The 2024 Q2 earnings season picks up considerable steam this week, with a notably busy reporting docket. We’ll hear from many different companies, a list that includes several cloud computing players such as Microsoft MSFT and Amazon AMZN.

Both stocks have been sensitive to their cloud results, often dictating the post-earnings move. We already heard from another notable cloud player, Alphabet GOOGL, and the results provided some insight into what to expect from MSFT and AMZN. Let’s take a closer look.

Alphabet Posts Positivity

Alphabet’s quarterly release was overall positive. The company enjoyed 31% EPS growth on nearly 14% higher sales. Both figures exceeded our consensus expectations, building on its recent streak of quarterly positivity.

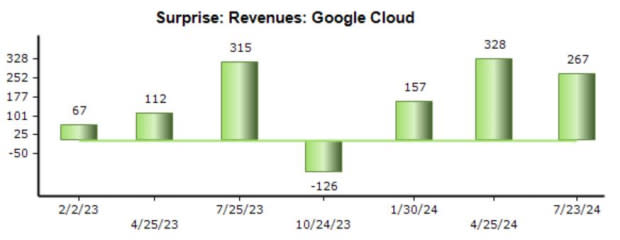

Cloud showed great growth, with revenues of $10.3 billion nearly 30% higher year-over-year and reflecting a quarterly record. In addition, operating income from Google Cloud saw a sizable jump, reported at $900 million vs. $191 million in the year-ago period.

Overall, the results were positive, but shares faced pressure following the release due to some uncertainty about AI CapEx. Alphabet has regularly exceeded our consensus cloud expectations as of late, as shown below.

Image Source: Zacks Investment Research

Microsoft’s Cloud Looks to Deliver Again

Cloud revenue growth of 23% year-over-year positively shocked investors in its latest release, showing stabilization after a few periods of slowing growth rates. Earnings and revenue expectations have overall remained stable over recent months, with the company expected to enjoy 8% EPS growth on 14% higher sales.

Recent cloud results from the company have consistently exceeded our consensus expectations, as shown below. For the upcoming release, the $28.7 billion estimate suggests a 20% climb from the year-ago period.

Image Source: Zacks Investment Research

Will Amazon Post Robust Results Again?

AWS delivered great results in the company’s latest period, with net sales of $25 billion showing 17% year-over-year growth and snapping a recent streak of negative surprises on the metric. For the upcoming print, the Zacks Consensus estimate for Cloud revenue stands at $25.9 billion, reflecting a 17.2% Y/Y climb.

Image Source: Zacks Investment Research

Earnings and revenue expectations for the upcoming release have primarily been muted, but big growth is expected, with EPS expected to be up 63% on 10% higher sales. Easing costs and operational efficiencies have aided profitability in a big way, leading to meaningful margin expansion.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Bottom Line

Several major cloud players report this week, a list that includes Mag 7 members Amazon AMZN and Microsoft MSFT. Google parent Alphabet GOOGL recently unveiled its cloud results, which were overall positive and showed great growth.

Investors will undoubtedly be laser-focused on the Y/Y growth rates these cloud businesses will post, as a deceleration could cause some spooks. On the flip side, better-than-expected growth could easily usher in post-earnings positivity, though other metrics will also be in focus.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.