Insights from the Third Quarter N-PORT Filing of 2024

Yacktman Fund (Trades, Portfolio), managed by Yacktman Asset Management (Trades, Portfolio), is renowned for its disciplined investment strategy aimed at achieving long-term capital appreciation and, to a lesser extent, current income. The Fund focuses on investing in high-quality U.S. companies, employing a meticulous approach that blends the principles of both growth and value investing. By targeting companies with excellent business models, shareholder-oriented management, and attractive valuations, Yacktman Fund (Trades, Portfolio) strives to deliver superior returns to its investors.

Portfolio Adjustments: Exits and Reductions

During the third quarter of 2024, Yacktman Fund (Trades, Portfolio) made significant changes to its portfolio, including completely exiting positions in two companies:

-

Kellanova Co (NYSE:K): The fund sold all 1,200,000 shares, impacting the portfolio by -0.91%.

-

GrafTech International Ltd (NYSE:EAF): The liquidation of all 8,000,000 shares resulted in a -0.1% portfolio impact.

Additionally, the fund reduced its holdings in 16 stocks. Notable reductions include:

-

Alphabet Inc (NASDAQ:GOOG): A reduction of 680,000 shares led to a -36.17% decrease in the holding size and a -1.64% impact on the portfolio. Alphabet’s stock price averaged $169.25 during the quarter, with a three-month return of -11.11% and a year-to-date gain of 18.84%.

-

Microsoft Corp (NASDAQ:MSFT): The fund cut its stake by 110,000 shares, marking a -13.75% reduction and a -0.65% impact on the portfolio. Microsoft traded at an average price of $427.47 this quarter, with a -7.98% return over the past three months and an 11.49% increase year-to-date.

Comprehensive Portfolio Overview

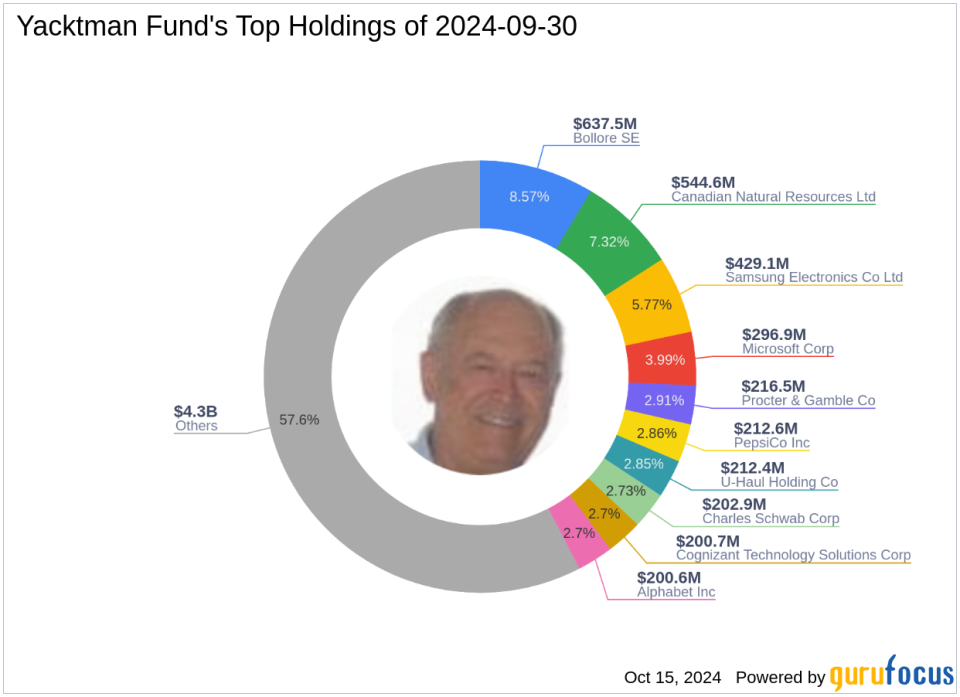

As of the third quarter of 2024, Yacktman Fund (Trades, Portfolio)’s portfolio comprised 56 stocks. The top holdings included 8.57% in Bollore SE (XPAR:BOL), 7.32% in Canadian Natural Resources Ltd (NYSE:CNQ), and 5.77% in Samsung Electronics Co Ltd (XKRX:005935). Other significant positions were 3.99% in Microsoft Corp (NASDAQ:MSFT) and 2.91% in Procter & Gamble Co (NYSE:PG). The portfolio is well-diversified across major industries, with significant allocations in Communication Services, Consumer Defensive, Technology, Energy, Financial Services, Industrials, Consumer Cyclical, Basic Materials, Healthcare, and Utilities.

This strategic positioning reflects Yacktman Fund (Trades, Portfolio)’s commitment to capitalizing on market opportunities while adhering to its foundational investment philosophy. The adjustments made during the quarter showcase a proactive approach to portfolio management in response to evolving market dynamics, particularly in the technology sector with significant adjustments in Alphabet Inc and Microsoft Corp.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.