LeBron James has made $272 million so far in his career, and is set to make another $117 million by the time his current contract with the Los Angeles Lakers ends in 2022. And he has delivered, winning three NBA championships and four NBA MVP awards, among many other accolades. He’s also capitalized on his success as much as any other athlete today, realizing that with his fame and wealth he could do more than just invest in others.

In the recently published biography of James, LeBron, Inc.: The Making of a Billion-Dollar Athlete, ESPN’s Brian Windhorst, who has covered James since he was a high-school freshman, outlines the biggest financial wins of LeBron James’s career.

By making timely investments and leveraging his influence, James, 34, has become one of the wealthiest athletes in the world. According to Forbes, James was the world’s 8th highest-paid athlete last year, when he made $89 million — $36 million from salary and $53 million from endorsements. And he’s estimated to have a net worth of $450 million.

Here are James’s four most successful investments.

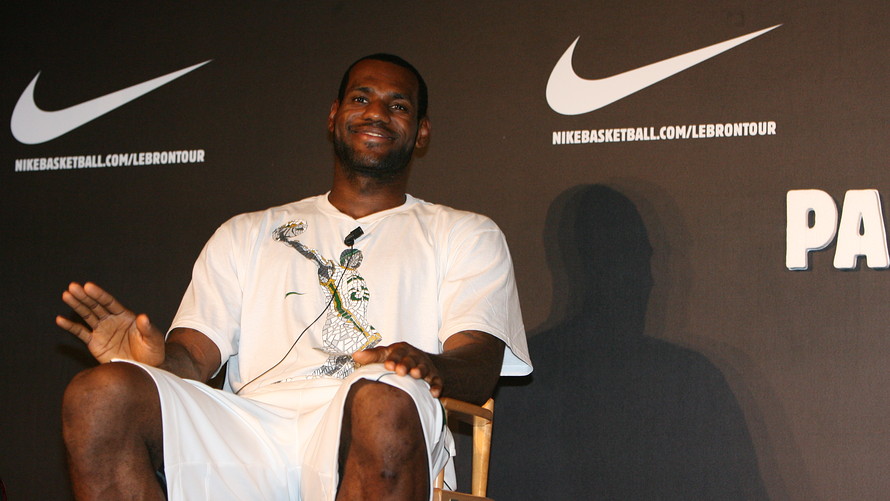

Choosing Nike over Reebok

Catherine Steenkeste

Catherine Steenkeste

As the most hyped young basketball player in decades, James was drafted first overall In the 2003 NBA Draft by the Cleveland Cavaliers straight from high school. Shoe companies were eager to ink James to one of the biggest endorsement contracts ever.

To illustrate just how famous James was as a teen, celebrities attended his Catholic high school games, and he was on the cover of Sports Illustrated at 17-years-old. Shoe executives were desperate for James to wear their brand’s logos.

Among the companies offering him a contract were Adidas ADDYY, +0.51% at $60 million, Nike NKE, +2.53% at $87 million and Reebok at a whopping $115 million, per Brian Windhorst.

In 2002, Nike was the leading shoe brand in the NBA coming off a lucrative partnership with Michael Jordan. James had dreams of wearing the swoosh, but to do so meant passing up an extra $28 million.

Reebok wanted to add James to its collection of star athletes that included Shaquille O’Neal, Allen Iverson and Venus Williams. After a long period of pitch meetings and private jet rides for him and his friends, James chose to accept the lower offer from Nike. Brian Windhorst wrote that James sided with who he thought would be a better long-term partner in Nike over a higher initial offer from Reebok.

And James clearly made the right decision. His most recent contract with Nike (while the exact terms are not fully known) is reportedly a lifetime deal that could exceed $1 billion. Meanwhile, as of 2019, Reebok doesn’t currently sponsor any NBA players.

Asking for an ownership stake in Beats by Dre

Jesse D. Garrabrant

Jesse D. Garrabrant

In 2006, music mogul Jimmy Iovine and his friend Andre Young, more commonly known by his rapper name Dr. Dre, started a headphones company called “Beats by Dre.” Iovine and Dre wanted to partner with James in an effort to boost sales. But Beats had a hard time gaining momentum in the mid 2000s.

James, a hip-hop junkie, was interested in working with the brand, according to Windhorst. But instead of just securing a typical sponsorship deal with Beats where he could be seen wearing the headphones in public, James and his team went another route.

