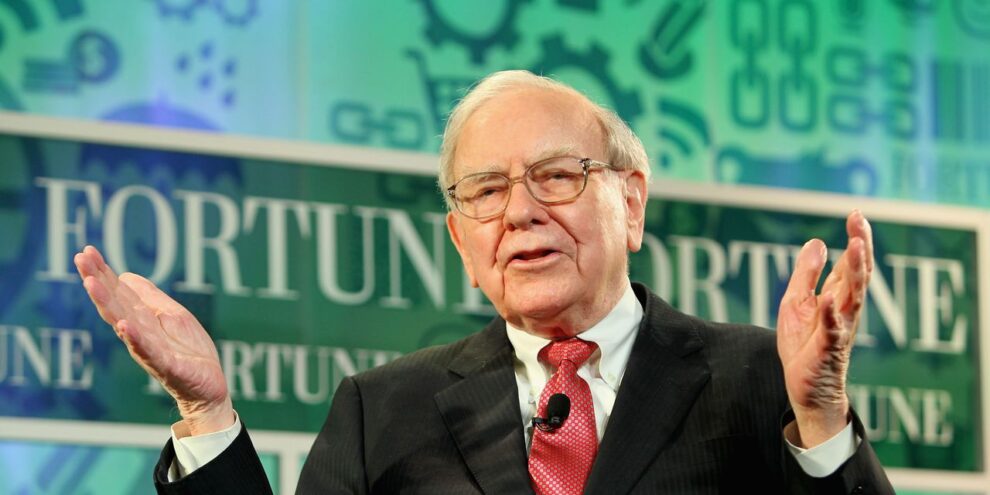

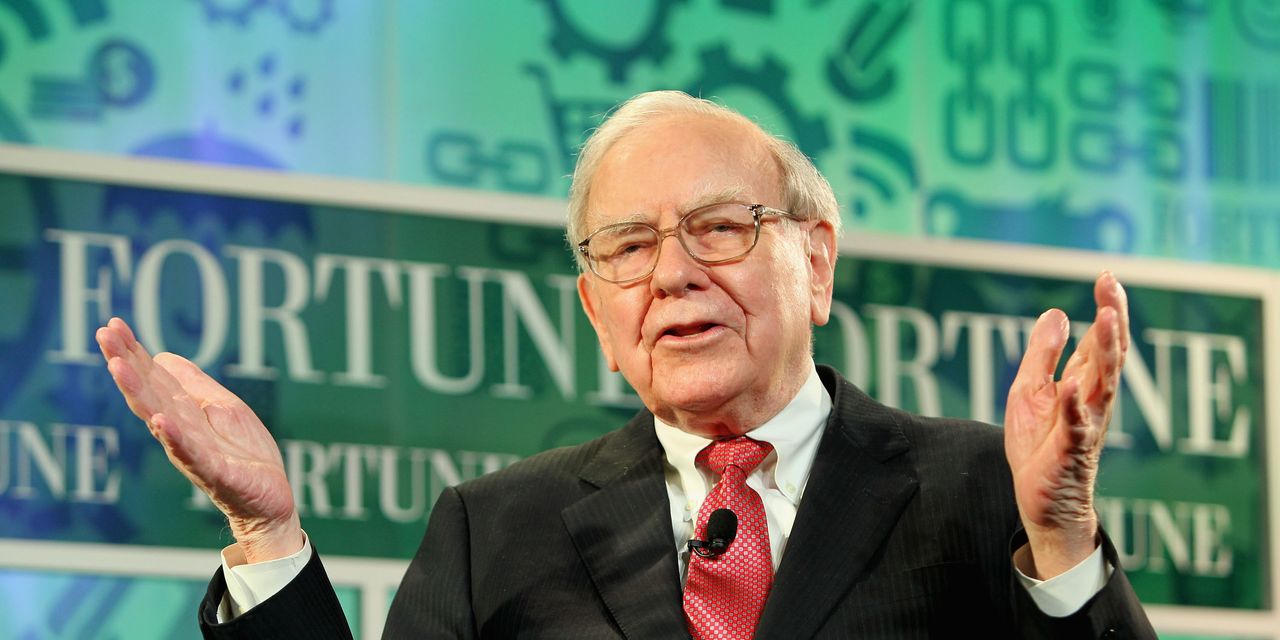

Warren Buffett picked the industry he arguably knows best, insurance, for his first major deal in two years.

Berkshire Hathaway BRK.B, -0.74% BRK.A, -1.05% struck an $11.6 billion, all-cash deal to buy property-and-casualty reinsurance company Alleghany Corp. Y, -0.08%, the companies announced Monday.

The $848.02 per share price is 1.26 times book value as of Dec. 31 and a 29% premium to its average price over the last 30 days, the companies said. Alleghany shares ended Friday at $676.75.

The deal allows Alleghany to actively solicit and consider alternative acquisition proposals during a 25-day “go-shop” period.

The $11.6 billion acquisition, if successful, will be Berkshire Hathaway’s largest deal since its $34.6 billion acquisition of Precision Controls, that completed in 2016. A more recent billion-dollar deal was the $8 billion acquisition of Dominion Energy’s gas transmission and storage deal in 2020.

Berkshire Hathaway recently disclosed it had $144 billion in cash. “These periods are never pleasant; they are also never permanent,” Buffett said in his most recent annual letter to shareholders.