Amazon (NASDAQ:AMZN) will post its fourth-quarter 2021 financial results after the market closes on February 3.

For an e-commerce firm like Amazon, total website visits are a strong measure of user engagement on Amazon’s platform. The company’s main website, amazon.com, focuses on buying and selling goods. As a result, more user engagement suggests increased demand for the company’s products and services available on its website, implying higher revenues.

Amazon also offers digital streaming content through its Amazon Prime Video and Twitch platforms. So, higher monthly users on these platforms imply higher subscription revenues earned by the company.

Therefore, we used TipRanks‘ new website visit tracking tool to learn more about Amazon’s performance ahead of Q4.

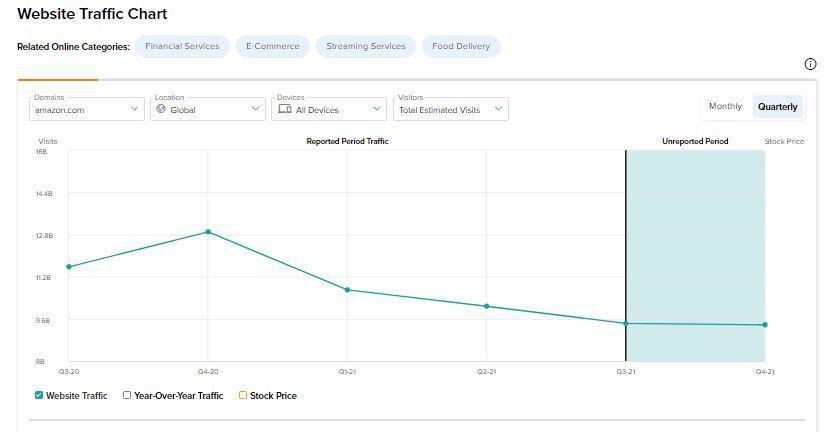

The graph below illustrates that total projected visits to Amazon’s core platform, amazon.com, decreased marginally throughout the quarter. More precisely, we see that total visits to amazon.com decreased by 0.57% sequentially to 9.4 billion.

Also, on a year-over-year basis, Amazon’s total estimated visits are down 27.35% in Q4 2021 compared to Q4 2020. The declining trend in monthly users suggests that Amazon’s e-commerce revenues may have been lackluster in the yet-to-be-reported quarter.

Website Stats for Amazon’s Other Domains

In addition, the tool reveals that user visits to Amazon’s video streaming sites, such as Amazon Prime Video and Twitch, decreased sequentially in Q4. Notably, the total estimated visits to prime.video.com and twitch.tv declined by 9.69% and 22% sequentially, respectively in Q4.

This quarterly drop indicates that subscriber growth may slow in the fourth quarter. Increasing competition in the streaming space or lack of new content could have led to a decline in website visits this quarter.

On the contrary, the website traffic figures for its subsidiary Whole Foods Market, a natural foods store chain, appear to be fairly encouraging. The total estimated visits to wholefoodsmarket.com climbed by 22.7% sequentially to 30.7 million in Q4. The growth has most likely resulted in higher retail revenues for the firm in the quarter under review.

Experts’ Take

Ahead of Amazon’s upcoming earnings release, Wedbush analyst Michael Pachter maintained a Buy rating on Amazon and a price target of $3,950 per share.

According to Pachter, macroeconomic issues such as “supply chain bottlenecks” and “full U.S. employment” will have a negative impact on Amazon’s financial performance in Q4. Therefore, he expects operating income and revenue to achieve the low end of the range of guidance.

Amazon also has a Strong Buy rating from Wall Street analysts, with 22 unanimous Buys. The Amazon stock projections indicate an average price target of $4,192.86, suggesting a possible 12-month upside of 40.2%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure