It’s getting harder to generate a good return on your cash.

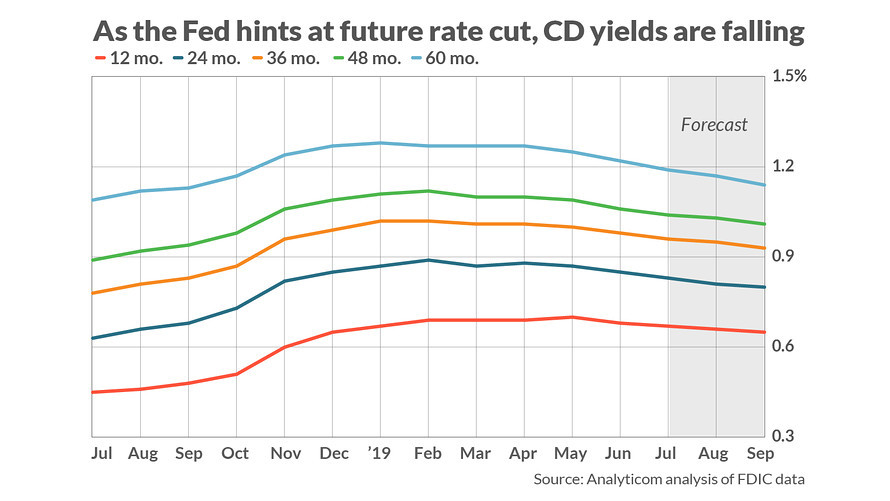

An analysis of Federal Deposit Insurance Corp. data by behavioral economics consulting firm Analyticom found that rates for certificates of deposits (CDs) are falling across the board for the first time in five years.

‘July is a turning point because this is the first month that all CD terms are trending down.’

Long-term CD rates began falling in January, Analyticom founder Dan Geller said. “Institutions started lowering their rates on deposits gradually, but July is a turning point because this is the first month that all CD terms are trending down,” he said.

Per Analyticom’s report, the average rate on a 12-month CD is expected to be 0.67%, down from a recent peak of 0.70% in May.

In the past weeks, multiple online banks, which have long offered competitive rates on their savings account products, have begun to lower those yields.

Marcus, the online division of Goldman Sachs GS, +0.98% said that it has lowered the annual percentage yield (APY) on its savings accounts to 2.15% from 2.25%.

Similarly, Ally Bank confirmed ALLY, +0.32% it has dropped the APY on its online savings account to 2.10% from 2.20%.

Pasadena, Calif.-based CIT Bank CIT, +0.54% has cut the APY on its Savings Builder accounts to 2.30%; the bank previously offered an APY of 2.45% on these accounts, according to Reddit users. (CIT confirmed that it decreased the APY, but didn’t provide the previous rate.)

Savers still can take advantage of strong CD rates

While CD rates are falling on average, good opportunities still exist — especially at smaller financial institutions.

“Banks and credit unions, especially smaller ones, have a lag in setting rates, so you can sometimes get a few weeks or even months after Treasury rates come down to lock in a rate with a CD before it falls in tandem,” Karimzad said.

Particularly for those who are risk-averse, such as retirees on a fixed income, this could be an ideal time to lock in a strong interest rate on cash, Geller argued, as banks could bring CD yields down even further if the Federal Reserve moves forward with a rate cut later this year as it has teased is possible.

Ultimately, there’s risk involved in locking in a CD rate. “Bond markets are saying there’s a strong chance growth and inflation will be slower two years from now, and it’s not convinced when that will accelerate afterward,” Karimzad said.

“That said,” he said, “bond markets can be wrong and, if so, those rates will rise again.”

Why banks are cutting interest rates on savings accounts and CDs

The last time CD rates trended downward in this manner was in mid-2007, right before the start of the Great Recession. However, Geller warned that the current yield-cutting is not a signal of an upcoming recession.

Instead, banks are looking to secure their bottom lines. Interest rates are also falling for loan products, which generates income for banks. As a result, banks don’t want to get stuck paying out high yields on deposit and savings accounts if they’re not earning as much.

‘Banks are catching up to the bond market with rates – which has been pricing in lower expectations for growth and inflation.’

“The reason we are seeing declining deposit rates has more to do now with hedging against Fed rate cuts in order to protect net interest margins down the road,” Geller said, referring to the important metric used to determine whether banks are turning a profit.

“Banks are catching up to the bond market with rates, which has been pricing in lower expectations for growth and inflation,” said Brian Karimzad, co-founder of personal finance website MagnifyMoney TREE, -0.39%

The yields on Treasury bonds TMUBMUSD10Y, +0.75% have skewed lowered throughout 2019 — this is an important benchmark for the interest rates banks charge on loans and pay out on deposits and savings.

“Banks are catching up to the bond market with rates, which has been pricing in lower expectations for growth and inflation,” said Brian Karimzad, co-founder of personal finance website MagnifyMoney TREE, -0.39%

“Interest rates are on the downswing and are projected to fall further,” a spokesman for Ally said. “These market conditions impact all kinds of things, from mortgages to CDs to savings accounts.”

A spokesman for Goldman Sachs also cited “market conditions” as an explanation behind Marcus’ APY cut, while a spokeswoman for CIT said the company considers “a number of marketplace factors.”

Consumers can still find high APYs at some institutions

Not all companies are slashing rates — and some have even boosted the yield on their savings accounts in recent weeks.

Robo adviser investment firm Wealthfront recently boosted the APY on its FDIC-insured cash accounts to 2.57%, which was the highest interest rate available on the market as of the end of June according to personal-finance site Bankrate.

When Wealthfront debuted these accounts earlier this year, they only carried a yield of 2.24%. The Wealthfront accounts only require $1 to open and carry no fees.

Wealthfront says it manages to keep the interest rate on its cash accounts higher than most other banks’ savings accounts because it automates its back-end processes.

Also see: Citi makes sweeping changes to its credit-card rewards programs

“Wealthfront’s repeated APY increases are not an accident, fluke, or temporary gimmick — this is how we built this part of our business to function,” Andy Rachleff, Wealthfront’s co-founder, wrote in a blog post. “Our cash team is relentless at driving down our cost through automation. Each time we are able to cut our costs, we try to pass along those cost savings to our clients.”

The robo adviser does warn that it could be forced to lower rates in the future if the Fed does choose to cut rates, but argues that it expects to still offer a higher yield than the industry average.

Meanwhile, Vio Bank and Salem Five Direct have raised the APYs on their online savings accounts — to 2.51% and 2.51% respectively, per Bankrate — in the past month. (Vio and Salem Five did not immediately return requests for comment.)

Don’t miss: Amazon’s new credit card could backfire on people with bad credit

At institutions like Ally and Marcus, savers are still coming out ahead these days, relative to what they could earn on their funds in the past.

“Even with a rate cut from the Fed, savers in online savings accounts will continue to earn a return that exceeds inflation,” Bankrate’s chief financial analyst Greg McBride said. “The Fed raised rates nine times in a three-year period. If they walk back one or two of those, savers are still far ahead of where they were for much of the past decade.”

Indeed, the average rate on savings accounts nationwide was 0.10% as of July 1, according to the FDIC.