When Barack Obama ran for president for the last time in 2012, sweeping reform of our college financing system wasn’t even on his agenda, let alone that of his Republican opponent Mitt Romney.

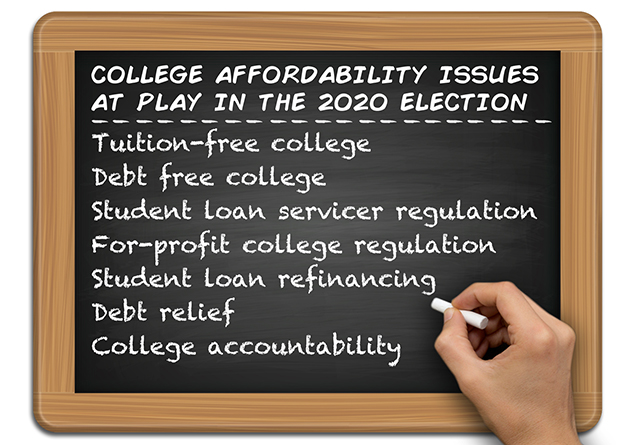

Fast forward just seven years and, in the first few months of the primary contest for the Democratic nomination, candidates have started to stake out their positions on whether to make college free in some form or provide some kind of relief for student-loan borrowers.

‘There is more consensus about the need to go big on college affordability than there has been in previous election cycles.’

This cycle’s contest will likely reanimate some of the 2016 debate between Hillary Clinton and Senator Bernie Sanders, an Independent from Vermont, and their supporters and critics over whether debt-free or tuition-free college is the best way to help more students afford higher education, said Mark Huelsman, associate director of policy and research at Demos, a left-leaning think tank.

Though the difference between debt-free and tuition-free college may seem like semantics, the question of which policy is most effective is a matter of debate among left-leaning policymakers and college-finance experts. Proponents of debt-free college argue that by promising students they won’t need to take on debt to afford school — instead of vowing free tuition for all students regardless of need — officials can target resources to students and families who require the most financial help.

Proponents of tuition-free college argue its simple messaging will mean that low-income students actually respond to its promise instead of viewing it as a program that requires a bunch of paperwork and hoops to jump through, like our current financial-aid system. What’s more, they say, offering the benefit to wealthier families could attract the political buy-in necessary to make it possible.

Terrence Horan/MarketWatch

Terrence Horan/MarketWatch

As the campaign progresses, Democratic candidates will likely debate which among these proposals makes the most sense. The fact that most of them appear to support at least one version of free college shows how normalized the idea has become in Democratic politics over the past several years, Huelsman said.

“There is more consensus about the need to go big on college affordability than there has been in previous election cycles,” he said. “There’s only one candidate that seems to be even pushing back on the notion of an affordability proposal. That’s noteworthy in itself.” (Senator Amy Klobuchar, a Democrat from Minnesota, said in a CNN town hall that she doesn’t support free four-year college for all.)

Borrowers can also likely expect some dramatic proposals for student-debt relief, Huelsman said. In the past, presidential candidates have focused on fixes like streamlining income-driven repayment plans or allowing borrowers to refinance their federal student loans at a lower interest rate.

Consensus among some left-leaning economists and policymakers has been building over the past few years that some form of debt cancellation might actually benefit the economy.

Student-loan refinancing has drawn both praise and skepticism over the past several years; critics note that any student-loan refinance plan would disproportionately benefit borrowers with the most debt, who are more likely to have attended graduate school and, therefore, make a decent living.

But Huelsman said he expects the debt-relief conversation to go beyond student-loan refinancing this election cycle. Consensus among some left-leaning economists and policymakers has been building over the past few years that some form of debt cancellation might actually benefit the economy by freeing up money young people spend servicing their debt for home and car buying as well as other major purchases.

“You’re going to see some pretty bold proposals on debt relief or debt cancellation from candidates,” Huelsman said.

Here’s where the candidates stand on college affordability and student debt relief so far (we’ll continue to update as more information becomes available and more candidates enter the race):

Sen. Bernie Sanders (I-Vt.)

