President Joe Biden has pledged to veto another change to the rules that dictate how much retirement-fund managers, including for 401(k)s and pensions, consider climate change, corporate board diversity and other factors when picking the stocks and funds that many workers will rely on for retirement savings.

This week, the Republican-led House voted largely along party lines to roll back a Department of Labor rule over Environmental, Social and Governance (ESG) considerations when investing for workers’ retirements that was passed late last year. The Senate on Wednesday passed the resolution by a 50-46 margin. West Virginia Sen. Joe Manchin and Montana Sen. Jon Tester, both Democrats, sided with Republicans on the rollback.

Biden has already said he will veto the DOL rule rollback.

“The [DOL] rule reflects what successful marketplace investors already know —there is an extensive body of evidence that environmental, social and governance factors can have material impacts on certain markets, industries and companies,” said a statement from the White House.

Washington’s latest action on the issue amplifies a debate that has already spilled over into the courts, state legislatures and governors’ offices, and the 2024 presidential race, as detractors ramp up their efforts to equate ESG with “woke” liberal politics.

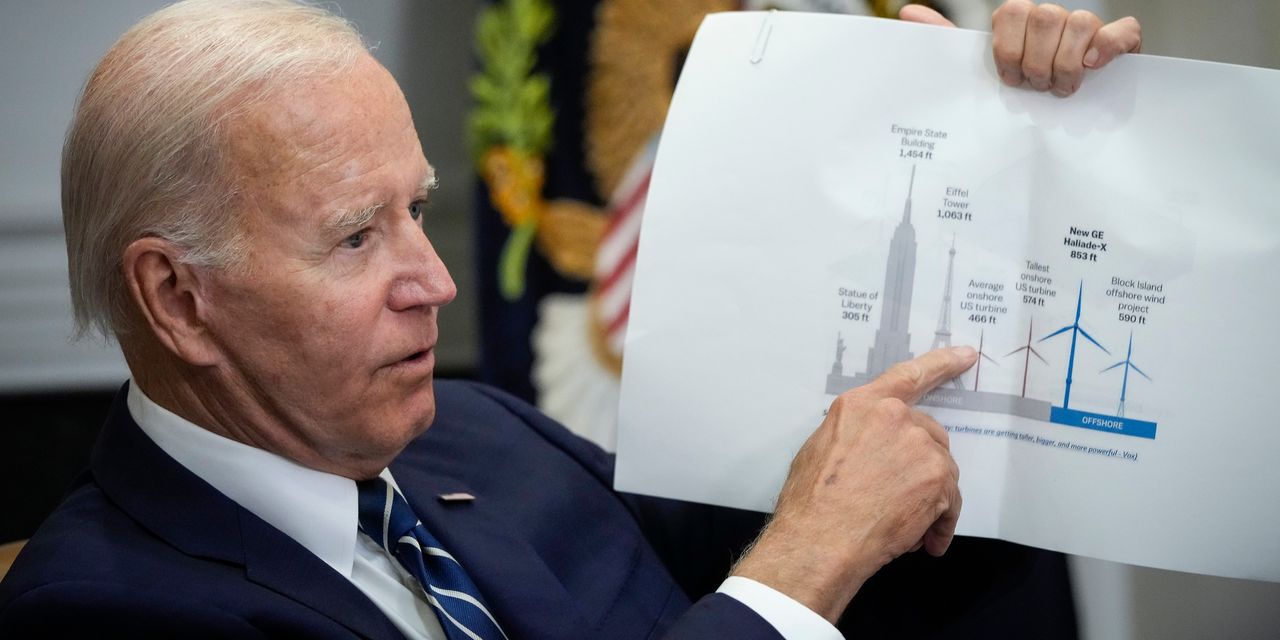

The DOL ESG rule passed in November itself reversed action taken during the Trump administration. The November change returned to “neutral” how regulations dictate investing considerations like renewable energy technology, or linking CEO compensation to an ESG score card, to name a couple of examples.

