Apple’s entry into the buy now, pay later (BNPL) space isn’t keeping Affirm founder Max Levchin up at night.

“BNPL as a category is so under-penetrated in the U.S. and you could argue, worldwide,” Levchin said on Yahoo Finance Live. “There is a lot of growth available to everyone. When PayPal announced they were going to get into the business, everyone expected us to sweat. We have yet to have any meaningful reduction in growth since PayPal entered the business. I fully expect Apple will continue promoting the idea of transparent, simple interest, or no interest at all in some cases. But ultimately, there is a lot of room for growth for everyone.”

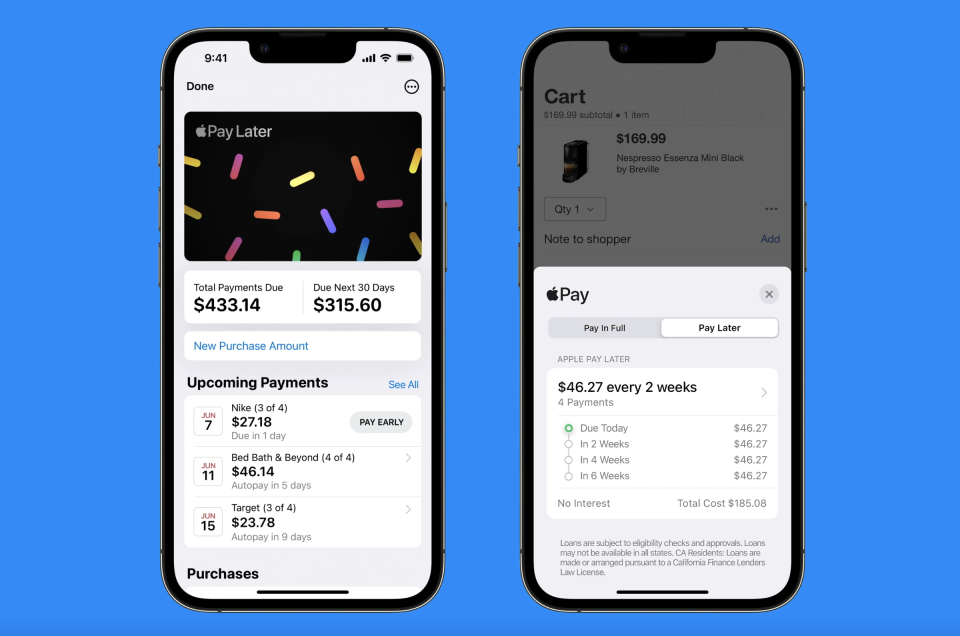

Apple revealed Apple Pay Later at its Worldwide Developers Conference (WWDC) earlier this week. The update to Apple Pay allows users to split the cost of an Apple Pay purchase into four equal payments over six weeks. No interest or late fees are charged.

The tech giant’s new BNPL service is powered by Mastercard’s network.

Affirm’s stock has dropped about 19% since Apple made the announcement, as it sparked fears of a heightened competitive market that also already includes Klarna and Afterpay.

Apple’s product “dials up the competitive threat,” Wedbush analyst David Chiaverini said in a new note to clients after the announcement. The analyst initiated coverage of Affirm with an underperform rating and $15 price target.

“We’re concerned about Affirm’s path to GAAP profitability, increasing competition in the buy now, pay later space, industry forecasts calling for slowing e-commerce sales (which drive Affirm’s gross merchandise volume, or GMV), and its ability to cover its cost of capital as funding costs increase,” he explained.

Yet, Wall Street is seemingly shrugging off the competitive threat to Affirm from Apple. The way the Street sees it, Affirm offers a larger suite of BNPL services for customers and is headed toward being a full shopping solution for customers amid a push into debt cards.

“We continue to like Affirm’s competitive positioning as Affirm offers a broader set of offerings, including Split Pay, 0% APR loans, and interest-bearing loans (long and shorter duration),” Morgan Stanley analyst James Faucette in a note. “This gives Affirm flexibility with merchants and consumers who need different credit offerings as well as the most levers to pull as interest rates rise to effectively offset higher funding costs.”

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Click here for the latest trending stock tickers of the Yahoo Finance platform

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube