(Bloomberg) — As Nvidia Corp. found itself the target of a deep selloff earlier this year, Impax Asset Management was quietly seizing the moment to build a stake it had long regretted not owning.

Most Read from Bloomberg

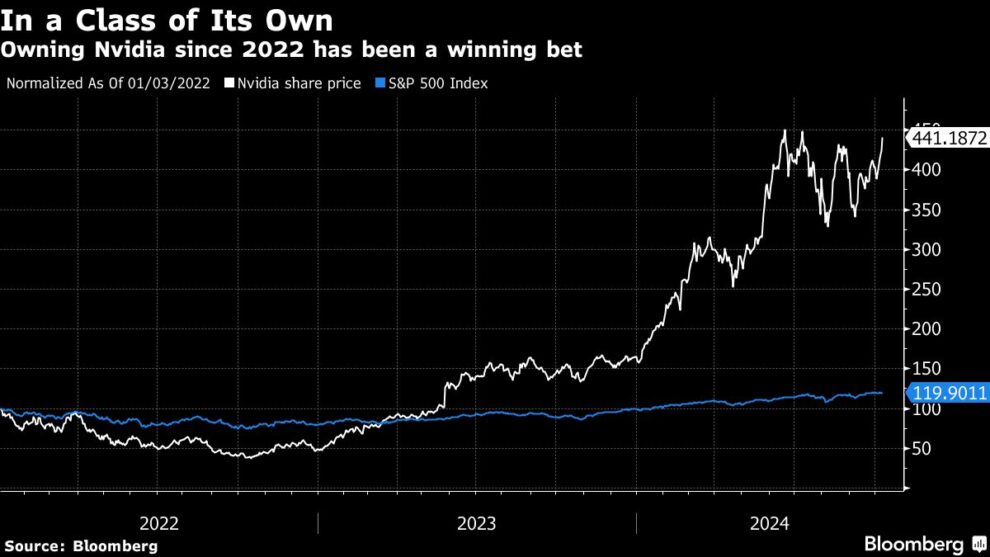

Ian Simm, chief executive officer and founder of the $50 billion London-based asset manager, says he and his team had been looking for an opportunity to correct what they had come to realize was a wrong call a few years ago, which meant missing out on Nvidia’s stunning 800% rally since the beginning of 2023.

“We just underestimated the market potential of their product,” Simm said in an interview. Impax had been looking for a way in, but Nvidia “was expensive.” That is, “until it had a selloff.”

Nvidia’s share-price slump earlier this year resulted in a peak-to-trough decline in its market value of close to $1 trillion. Though much of that has since been recouped, Simm says he thinks the company’s current valuation of more than $3.2 trillion still understates what it’s really worth.

Established in 1998, Impax has made a name for itself as a giant among asset managers focused on the transition to a more sustainable economy. Simm says that goal should be compatible with making money for his clients. But it’s been a tough sell of late.

Over the past couple of years, a spike in interest rates, an energy crisis and the ascent of the so-called Magnificent Seven of technology behemoths have turned green investing into a losing bet. Impax’s own share price is down almost 30% this year, while the S&P Global Clean Energy Index has lost more than 10%. The S&P 500, meanwhile, is up more than 20% in the same period.

Impax recently reported results that showed gains in listed equities of £5.3 billion ($6.9 billion) for the fiscal year ended Sept. 30. That was less than the £5.8 billion of net outflows that Impax saw in the period.

A few years ago, Simm says there was a “big debate” at Impax on the merits of piling into Nvidia. The case around artificial intelligence was “speculative at the time,” he said. Back then, the asset manager concluded that Nvidia’s technology was largely limited to the gaming industry and therefore the asset manager decided against going big on investing.

“Frankly, we’ve underperformed for the last couple of years in our main strategies because we’ve been more growth-at-a-reasonable-price, staying away from the momentum and hype around mega-cap tech investing,” he said.

As Nvidia’s share price was falling in June, Impax more than tripled its stake in the company to 4.9 million shares by the end of the month from 1.4 million shares at the end of the first quarter, according to data compiled by Bloomberg and confirmed by Impax.

Simm says Impax still considers Nvidia to be undervalued when taking into account how the boom in artificial intelligence is expected to drive demand for its chips.

Simm says holding Nvidia, which like other technology giants needs to consume vast stores of energy to power its growth, also makes investing sense from a climate perspective. As demand for energy continues to increase, Nvidia and other companies that develop more efficient models will be better for the environment, he says.

Nvidia’s Blackwell chips, which are beginning to roll out to customers this year, would need 3 gigawatts of power to develop OpenAI’s GPT-4 software, the company said at an event earlier this month. Ten years ago, that process would have required 5,500 gigawatts, the chipmaker said.

“Nvidia’s ability to deliver energy savings makes it even more valuable,” Simm said.

Nvidia is emitting greenhouse gasses at a pace that exceeds levels needed to limit global warming to the critical threshold of 1.5C. Back in April, Morningstar analysts estimated the company’s so-called implied temperature rise was 3.8C.

“You can still make money from investing in society’s response to too much CO2 emissions while still being bearish about what the net result’s going to be,” Simm said. Impax looks “for growth at a reasonable price rather than from an ethical perspective or the non-financial impact.”

Exceeding the thresholds in the Paris climate agreement is “a risk issue.”

But “pricing should sort that out, if countries are moving ahead with internalizing the cost of CO2 emissions,” he said.

Impax holds Nvidia in five strategies and funds. That includes its Global Opportunities portfolio, which is limited to 40 stocks and consists of companies that have a diversified business model, operate in high-growth markets and are “out of favor for whatever reason,” Simm said. Microsoft Corp. is included because Impax thinks it’s undervalued “in the context of the secular trend toward more AI,” he said.

In fact, “the whole industrial space” now looks undervalued, Simm said. That may change as a “soft landing in the US” looks increasingly likely, which is helping restore confidence, he said. The cost of capital is falling and consumer sentiment is stabilizing, so equity “is looking more attractive.”

(Adds Nvidia implied temperature rise, CEO comments in final paragraphs.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.