Related: Retirement stock plans — and increasingly, 401(k)s — can use ESG: Labor Department

The Trump-era rules essentially penalized fund managers for using ESG at all to screen investments; the Biden administration changes removed such punishment and said ESG, both to measure long-term risks to an investment and to size up potential investment opportunities for a company, could be considered. But ESG scrutiny should only follow fiduciary and economic considerations, the Biden DOL changes said.

The Biden DOL rules also suggest that climate-related financial risk factors and other ESG considerations are just as material as other risk-return factors that retirement plans consider, meaning evaluating these risk factors is consistent with fiduciary duty.

Rep. Andy Barr, a Kentucky Republican, said in a statement that if Congress “doesn’t block the Department of Labor’s rule greenlighting ESG investing in retirement plans, retirees will suffer diminished returns on the investment of their hard-earned money.” Barr and others are tapping the Congressional Review Act, which lets Congress disapprove — by a simple majority vote — a final rule issued by a federal agency if it has not been in effect for more than 60 legislative days.

Senate Majority Leader Charles Schumer, a New York Democrat, used a Wall Street Journal op-ed to suggest that it’s simply free markets at work when funds can use ESG to help decide stock winners and losers.

“Republicans conveniently ignore something very important: America’s most successful asset managers and financial institutions have used ESG factors to minimize risk and maximize their clients’ returns,” he wrote. “In fact, according to McKinsey, more than 90% of S&P 500 SPX, -0.33% companies publish ESG reports today.”

Many companies are already acting

Policy groups that support using ESG as one of many retirement-plan guides say the congressional move to strike down the rules, which is coming at a time when Republican-led states are taking their own actions to limit what they say are “woke” practices driving social concerns over profits, could have a chilling effect on financial firms transparently managing and addressing risk, and adhering to their climate commitments.

Many publicly traded companies, including Amazon.com AMZN, -0.64%, Microsoft MSFT, +0.19% and others, have made net-zero emissions pledges for the coming decades as a means to slow climate change. Emissions, given off by coal, oil and gas NG00, +0.14%, are blamed for the global warming that is bringing drought and heat, and acidifying oceans. Some executives have said that considering ESG practices internally has been critical to expanding a hiring pool for younger workers during a tight labor market.

“The Department of Labor’s ESG rule is a sensible policy allowing retirement plan fiduciaries to consider all financially relevant information when making investment decisions,” Bryan McGannon, managing director of U.S. SIF, an advocacy group for sustainable investing, said. “This benefits plan participants and it ends the retirement policy pendulum between administrations. These gains are undermined by today’s vote to kill the rule.”

Meanwhile, some House Democrats have introduced legislation to codify the rule. Doing so, they say, will protect retirement sponsors’ flexibility to consider ESG factors in workplace retirement plans and give them the option to offer ESG investments.

Nearly one hundred groups, including labor organization AFL-CIO, sent letters to lawmakers supporting the finalized rule.

Source of the research matters

Scott Shepard, the director of the National Center for Public Policy Research’s Free Enterprise Center, which bills itself as a conservative shareholder activism program, said the DOL rule that’s currently in place “is completely neutral, and there’s no need for a new rule.”

“The only factors that should be considered are those that demonstrably affect bottom lines,” he continued. “If fund managers want to consider ESG issues, the duty lies with them, under ERISA and background fiduciary-duty law, to make the connection between the ESG proposal and the fund’s bottom line, and to show their work… rather than simply relying on slogans and jargon or fail to consider all relevant inputs.”

But nuance in the fiduciary scrutiny does come into play.

Shepard said one example ties to whether fund managers are really considering if a push to decarbonize the U.S. economy, meaning it will rely less on oil CL00, +0.27% and gas, will be as strong under Republican leadership as Democratic leadership. Europe, for example, has recently walked back its climate-change push once the Russian war in Ukraine sparked a near-term energy crisis and when other cost factors toward converting to renewables cropped up.

