The Latin American e-commerce company has a lot of growth potential, which could make it look like a bargain in the years ahead.

MercadoLibre (MELI -1.05%) is often compared to Amazon for its strong success in the e-commerce market. A focus on Latin America — with its developing markets that have attractive prospects — has made it an intriguing growth stock to own.

And over the past five years, the stock’s 150% return has blown past Amazon, which is up by around 97% during the same time frame.

But some investors might be growing concerned that MercadoLibre has become too expensive. It trades at more than 70 times earnings, which can be a tough valuation to swallow, especially as fears are rising that the stock market might have become overheated this year, with the S&P 500 continuing to soar to new records.

Why MercadoLibre stock looks expensive

The problem with looking at just a price-to-earnings (P/E) multiple is that it only tells you how a stock is valued based on its earnings over the past four quarters. If a company had a bad quarter or if it incurred an unexpected expense, that would impact those numbers.

In other cases, a business might be growing fast and generating a lot of bullishness in the markets, but its margins are not high enough to prevent the earnings multiple from rising too quickly.

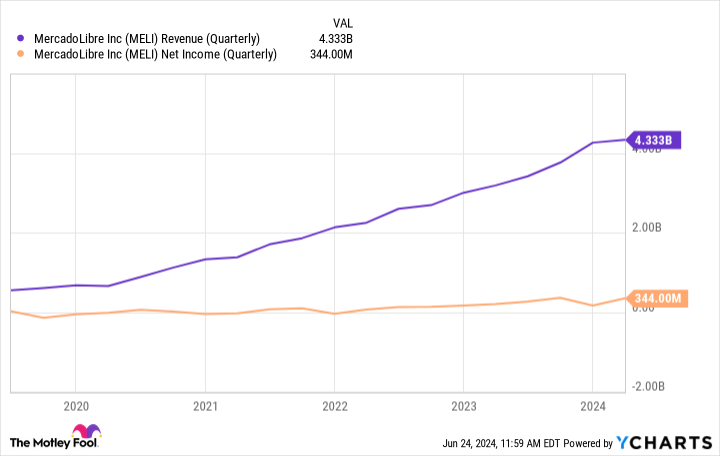

MercadoLibre falls into the latter category. While the top line has been taking off and so has the stock price, the bottom line has been rising at a slower pace.

MELI revenue (quarterly); data by YCharts.

In the trailing 12 months, the business has averaged a profit margin of just over 7%. That’s a decent margin, but the company is working on expanding it. If it’s successful, then that will mean more of each new dollar of revenue will flow through to the bottom line.

Investors shouldn’t overlook the promising growth potential

For growth investors, an important metric to consider is the price/earnings-to-growth (PEG) ratio. It considers the P/E ratio along with how much growth analysts expect from the business in the future (typically the next five years).

And based on its PEG ratio of less than 1.5, MercadoLibre’s stock might look a bit expensive, but not by much. Normally, growth investors see a PEG of 1.0 as being the cutoff between a good growth stock and an expensive one. The lower the PEG, the better a buy it is. While MercadoLibre is above that threshold, it’s not significantly higher.

In the very long run, there could be even more room for the company to become more valuable. It is a growing business with a presence in 18 countries, and it has over 100 million active users.

Fintech is another growth opportunity for MercadoLibre. It operates Mercado Pago, an online payment platform that merchants can use to accept bank and credit card payments.

Should you buy MercadoLibre stock?

MercadoLibre can be a good option for growth investors to consider today. Although its price might seem high right now, it’s important to always consider where the business could be in not just a year or two but also five or ten years down the road. And based on that potential, MercadoLibre looks like it could be a cheap buy.

The company has established itself as a big brand in Latin America, and as those markets grow in size, the payoff could be significant for investors willing to be patient and stay the course. The stock can also be a great way to help diversify your portfolio and gain exposure to some promising developing markets.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and MercadoLibre. The Motley Fool has a disclosure policy.