It’s shaping up to be an action-packed week in the market. Earnings season is revving up, which means companies are finally unveiling their long-awaited 2022 Q1 results. It’s a thrilling time of the year to be an investor because earnings season is when stocks typically see the most movement and companies provide investors guidance moving forward.

Uncertainty caused by supply-chain bottlenecks, soaring energy prices, high labor costs, and other economic restraints in Q1 has dampened the earnings outlook for many companies. Now that we’ve arrived, it’s time to face the music and see what’s been going on behind the curtains.

On deck to report this week on Tuesday after the bell rings is Netflix NFLX. Investors are laser-focused on the company’s quarterly results as it has transformed into a widely-followed name in the market. With that being said, let’s dive into the forecast for the streaming giant heading into its quarterly report.

Subscriber Count Is King

Being a digital platform for online streaming services, Netflix NFLX relies heavily on having a healthy subscriber count that continuously expands and reaches new audiences. It goes without saying that a diminishing subscriber count negatively affects the company’s future outlook and current performance vastly.

When COVID-19 first rattled the market back in early 2020, Netflix’s subscriber count surged immensely due to lockdowns and widespread fear of the virus. For perspective, NFLX added almost 37 million new customers in 2020 – a 32% year-over-year jump from 2019. With the pandemic subsiding, Netflix hasn’t been able to reciprocate 2020’s stellar growth rates; new membership additions slipped to 18.1 million in 2021, a 50% decrease when compared to the 37 million added in 2020.

That brings us to the current year, where analysts are forecasting subscriber counts in an entirely new environment where people are returning to outdoor life. For the quarter, analysts are forecasting roughly 223 million paid streaming memberships, a 5% increase from the September 2021 value that was reported at approximately 211 million.

Netflix has repeatedly beat total membership projections. In June 2021, analysts forecasted a 208.1 million subscriber count; Netflix beat the estimate by 0.12% and reported a value of 208.4 million. The same can be said for September 2021, where the streaming giant once again beat analyst projections by a marginal 0.15%.

In December, Netflix provided guidance for Q1 subscriber growth that fell well short of expectations. For Q1 2022, NFLX is forecasting paid net subscriber additions of 2.5 million vs. 4 million in the year-ago quarter. The streaming giant says that as its membership base continues to grow, there will naturally be more volatility in its absolute paid net subscriber additions performance vs. forecasts.

All in all, Netflix’s subscriber base has grown remarkably since 2019, though vastly boosted by stay-at-home orders during the pandemic. Looking forward to Q1, subscriber addition forecasts are looking very cloudy, signaling that the new customer surge is most likely over.

However, Netflix remains optimistic about expanding its customer base due to the wide range of engaging content it plans to add to the service. We will have to wait until the Q1 report to see actual numbers, but still, analysts are already penciling in a substantial slowdown in net subscribers added – and so did Netflix in its latest quarterly report last December. Additionally, Netflix halted all operations in Russia, a country with over one million subscribers.

Previous Earnings

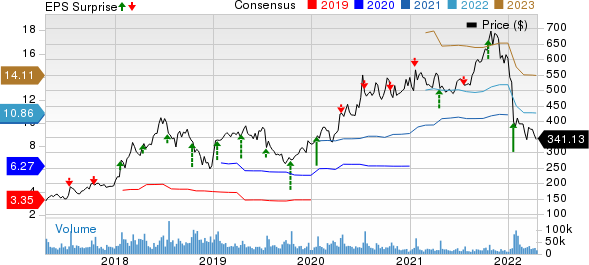

Pivoting away from subscriber counts, let’s take a look at the recent quarterly reports of NFLX and projections for Q1. Over the last 60 days, the Consensus Estimate Trend for Q1 has fallen 1% and is now forecasting earnings of $2.92 per share. Out of the five estimate revisions that hit the tape, four were downwards.

In its latest quarter, NFLX smashed the $0.82 per share estimate by nearly 63% and reported quarterly earnings of $1.33 per share. Additionally, Netflix has beat estimates three times out of its last four quarterly reports and has acquired a four-quarter trailing average EPS surprise of nearly 27%.

The $2.91 per share earnings estimate for Q1 reflects a concerning year-over-year decrease of 23%, and full-year earnings for 2022 are projected to slip by 3.4% compared to 2021. Looking at quarterly revenue, the $7.9 billion estimate displays an impressive 11% year-over-year increase, and full-year sales estimates represent a 12% increase in the top line from 2021.

Netflix, Inc. Price, Consensus and EPS Surprise

Netflix, Inc. price-consensus-eps-surprise-chart | Netflix, Inc. Quote

Recent Performance

Following the worse-than-expected guidance from Q4 2021, NFLX shares took on a sharp downwards trajectory, retracing nearly 44% in value year-to-date. This adverse price action is very telling; many investors and analysts do not believe that Netflix can reciprocate the growth rates seen during the early and mid-stages of the pandemic. Month-to-date, shares are down nearly 10%.

Disney

Let’s take a quick look at Disney DIS, one of Netflix’s main rivals and a stock that stands to benefit from a better-than-expected earnings release.

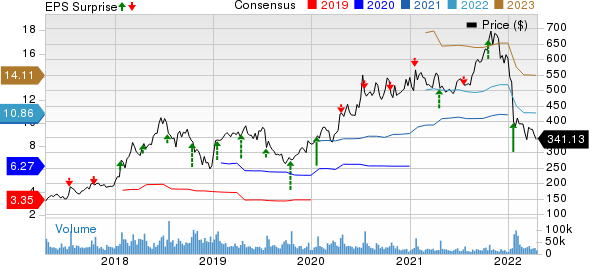

Over the last 60 days, the Consensus Estimate Trend for the next quarter has increased by an impressive 4.3%, now forecasting quarterly earnings of $1.22 per share for Disney.

In its latest quarter, DIS smashed EPS estimates by nearly 90%, and over its last four quarterly reports, DIS has a four-quarter trailing average EPS surprise of nearly 70%. Additionally, analysts are forecasting a 97% jump in earnings for the current year.

Disney is a Zacks Rank #3 (Hold) with an overall VGM Score of a C.

The Walt Disney Company Price, Consensus and EPS Surprise

The Walt Disney Company price-consensus-eps-surprise-chart | The Walt Disney Company Quote

Bottom Line

While COVID-19 was unbearable for the rest of the world, NFLX was able to benefit, no doubt displayed by its remarkable run from $400 a share in March 2020 to all-time highs of nearly $700 per share in November 2021.

Now that the pandemic seems to be in its closing act, Netflix looks to be negatively impacted by the re-opening of the world. However, the company remains optimistic about its future due to highly-regarded TV shows and movies coming to its catalog.

The forecast for net subscriptions added, the most critical aspect heading into Q1, took a hit in its Q4 report. This, paired with geopolitical issues causing the company to cease operations in Russia, does not bode well for the metric. These factors lead me to believe that investors should heed caution heading into the Q1 report. Netflix is currently a Zacks Rank #3 (Hold) with an overall VGM Score of an F.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.