Semiconductor stocks have lost serious power in 2022 after providing supercharged returns over the last several years.

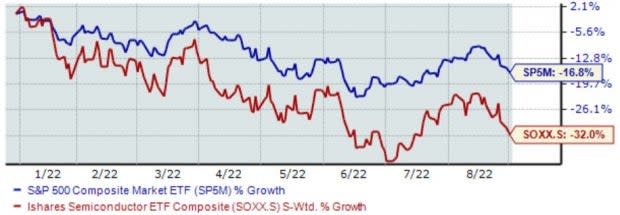

To put things into perspective, SOXX, the iShares Semiconductor ETF, is down more than 30% year-to-date, vastly underperforming the S&P 500.

Image Source: Zacks Investment Research

As we can see, it’s been anything but fun for chip stocks in 2022 amid a hawkish Fed and supply-chain disruptions.

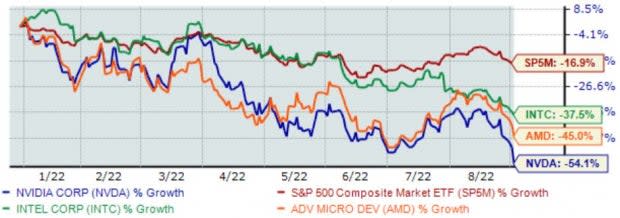

An investor favorite, NVIDIA NVDA, has been no exception to the adverse price action, with shares losing more than half of their value YTD and coming nowhere near the general market’s performance.

In fact, the share performance even widely lags a few of its peers, including Advanced Micro Devices AMD and Intel INTC. This is shown in the chart below.

Image Source: Zacks Investment Research

It raises a valid question, what’s going on with NVIDIA shares to make them perform so poorly relative to other chip stocks? Let’s take a closer look.

Near-Term Outlook Appears Grim

Flipping the pages back a little, NVIDIA shocked the market in early August, providing disheartening guidance that they were forecasting Q2 sales of $6.7 billion vs. the previous $8.1 billion outlook.

This was when the tide started to shift, and the market didn’t react well to the guidance, to say the least – NVDA shares lost nearly 7% the day of.

NVDA reported quarterly sales of $6.7 billion, right at their guidance. The value reflected year-over-year growth of 3% but a sequential decrease of 19%. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Still, why did they initially guide lower? One primary reason included their gaming revenue, which was negatively impacted by macroeconomic headwinds that heavily affected demand.

Fast-forward to today, and the semiconductor titan is back in the headlines following news that the U.S. government will impose a new license requirement for future exports to China.

It’s a significant development, with NVIDIA stating that it could lose up to $400 million in quarterly revenue as a result, which is obviously not a positive sign.

Is It Time To Buy?

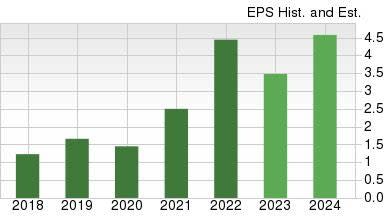

As expected, analysts have substantially pulled back their earnings estimates over the last 60 days, pushing the stock into a Zack Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Investors should target Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) stocks, as they provide much higher odds of investors reaping considerable gains. With NVDA carrying a Zacks Rank #5 (Strong Sell), it tells us that its near-term earnings outlook is a bit cloudy and under pressure.

The Zacks Consensus EPS Estimate for the company’s current fiscal year (FY23) resides at $3.48, suggesting a Y/Y decrease of a steep 21%. NVDA’s bottom-line is projected to see some relief in FY24, with the $4.57 per share estimate reflecting year-over-year growth of 31%.

Image Source: Zacks Investment Research

However, the company’s valuation levels have fallen extensively, suggesting that long-term investors could start becoming interested.

NVDA’s forward 12-month price-to-sales ratio has fallen to 12.3X, right at its median of 12.4X over the last five years. Further, the value is 55% off its high of a steep 27.5X in 2021.

Image Source: Zacks Investment Research

Bottom Line

Once seemingly unstoppable investments, chip stocks have fallen from glory in 2022, leaving dents in many portfolios.

A poster-child for the industry, NVIDIA, has recently fallen on tough times, with its earnings outlook shifting negative for the near term amid new licensing requirements and a massive growth slowdown within its gaming segment.

Following the deep sell off, the company’s valuation levels have come down substantially, perhaps intriguing investors with a long-term horizon.

However, it’s vital to recognize that its unfavorable Zacks Rank indicates that more pain could be ahead.

A great strategy would be to wait until NVIDIA’s NVDA earnings outlook strengthens, especially amid the currently cloudy outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research