Getty Images

Getty Images

Sanders’ 2016 campaign for president brought the idea that students should be able to attend public colleges tuition free into the mainstream — a position it appears he will continue to push during his 2020 campaign.

In 2016, Sanders proposed making public college tuition-free to students through a partnership between the federal government, which would fund two-thirds of the cost, and the states, which would fund the rest. He proposed paying for the plan through a tax imposed on investment houses, hedge funds and others for transactions involving trades of stocks bonds and derivatives.

‘It is totally counterproductive for our future that millions of Americans are carrying outrageous levels of student debt.’

After Hillary Clinton became the Democratic nominee, Sanders, 77, backed a Clinton proposal to make college “tuition-free for the middle class and debt-free for all.” In 2017, Sanders introduced the College for All Act, which would make college tuition-free for students from families earning $125,000 or less and make community college free for everyone.

Sanders hasn’t formally unveiled his 2020 campaign plan on college affordability, but it appears likely he’ll be pushing some version of his earlier proposals on the campaign trail.

“It is totally counterproductive for our future that millions of Americans are carrying outrageous levels of student debt while many others cannot afford the high cost of higher education,” Sanders said in a video announcing his presidential run. “That is why we need to make public colleges and universities tuition-free and lower student debt.”

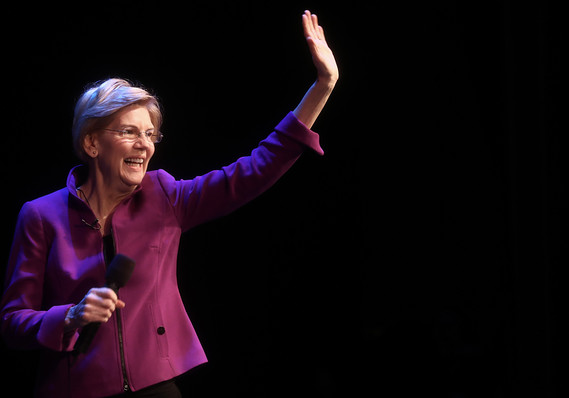

Sen. Elizabeth Warren (D-Mass.)

Getty Images

Getty Images

During her tenure in the Senate, Warren has regularly used her role to call attention to challenges students and families face affording college and repaying student loans. She’s been one of the Senate’s most aggressive critics of the student-loan and for-profit college industries as well as the Department of Education’s oversight of those sectors, frequently writing letters and commissioning investigations into the companies’ and the agency’s practices.

In addition to closely monitoring student-loan industry practices, Warren, a Democrat from Massachusetts, has also introduced legislation aimed at curbing student debt. She introduced a bill as early as 2014 that would allow federal student-loan borrowers to refinance their debt at a lower interest rate.

On the presidential campaign trail, Warren hasn’t said much yet about her plans to address student debt and college affordability, though she has mentioned that proceeds from her proposed tax on the wealthiest Americans could go towards student-loan relief.

Warren, 69, also backed Sanders’ 2017 proposal and is a co-sponsor of a bill introduced by Senator Brian Schatz, a Democrat from Hawaii, last year and reintroduced this year that would use federal government money to incentivize states to help students attend college debt-free — including the cost of room, board, books and supplies.

Given Warren’s history on theses issues, it wouldn’t be surprising to see a sweeping proposal that includes a major stab at college affordability, student-debt relief and aggressive oversight of the student-loan and for-profit college industries.

Sen. Kamala Harris (D-Calif.)

Getty Images

Getty Images

Harris has already made it clear she supports a major reform of our college financing system. In addition to co-sponsoring Schatz’s bill and backing Sanders’ bill, Harris told viewers in a CNN town hall that “we need a national priority and commitment to debt-free college, which I support.”

Harris, 54, also indicated she’d take an aggressive stance towards for-profit colleges, if elected, citing her work as California attorney general uncovering fraud at the now-defunct Corinthian Colleges, once one of the largest for-profit college chains in the country. Harris’ office won a more than $1 billion judgement against the school.

Over the past several years, for-profit colleges have been accused of using misleading job placement and graduate rates to lure students and their financial aid dollars, but providing them with little in the way of marketable credentials. The Obama administration worked to crack down on the industry though the Trump administration has worked to make that oversight more lax.

