(Bloomberg Opinion) — When you return to the gym, your workout will be noticeably different than before the coronavirus lockdown. Don’t plan on pumping iron for more than an hour, or taking a shower. And you can probably forget those trendy boxing classes that have you making contact with your fellow gym-goers.

Welcome to the new world of fitness, which will be characterized by social distancing, obsessively wiping down equipment and, for those who don’t want to brave the gym, sessions with a virtual coach on a Peloton bike at home.

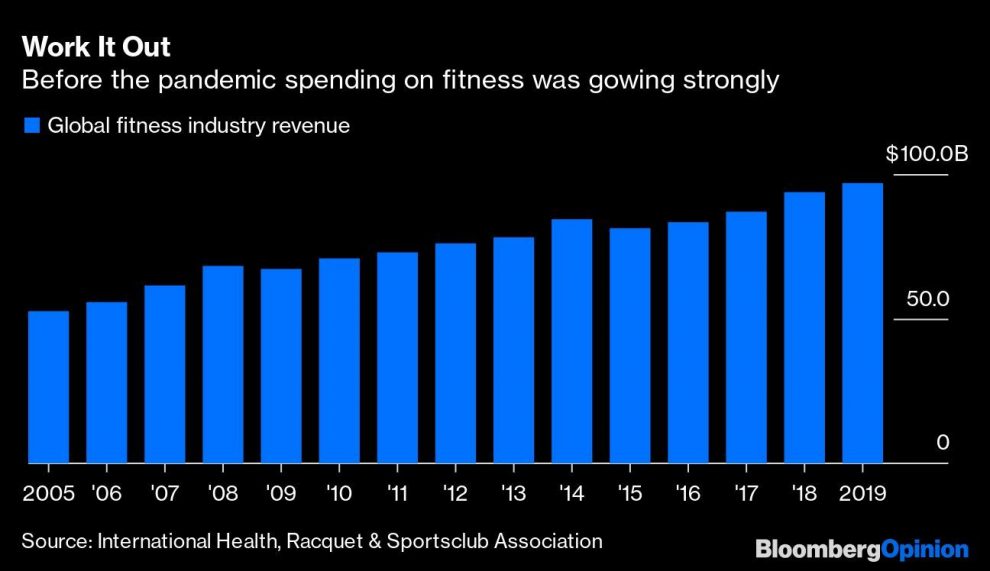

The Covid-19 pandemic has hit something that we largely take for granted: our health. So people are now likely to spend even more of their incomes on well-being, including staying in shape. But with a plethora of choices, from Zoom yoga to ballet barre via Instagram Live, not all of this money may find its way into the traditional fitness sector.

That is likely to lead to a shakeout of an industry that has seen the number of global facilities roughly double over the past 15 years. Many clubs could now close or shrink. Those best placed to survive are the trendy boutiques that can successfully pivot to providing digital content and the no-frills operators that can appeal to cash-strapped fitsters.

Some fitness fans can’t wait to get back to the gym. For others, being in close proximity to other people engaging in sweaty exercise is the last place they will feel comfortable. And for now, workout chains remain closed in some parts of the U.S. Clubs in England will be able to open from July 25.

Where gyms are trading, they’re limiting the number of people inside at any one time and offering “busyness trackers” on their apps, so customers can decide the best time to visit. At peak hours, people may be asked to book ahead of time, or keep their workouts to an hour. As for showers it’s a mixed picture, depending on particular clubs and locations. Many people are choosing to get changed at home anyway.

For gyms, in addition to contending with costly measures to contain the spread of the virus and keep customers feeling safe, it’s a changing landscape in terms of where their customers are and what they may want.

Because many fitness centers are located in business districts, there may be far less demand when they reopen as working from home becomes entrenched. Virgin Active, owned by investment holding company Brait SE, whose clubs are mostly in metropolitan areas, looks particularly exposed here. And the new routines people have embraced while at home may lend themselves to working out in one’s kitchen or bedroom, rather than going to the gym at all. Consequently, clubs could face a wave of cancellations.

Already, months of closure and higher reopening costs have taken their toll. Bodybuilder favorite Gold’s Gym International Inc. and 24 Hour Fitness Worldwide Inc. have filed for bankruptcy protection. But it is not just the legacy gyms, already caught in the ultimate barbell economy between chic boutiques and budget operators, that are feeling the burn.

The boutiques, such as those that specialize in cycling, yoga or Pilates, face unique and acute challenges. The economics of many of these businesses are built around cramming lots of class participants into a tiny space — the kind of set-up people are likely to want to avoid.

These fitness outposts are experimenting with ways of hanging onto their members. In a particularly fanciful example, SoulCycle Inc. is offering some outdoor classes in the Hamptons this summer that cost $50 for a single class. In such a posh location, there may be plenty of takers, but that’s hardly a model that can be replicated across the country. And outdoor classes will lose their appeal in the dead of winter.

That is why some gyms, both boutiques and big-box outlets, are turning to digital content. Yogaworks Inc., for example, is live-streaming more than 100 daily classes from teachers at their studios all over the U.S. If this becomes really popular, it’s not hard to imagine the company needing to upend its business model, perhaps by reducing its roster of instructors, closing underperforming brick-and-mortar studios and hiring more technologists.

Going online is far from a sure bet. It’s a highly competitive space that includes everything from free workouts on YouTube to Nike Inc.’s activity app and subscription programs like Glo and Daily Burn. In the U.K. alone, David Minton of the Leisure Database Company said he counted more than 600 Instagram Live workout classes in one day.

It also puts operators in more direct competition with trendy home-workout programs such as the Mirror, which was just acquired by yoga-wear maker Lululemon Athletica Inc. for $500 million, and Peloton Interactive Inc., which has seen such explosive demand for its stationary bikes that it paused advertising back in March while it moved to accelerate its supply chain.

The budget sector, which has been booming on both sides of the Atlantic, is not immune to the new pressures either. It faces a future with higher hygiene-related costs, such as the more regular and intensive cleaning of equipment. These may be difficult to accommodate when clubs are typically charging only about 20 pounds ($25) a month.

Even so, companies such as Planet Fitness Inc. in the U.S. and Basic-Fit NV in Europe, as well as U.K. operators The Gym Group Plc and Pure Gym Group Plc, are probably best placed. Their clubs tend to be large, and many are located in suburban areas. In some cases, members are younger, and so may be less cautious about coming back. Pure Gym found that when its clubs reopened in Switzerland, people under 30 were three times more likely to return than those over 50.

Yes, some people may ditch their subscriptions as the hard economic impact of the lockdowns hits. But no-frills clubs may also benefit from cash-strapped fitness fans trading down.

The result is that even the most nimble, well-situated competitors will have to work up more of a sweat to compete in the Covid-19 era.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

Sarah Halzack is a Bloomberg Opinion columnist covering the consumer and retail industries. She was previously a national retail reporter for the Washington Post.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”71″>For more articles like this, please visit us at bloomberg.com/opinion

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”72″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment