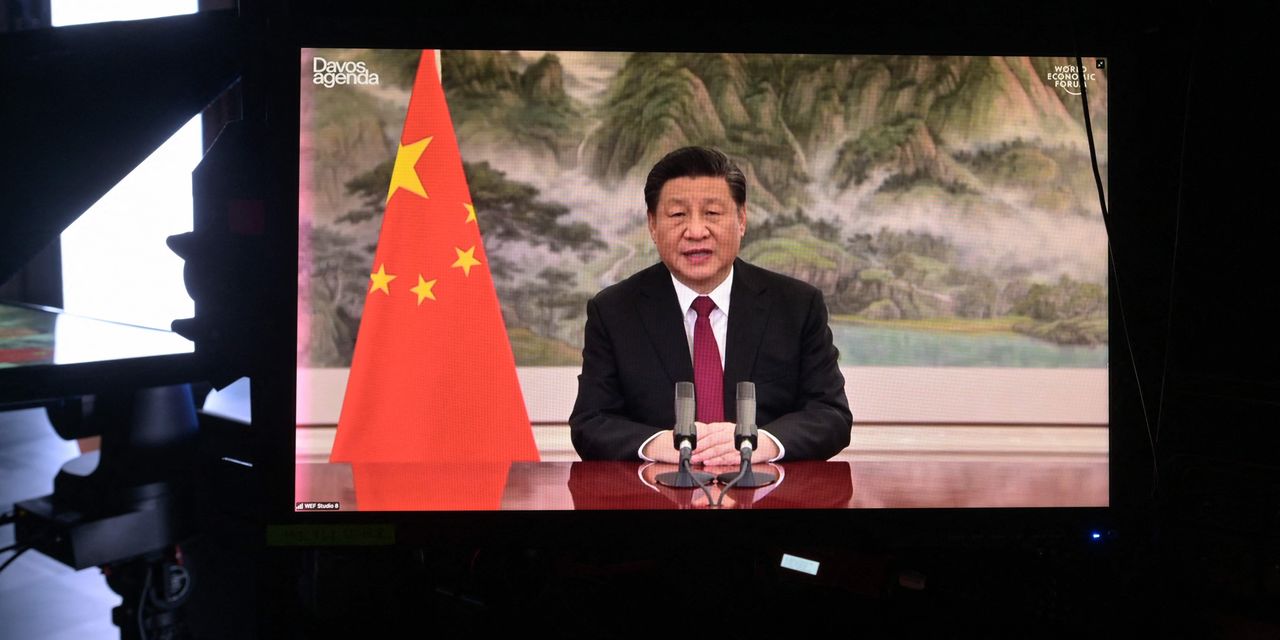

Chinese President Xi Jinping took to the virtual stage at Davos to address Fed Chair Jerome Powell — please don’t lift interest rates.

“If major economies slam on the brakes or take a U-turn in their monetary policies, there would be serious negative spillovers. They would present challenges to global economic and financial stability, and developing countries would bear the brunt of it,” said Xi, according to a transcript of his remarks on Monday.

Of the major central banks, the Fed is expected to be the most aggressive, with financial markets now pricing in four rate hikes, and also expecting the central bank to start reducing the size of its nearly $9 trillion balance sheet. Yields on the benchmark 10-year Treasury TMUBMUSD10Y, 1.813% on Tuesday reached the highest level since Jan. 2020.

Traditionally, Fed officials brush off concerns about how their policies impact other economies, saying they can only set policy for the U.S. economy.

Xi has reason to be nervous about Fed tightening.

Despite tariffs that were started by President Donald Trump and continued under President Joe Biden, Americans are still aggressively buying Chinese products. Through November, China was the number-one source of imported goods at $463 billion, topping Mexico at $350 billion and Canada at $324 billion.

Craig Bothan, chief China+ economist at Pantheon Macroeconomics, pointed out export growth has helped China compensate for weaker domestic growth and propped up its manufacturing sector.

China’s economy continues to slow, falling to 4% year-on-year in the fourth quarter from 4.9%. On Monday, the People’s Bank of China cut two policy rates by 10 basis points.