If elected, it appears Harris will take a particularly aggressive stance towards the schools. “We need to get rid of the for-profit colleges that are preying on students like you,” Harris told a college student during her CNN town hall.

Sen. Kirsten Gillibrand (D-N.Y.)

Getty Images

Getty Images

Like Harris, Gillibrand co-sponsored Schatz’s debt-free college proposal and backed Sanders’ bill, indicating she’d likely support some kind of free college proposal as president, though she has yet to release any specifics.

But Gillibrand, a Democrat from New York, did lay out a specific college-affordability proposal in a February tweet TWTR, -0.23% One of the first things she’d do as president, she wrote, is allow borrowers to refinance their loans at a 4% interest rate. (Undergraduate students who took out a loan this year had an interest rate of 5.05% and graduate students borrowed from the federal government at a minimum interest rate of 6.6%).

“Student debt is at a crisis level in this country, and it holds our whole economy down,” Gillibrand, 52, tweeted.

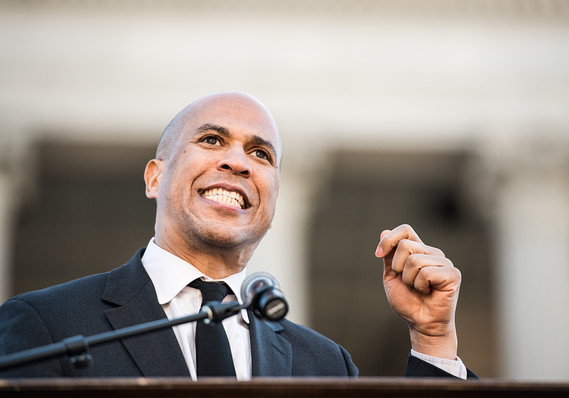

Sen. Cory Booker (D-N.J.)

Getty Images

Getty Images

Booker hasn’t talked much in detail yet about his plans to curb student debt, though he also co-sponsored Schatz’s debt-free college bill, indicating that he too would support some kind of dramatic re-shaping of our college affordability system.

But one of Booker’s signature proposals aimed at closing the racial wealth gap could provide families with a new resource to pay for college. Booker, a Democrat from New Jersey, introduced a bill last year that would provide an account with $1,000 to every baby born in the U.S. The accounts, dubbed baby bonds, would be eligible for an up to $2,000 deposit each year depending on family income.

The funds would sit an account managed by the Treasury Department where they would earn about 3% in interest. At age 18, the account holders could tap the money to pay for college or buy a home.

Seeding children with some sort of savings account has been popular in some policy circles for years. San Francisco is one of a handful of cities across the country that provides children with an account to save for college.

Research indicates that when children know there’s some money saved for them, they’re more likely to attend college. But the idea behind Booker’s proposal is even broader: To provide every American child with the type of nest-egg already available to most wealthy children to help build their future.

“This proposal is about helping families break through barriers that keep so many Americans from wealth-creating opportunities,” Booker, 49, said in a statement announcing the plan called the American Opportunity Accounts Act.

Sen. Amy Klobuchar (D-Minn.)

Getty Images

Getty Images

Klobuchar appears to be the first mainstream Democratic candidate to push back on the idea of debt-free or tuition-free four-year college. “I am not for free four-year college for all, no,” Klobuchar told the audience at her CNN town hall in February. “I wish — if I were a magic genie and could give that to everyone and we could afford it, I would.”

Klobuchar, 58, explained that given the level of the national debt, she doesn’t believe the country can afford a four-year free college program. Still, Klobuchar, who represents Minnesota, said she’d support some policies that could help ease the burden of college costs and student debt, including making two-year degrees and community college free, expanding Pell grants — the money the government provides low-income students to attend college — and allowing borrowers to refinance their student loans.

In addition, Klobuchar has signaled she’d be interested in making it easier for students to afford job training programs that don’t fit in with the traditional image of a college education. She introduced a bill earlier this year that would allow workers to use 529 plans — tax-advantaged college savings accounts — for licensing, credentialing and other short-term training programs.

Beto O’Rourke, former Texas congressman and candidate for Senate

Getty Images

Getty Images

Since officially declaring his run for president in March, former Texas congressman and U.S. Senate candidate Beto O’Rourke hasn’t offered many specifics on how he would address college affordability or student debt. But a 2017 Q&A with the University of Houston’s student newspaper, The Cougar, might provide some insight.

There, O’Rourke, 46, expressed support for a 2015 proposal from then-president Barack Obama, which would have allowed all students to attend two years of community college for free. In a town hall appearance in South Carolina last month, O’Rourke reiterated that position, saying “Let’s make sure that if you want to go to community college you go without paying a single dime.”

O’Rourke also told the South Carolina crowd that students who go to public four-year universities should be able to go for free.

Finally, in the 2017 interview, O’Rourke also floated the idea of supporting graduates who agree to work in an under-served field by either wiping away their debt or not allowing it to accrue in the first place. It’s hard to say whether O’Rourke is proposing an expansion or tweaks to the Public Service Loan Forgiveness program, which allows people who work in government and at some nonprofits to have their federal student loans forgiven after 10 years of payments. When asked to elaborate at a New Hampshire event in March, O’Rourke didn’t provide much in the way of specifics.

At the South Carolina town hall, he criticized a provision in the Trump administration’s budget proposal to cut PSLF, and said he also supports allowing federal student loan borrowers to refinance their debt at lower interest rates.

Rep. Eric Swalwell (D-Calif.)

Getty Images

Getty Images

As a congressman, Swalwell has always kept his identity as a millennial and student loan borrower front and center. Now, he’s hoping it will propel him into the White House. The 38-year-old is still paying back the roughly $150,000 he borrowed to attend college and law school.

“I want to be the student debt solutions candidate,” he told MarketWatch in a recent interview.

If elected, Swalwell said he plans to address student debt and college affordability in the first 100 days of his presidency. His proposals include: creating a path to debt-free public college for students who do work study and commit to serving their communities after college, slashing student loan interest rates to zero, holding colleges accountable to a larger range of metrics and making it easier for employers to help their workers pay off their student debt.

Rep. Tulsi Gabbard (D-Hawaii)

Getty Images

Getty Images

During her tenure in Congress, Gabbard has supported the idea of free college, including by co-sponsoring the House version of Sanders’ College for All Act.

Gabbard, 37, who twice served in the military in the Middle East and who is currently a major in the U.S. National Guard, has also been active around veteran education issues, including introducing legislation last year to improve and expand GI Bill benefits that veterans can use to pay for their education.

Julián Castro, Obama-era Secretary of Housing and Urban Development and former mayor of San Antonio

Getty Images

Getty Images

In announcing his run for president in January, Castro said one of his priorities is to make the first two years of college, a certificate or apprenticeship program more affordable “so millions more people get the skills they need to get a good job without drowning in debt.”

At a campaign event in New Hampshire a couple of days later Castro, 44, appeared to go even further, telling an audience at St. Anselm College, “we need to work toward a tuition-free system of public university, college, apprenticeship and certification programs in this country,” according to the Hill.

Pete Buttigieg, mayor of South Bend, Indiana

Getty Images

Getty Images

Buttigieg is the only candidate so far not to endorse some form of debt-free college. At an April event at Northeastern University, Buttigieg told students that because college graduates earn more than those who don’t attend college, he didn’t view a debt-free college proposal as very progressive.

“I have a hard time getting my head around the idea of a majority who earn less because they didn’t go to college subsidizing a minority who earn more because they did,” he said.

Buttigieg has said that if elected, he’d support expanding the Pell grant and encouraging states to spend more on their public higher education systems.

Andrew Yang, entrepreneur

Getty Images

Getty Images

Though he’s perhaps best known for his proposal to establish a universal basic income, entrepreneur-turned-presidential candidate Andrew Yang also has a series of proposals on college affordability and student debt.

Yang, who most recently worked as the founder of Venture for America, an organization that works with entrepreneurs in various cities across the country, has said if elected, he’d explore a partial reduction in student loan principal for recent graduates and a plan whereby the federal government would buy up all the outstanding student debt and allow borrowers to repay their loans by putting 10% of their income toward their loans for 10 years.

