Reported delays of Nvidia’s next-generation artificial intelligence (AI) may not be as bad as originally feared.

Shares of Nvidia (NVDA 5.75%) surged higher on Tuesday, jumping as much as 6.2%. As of 1:33 p.m. ET, the stock was still up 5.7%.

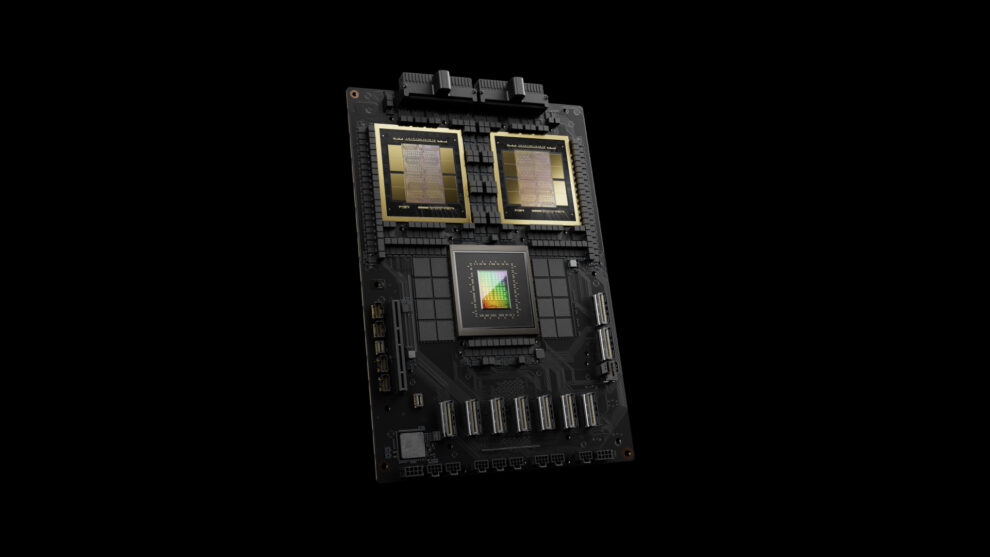

The catalyst that sent the chipmaker and artificial intelligence (AI) specialist higher were reports that delays of the Blackwell AI processor likely won’t be as bad as originally feared.

Billions at stake

Earlier this month, reports suggested that Nvidia’s much anticipated Blackwell B200 AI processor, which is scheduled to begin shipping later this year, would ship as much as three months late, thanks to a design flaw, according to a report that first appeared on the website The Information.

With billions of dollars in potential sales of the next-gen AI processor at stake, investors were justifiably concerned, sending the stock lower in the wake of the report.

However, things may not be as bad as all that. Analysts at UBS have researched the matter and contend the shipments of the Blackwell chips are delayed by “maybe four to six weeks at most, putting them at the very end of January 2025.” Demand remains strong and will likely be filled by Nvidia’s H200 processor during the shorter delay, the analyst wrote in a note to clients. UBS went on to suggest that research labs and enterprise customers alike continue to invest heavily in AI, “both bullish indicators.”

A long road ahead

It’s important for Nvidia investors to keep in mind that the company’s growth — particularly as it relates to AI — will come in fits and starts. Furthermore, a look at Nvidia’s stock chart reveals an important lesson. Even as the stock has gained 24,000% over the past decade, there have been numerous declines of 50% or more.

Investors with the ability to withstand the occasional gut-wrenching volatility that comes with owning this high-growth stock have been richly rewarded. Additionally, one must ignore the day-to-day machinations of the stock market in order to reap those rewards.

Nvidia might seem expensive at 42 times forward earnings, but I’d argue it’s a reasonable price to pay for a company generating triple-digit growth and in pole position in the AI revolution.