Shepard also said that variance in measuring how fast the U.S. might convert to renewable energy ICLN, -1.23%, and an assumption that a corporate CEO is never acting out of their own personal politics, can pose a challenge for “neutral” fund managers.

“Where biased assumptions are included or sources used, then it is left-political ESG,” he said. “If a company just assumes that their reliable-energy assets will be ‘stranded’ because the U.S. will stick to partisan decarbonization schedules and regulations forever… then the relevant fund managers or corporate executives or investment houses are acting politically rather than according to their objective fiduciary duty.”

“‘Where biased assumptions are included or sources used, then it is left-political ESG.’ ”

Other observers of markets and climate issues say that lowering the importance of climate change to below other investing factors is problematic.

“It’s all about calculating risk, whether its my personal pension or a BlackRock fund: inflation, interest rates, climate change, the future of crypto. All of these are risks, and all of these could be opportunity,” said Steven Rothstein, managing director of the Ceres Accelerator for Sustainable Capital Markets. Nonprofit Ceres pushes for climate-minded, or sustainable, investing.

“Telling investors to not think about climate change is like telling them they shouldn’t be thinking about inflation,” he said. “Nowhere does the rule say funds have to divest from certain companies, like fossil-fuel companies. Everyone makes their own judgement.”

Rothstein and others said attention on ESG and sustainable investing isn’t new but has attracted a fresh flurry of attention both for and against as the number of droughts, floods, wildfires and other damaging conditions has increased. Plus, said Rothstein, the COVID-19 pandemic showed what can happen when “a nature-based crisis crippled a supply chain bringing micro-chips to diapers to market… Now, even more people are aware, and aware of the impact on markets.”

“‘Telling investors to not think about climate change is like telling them they shouldn’t be thinking about inflation.’”

Lean on ESG experts and educate the investing public

Andrew Remo, director of legislative affairs for the American Retirement Association, the trade group that represents several interests around private pensions, said it was the Republican Trump administration’s push to make anti-ESG part of permanent rulemaking and out of the world of minor rulemaking that now makes the issue vulnerable to all the back and forth.

And he said his group and others are trying to increase the education around ESG and how it ties into fiduciary responsibility.

Retirement plan sponsors, and certainly, the investing public, are still trying to wrap their arms around just what it means to invest with ESG in mind.

One in four investors couldn’t identify what the ESG acronym stands for, believing it meant things such as “earnings, stocks and growth,” according to a survey in 2022 by the FINRA Investor Education Foundation and the University of Chicago.

“I saw it referenced recently as ESG — Everyone Sees Gibberish — and it’s true, many plan sponsors don’t want to touch it,” Remo said. “But ESG is of greater interest to both retirement plan advisers and the larger industry, and that’s where experts come in.” A retirement plan sponsor is the entity that offers the plan, not that doing the stock-picking. If you own a business or company that offers a 401(k) plan, for example, your business qualifies as a retirement plan sponsor.

“1 in 4 investors can’t identify what ESG stands for.”

Remo said the fund and pension industries, and investment circles in general, can’t do enough to educate investors on what ESG thinking entails. “There’s a big difference between an ESG screen and automatic ESG integration,” he said.

Remo said some concerns that any ESG focus is automatically detrimental to 401(k) returns is short-sighted.

“401(k) investments by historical standards tend to be more conservative than not, and the reason is a fiduciary standard of care. That remains paramount,” he said.

Even if Biden vetoes the rollback, ESG investing in retirement accounts still faces challenges.

Earlier this year, Republican attorneys general from 25 states filed a joint lawsuit against the DOL, claiming that the department overstepped its authority by allowing ESG considerations in retirement plans.

What’s more, Republican lawmakers have also proposed bills at the state level that would prohibit public entities from considering ESG factors in their investing, contracting, and bond-issuance decisions. Others laid out state-level requirements for pensions and other funds to divest from investment firms that have been active in ESG investing, such as BlackRock BLK, -0.65%.

Read: ‘Anti-woke’ reaction? Fund giant Vanguard quits net-zero climate alliance.