Wedbush recently commented on the technology sector’s recent decline and classified Microsoft Corp. (NASDAQ:MSFT) as a secular growth prospect. According to the bank, “The Street is already baking in a mild recession into current tech stocks, and the risk-reward set up is favorable for our top enterprise plays.”

Microsoft’s stock has capitulated roughly 25% since the turn of the year, which poses a binary outcome from here onward. The stock could surge back to its previous level as the market regains stability, or it could spiral down even further due to risk-aversion from technology investors.

Is Microsoft a secular growth asset?

Secular growth refers to the kind of growth that can bypass economic cyclicality. Moreover, secular stocks exhibit the ability to weave a bear market as they remain part of a small pool of performing companies during trying times in the financial markets.

If the central question were asked 20 years ago, I would say definitely. However, matters need to be assessed according to the current climate.

Let us break down a few headline metrics to get an overview of the company’s prospects.

-

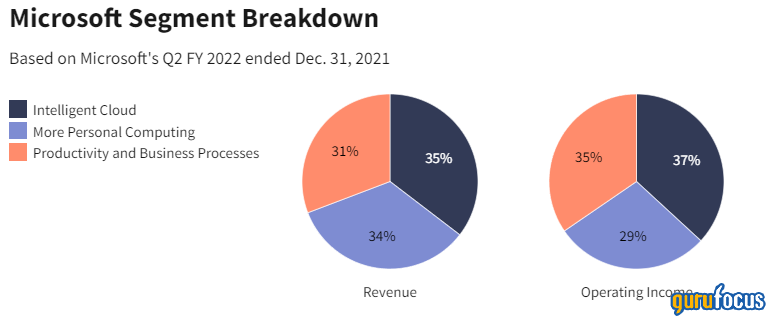

Microsoft generates revenue from productivity and business processes, which is forecast to increase at a compound annual growth rate of 12.6% until 2026.

-

The company owns roughly 20% of the cloud computing marketplace with its Azure offering. This is certainly a hypergrowth aspect as the cloud computing space is forecast to grow at a CAGR of 17.9% until 2025.

-

Microsoft only holds down 3.4% of the personal computing space, with the industry reaching maturity at a low CAGR forecasted of only 8.5% until 2025.

Microsoft’s headline Ebitda five-year CAGR of 23.40% reasonably reflects the company’s sum of the parts prospects. Readers must note that certain segments might recede in growth if a recession had to occur as enterprise and consumer spending might both wane. Nonetheless, I believe investors will remain invested in the equity markets to some extent, and Microsoft could be a habitat for those seeking continued growth in a challenging stock market.

Source: Investopedia

Quantitative metrics

Secular growth is best measured by looking at metrics such as return on equity, forward earnings per share and capital expenditures.

From a return vantage point, it is clear Microsoft’s stock exhibits illustrious ROE, indicating it certainly is a rapid growth stock despite its mature stage.

Moreover, Microsoft exhibits quality earnings per share growth, suggesting investors’ intrinsic value could grow for a prolonged duration. Microsoft’s capex growth has decayed to 11.97%, which is below the industry. However, I suspect the reason is conservativeness amid uncertain economic times and do not think it would damage growth by any means.

Concluding thoughts

Microsoft exhibits secular growth prospects, which could see its stock perform head and shoulders above competitors during these trying economic times. Additionally, quantitative metrics convey Microsoft’s illustrious growth trajectory.

This article first appeared on GuruFocus.