James and his business manager Maverick Carter secured a partnership that included elements of a traditional deal (commercials, etc), but also included an ownership stake in the company. This would become a common thread of James’s business dealings over the years.

Carter, who never graduated from college but frequently claims he got a degree at the “University of Nike” after an internship at the company, didn’t see James as just a basketball player, but as a brand.

Windhorst details that through James’s influence, Carter was able to befriend high-profile businessmen like Warren Buffett of Berkshire Hathaway BRK.A, +1.63%, who only added to Carter’s already savvy business acumen.

Carter and James didn’t just want to be used by large corporations to promote products. They wanted to be partners — and they wanted ownership. James knew his brand was so strong that leveraging his influence for an ownership stake would see the most returns. James eventually agreed to a deal where he would promote Beats in exchange for a small piece of ownership.

One major factor in the ascension of Beats was the 2008 Beijing Olympics. While Beats was not an official sponsor of the Olympics, Carter and James deployed a one-of-a-kind marketing campaign in China.

Windhorst writes that Carter was acutely aware that athletes, especially basketball players, had a virtual fashion runway when they moved in and our of venues, not unlike Hollywood celebrities. Knowing the Team USA basketball team were the biggest celebrities in Bejing, Windhorst claims it was Carter who told James to gift each of his teammates a pair of Beats headphones.

For the entirety of the Olympic games, these fifteen extremely tall and famous men strolled around Olympic village and parts of China with the headphones around their neck.

Beats eventually was purchased by Apple AAPL, +1.83% for $3 billion, netting James an estimated $50 million from the sale, according to Windhorst.

Investing in Blaze Pizza

Vince Talotta

Vince Talotta

Fast food brands have been endorsing athletes for decades. Big chains like McDonald’s MCD, +1.10% have famously made commercials featuring NBA stars Michael Jordan and Larry Bird, and tennis’ Williams sisters, among others.

James too had been in a number of McDonald’s commercials — he was their top athlete for many years. According to Windhorst, when his latest McDonald’s contract was set to expire in 2017, James declined a lucrative $15 million extension to fully commit to his 2012 investment in pizza chain start-up Blaze Pizza.

Similar to his agreement with Beats, James was interested in an ownership stake. James was able to buy into the company at a heavily discounted rate in exchange for his influence, per Windhorst. James’s initial investment amount is unknown, but Windhorst writes that James was also given ownership of two franchise locations. According to Forbes, he now owns 21 franchises.

Blaze Pizza soon became the fastest growing restaurant chain of all time, according to Forbes. As of 2017, James’s investment in Blaze Pizza was reportedly worth ‘at least’ $40 million, per ESPN.

James later said of his investment, “I was like, ‘Who doesn’t like pizza?’ I don’t know a single person in the world who doesn’t like pizza.”

Acquiring a 2% stake in Liverpool F.C.

Andrew Powell

Andrew Powell

James has openly spoken about his desire to own an NBA team one day, but current NBA rules prohibit active players from owning any part of NBA franchises. Because James’s hunger to own a sports team cannot currently be satisfied by the NBA, he looked towards Europe.

In 2011, James acquired a minority stake in Liverpool F.C., an English Premier League soccer club. James ‘acquired’ his 2% stake in the soccer club rather than ‘purchased’ it because James was able to work out a deal with the club majority owners (Fenway Sports Group) where he didn’t actually have to risk any money.

Fenway Sports Group (FSG) and James made a deal where the NBA star agreed to be added to their official client list that they used to recruit new clients. James also agreed to allow FSG to pitch him other business deals where they would earn a commission. In exchange, James and his business partner Maverick Carter were given a 2% stake in Liverpool.

FSG wanted so badly to be in the LeBron James business, they gave up equity in their team for what amounted to commission checks on partnerships they got for James that included Dunkin’ Donuts and the Swiss watchmaker Audemars Piguet, according to Windhorst.

Since the agreement, Liverpool F.C won the UEFA Champions League tournament and is now worth upwards of $1.9 billion, four times what FSG paid for it. James and Carter’s stake in the club is valued at over $30 million.

After the deal with Liverpool was reached, James traveled to England to watch a Liverpool match. James met with all of the players and gifted them a pair of special edition Beats headphones.