It’s been a battlefield within the market landscape throughout 2022, with high-growth and tech stocks seemingly walking around with big targets on their backs. Buyers have entirely retreated, and bears have been pushing forward all year. It’s been exhausting, and bears keep reloading.

Day-traders and scalpers undoubtedly welcome the volatility, but the same can’t be said for long-term investors. Long-term investors don’t benefit from the significant intraday price swings that we’ve become familiar with; they desire considerable, consistent gains on a much larger time horizon.

Let the day-traders and scalpers have their fun. In the meantime, we’ve been presented with a fantastic opportunity to add to long-term positions at valuation levels that have not been seen in quite some time.

Let’s face it – it’s never fun to see some of your big-time winners give back gains. However, building up more significant positions in some of the best companies in the world is always exciting.

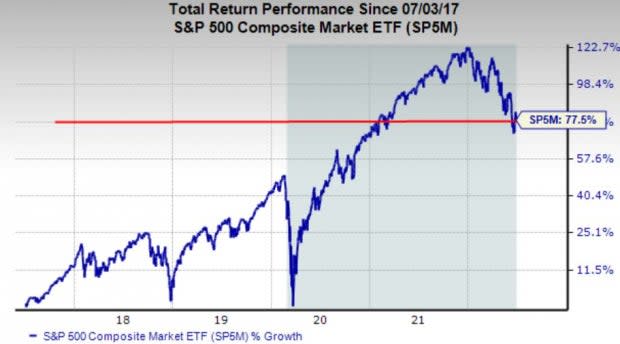

Below is a five-year chart of the S&P 500.

Image Source: Zacks Investment Research

As we can see, it sits at levels it hasn’t visited since 2021 Q1.

Furthermore, the S&P 500’s forward earnings multiple currently resides at 17.1X, the lowest we’ve seen since 2020 Q1. The value is also well below its five-year median of 19.9X.

Image Source: Zacks Investment Research

So, what does this tell us? A stretch of poor price action year-to-date has presented us with a rich buying opportunity not seen in years.

Alphabet

Alphabet GOOGL shares have tumbled in 2022, decreasing nearly 25% in value. The year-to-date chart below illustrates that.

Image Source: Zacks Investment Research

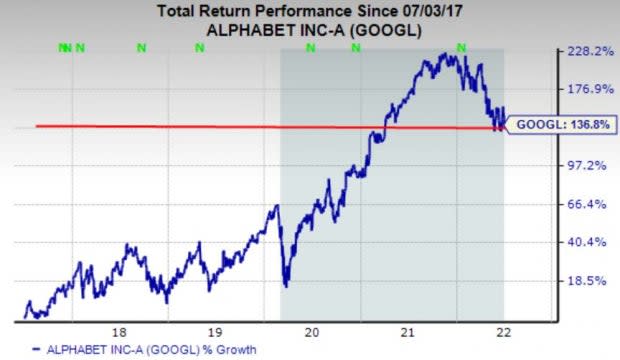

However, when you extend the time frame, we can see that GOOGL shares are trading at their lowest level since early 2021.

Image Source: Zacks Investment Research

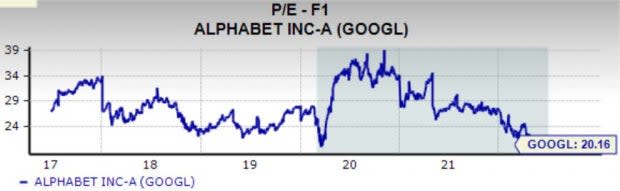

Additionally, valuation levels have come down extensively. GOOGL’s current forward earnings multiple of 20.2X is nowhere near 2020 highs of 39.1X and is well below its five-year median value of 27.1X.

Image Source: Zacks Investment Research

Nvidia

Nvidia NVDA shares have been sent down the drain in 2022, losing nearly 50% in value. The chart below illustrates the year-to-date price action of NVDA shares.

Image Source: Zacks Investment Research

However, upon zooming out, we can see that NVDA shares are currently trading at May 2021 levels, an area where the stock had faced previous resistance – perhaps the previous resistance level will turn into a support level.

Image Source: Zacks Investment Research

In addition, NVDA’s current forward earnings multiple resides at 34.2X, which appears a bit pricey. But, the current value is well below its five-year median of 49.8X and is nowhere near 2021 highs of 93.5X.

Image Source: Zacks Investment Research

Apple

Apple AAPL shares have struggled year-to-date, retracing nearly 23% in value. Below is a year-to-date chart of AAPL shares.

Image Source: Zacks Investment Research

Once again, upon zooming out, the rocky price action is less concerning – Apple shares are still up 300% over the past five years and are currently trading near July 2021 levels.

Image Source: Zacks Investment Research

Apple’s current forward earnings multiple resides at 22.8X, a fraction of its 2020 high of 41.5X and just above its five-year median value of 20.3X.

Image Source: Zacks Investment Research

Dollar Cost Averaging

Let’s face it – it’s impossible to time the market.

Of course, I’m sure you’ve heard the saying, “buy low, sell high.” If it was all that simple and investors could consistently and accurately forecast tops and bottoms, the market would be thrown out of balance entirely.

Then, there is the “buy the dip” approach, which is asking for trouble. Many people buy at the “dip,” yet it keeps dipping – that’s never fun. And, what exactly classifies as a “dip”?

One of the best and easiest ways to build a more prominent position for your long-term winners is the simple approach of dollar-cost averaging.

Dollar-cost averaging is a strategy in which investors split up their initial buys in periodic timeframes, reducing the impact of volatility on the overall purchase. It allows you the flexibility to “buy the dip” and add on to those winners whenever they come into uptrends.

It’s a stellar way to limit overall risk and protect investors against violent short-term price swings.

Bottom Line

It’s undoubtedly frustrating to watch your favorite stock give back all of its gains, but in the long-term picture, things don’t look nearly as bad as it seems. It’s vital to remain confident in your investment thesis through the ups and downs.

There was a reason behind that first initial buy, and if that reason hasn’t changed, there’s no need to panic. Instead, it’s highly beneficial for investors to dollar-cost-average into these positions, making the ride back up even sweeter.

When in doubt, just simply zoom out.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research