If elected, Yang said he would also take steps to curb the cost of college, including exploring a plan that would reduce the ratio of college administrators to students, require university presidents to meet yearly with alumni groups to understand their job prospects and require colleges with endowments over $30 billion to contribute 1% of their endowment per year to help found a new university.

In addition to these relatively unique proposals, Yang, 44, who worked in a variety of fields, including education and health care before launching his campaign, appears to support some more widely discussed initiatives, including expanding loan forgiveness for borrowers who work in underserved communities and creating a more robust college information database for the public.

Wayne Messam, mayor of Miramar, Florida

Getty Images

Getty Images

Student debt and college affordability were featured prominently in Wayne Messam’s first speech as a presidential candidate in late March. Messam, mayor of Miramar, Florida, and a former college football player, said that if elected he’d throw his support behind the idea of national student debt forgiveness. Messam, 44, proposed paying for the debt relief by repealing the tax cuts pushed by President Donald Trump and congressional Republicans in 2017.

In the speech, Messam cited research indicating that large scale student debt forgiveness would boost the economy. And indeed, a 2018 study from left-leaning economists indicates that wiping away student debt would free up borrowers’ to make other large purchases, like homes and cars, fueling economic growth.

“It’s time we boost our economy and give Americans a second chance at the American Dream,” Messam told supporters.

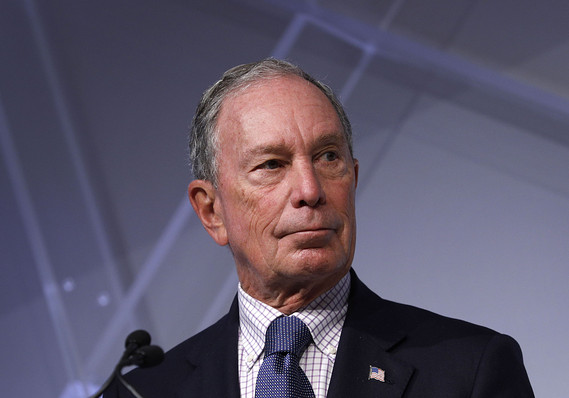

Michael Bloomberg, former mayor of New York City and founder of Bloomberg LP

Getty Images

Getty Images

After much speculation, Bloomberg announced in March that he wouldn’t run for president (though some reports indicate he may reverse that position), but as he tested the waters, voters got a sense of his views on college access and affordability.

At a January New Hampshire event, Bloomberg described free public college as “totally impractical.” “Free college tuition would be a nice thing to do but unfortunately professors want to get paid,” Bloomberg told the crowd, according to Politico.

As a philanthropist, Bloomberg, 77, has taken an interest in making college more accessible to low-income students, though mostly through donating towards financial aid and encouraging colleges to undertake these efforts on their own — not through a broader policy mechanism.

Bloomberg Philanthropies backs the American Talent Initiative, a consortium of 296 colleges and universities that graduate at least 70% of their students within six years and that aim to enroll 50,000 more low-income students by 2025. Bloomberg also personally donated $1.8 billion to his alma mater Johns Hopkins University last year for the school to use for financial aid, the largest such donation in history.

In announcing his decision to not run for president, Bloomberg said he planned to double down on his work as a philanthropist and activist, including in the higher education space.

Starbucks founder Howard Schultz

Getty Images

Getty Images

Schultz, who is exploring a run for president as an independent, has been critical of many of the more progressive proposals from Democratic candidates, including making public college free.

“Government-paid, free college for all — first of all, there’s no free. I mean nothing is free,” Schultz told NPR’s Morning Edition in January.

During his tenure as chief executive of Starbucks SBUX, +1.25% Schultz, 65, did help to cover the cost of college for his employees through a program offering tuition assistance, in some cases up to the full cost of a degree, to attend Arizona State University online.

When the program launched, Schultz framed it as a tool for recruiting and retaining talented employees, telling The New York Times in 2014, “I believe it will lower attrition, it’ll increase performance, it’ll attract and retain better people.”

This story was originally published on Feb. 20, 2019.

Get a daily roundup of the top reads in personal finance delivered to your inbox. Subscribe to MarketWatch’s free Personal Finance Daily newsletter. Sign up here.