This is my fourth bear market as defined by a 20% or more decline in the S&P 500. Based on what I have learned from the previous three, I do not expect this one to be any different.

The average bear market lasts 15 months; this means we could be in this market until the middle of next year.

Bear markets are like storms; they arrive, do their best (or worst) and then they leave. There will be a bear market about twice in a decade and a recession about once every six to seven years. You cannot avoid them, so it is best to accept them and learn how to take advantage.

While I do not think this bear market is the prelude to another great depression or even a great recession, we need to be prepared that stocks will fall further than expected because of the very overvalued conditions we had in 2021. Things always overshoot to the downside because fear is more powerful than greed as a driving emotion. Predictably, many people will do very foolish things like liquidate at or near the bottom. We don’t need to be one of those people.

Predicting a bear market in time is exceedingly difficult. The important thing is regulating your behavior during a bear market. As such, I suggest that you first breathe and do nothing. Then think before inverting.

The first two steps are obvious. The idea here is to liquidate our fear (not out portfolio). Resist the urge to cut and run. It is too late to sell anyway, so the best thing to do is be is to be thoughtful and take your time before acting.

The third step is counterintuitive. Charlie Munger (Trades, Portfolio), quoting German mathematician Carl Jacobi, said, “Invert, always invert.” This means turning the problem upside down and looking at it again. Sometimes doing the opposite of what you want to do makes more sense. Perhaps we should welcome bear markets as an opportunity. It may not feel like it, but this is the season to sow seeds for our next harvest. Think about it, there was a stock you loved last year and could not wait to buy it. Now it is selling for half the price. Is that a bad thing? Most likely not, unless we tip into a long depression (which is possible but not likely) or the company was overleveraged to begin with and might go bankrupt. In most cases, it may make sense to just sit tight and if the company is still solid, to buy more. Once the bear market ends, weak stocks (provided they have survived) will go up much faster than strong ones.

Do not run blindly toward safety. Rather, embrace risk using common sense. The risk-return ratio is still alive, bear market or not, so focus on survivability, not just safety. A lot of people will be running toward safe stocks like consumer staples and dividend aristocrats, but then these stocks become too expensive because everyone wants them. At that point, they may no longer be of good value.

I also recommend avoiding all-in or all-out bets. Rather, edge in or out of positions gradually. If I am particularly nervous about a stock, I might sell that one and buy another one I feel is of better value. As a result, you swap your way to better quality and avoid sitting on cash.

Bear markets are also full of bull traps. They will lure you in and then go down some more. Make sure you have enough stamina and resources to survive if that happens. Do not be afraid of missing the bottom as there will be plenty of time to buy as the stock market recovers. One technique I use is not to buy anything with new money until the 50-day moving average starts to go up. While we will miss the bottom, we will avoid the worst of a bull trap.

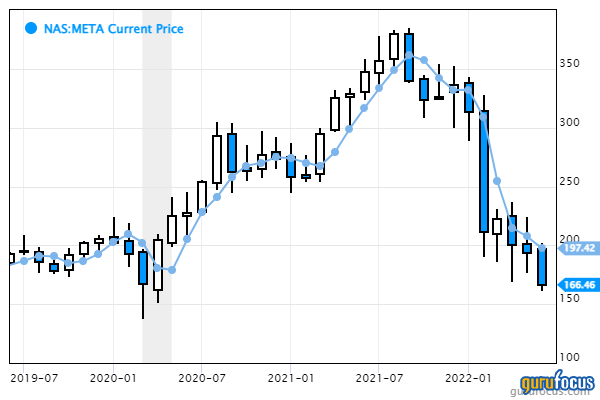

For example, I am currently interested in Meta Platforms Inc. (NASDAQ:META), but will buy it when the 50-day moving average starts sloping upward.

Wishing you all a happy bear market. We may not realize it now, but bear markets are where we end up making most of our money.

This article first appeared on GuruFocus.