One of this tech giant’s side projects will soon be a major profit center.

There’s no denying Alphabet‘s (GOOG -0.02%) (GOOGL 0.10%) third-quarter results were terrific. Not only were the company’s top and bottom lines higher on a year-over-year basis, but each topped analysts’ estimates as well.

Alphabet stock’s surge following the news, however, added to already big gains that first began materializing a week earlier. Thanks to the post-earnings pop, Alphabet shares are now up an intimidating 12% in just the past few days. It’s the kind of move many investors simply don’t want to chase, fearing a wave of profit-taking awaits.

If that’s you, you might want to hold your nose and dive in anyway. While there’s certainly no guarantee this rally will remain uninterrupted, this stock’s price still doesn’t reflect Alphabet’s full potential. There’s an underappreciated bullish force at work here.

Google Cloud’s quiet strength

For the three-month stretch ending in September, Google parent Alphabet turned $88.3 billion worth of revenue into per-share profits of $2.12. That’s markedly better than the year-ago comparisons of $76.7 billion and $1.55 (respectively). And, perhaps even more bullishly, these figures topped analysts’ estimates for $86.3 billion in revenue and earnings of $1.85 per share. The bulk of this growth was driven by Google’s search advertising business.

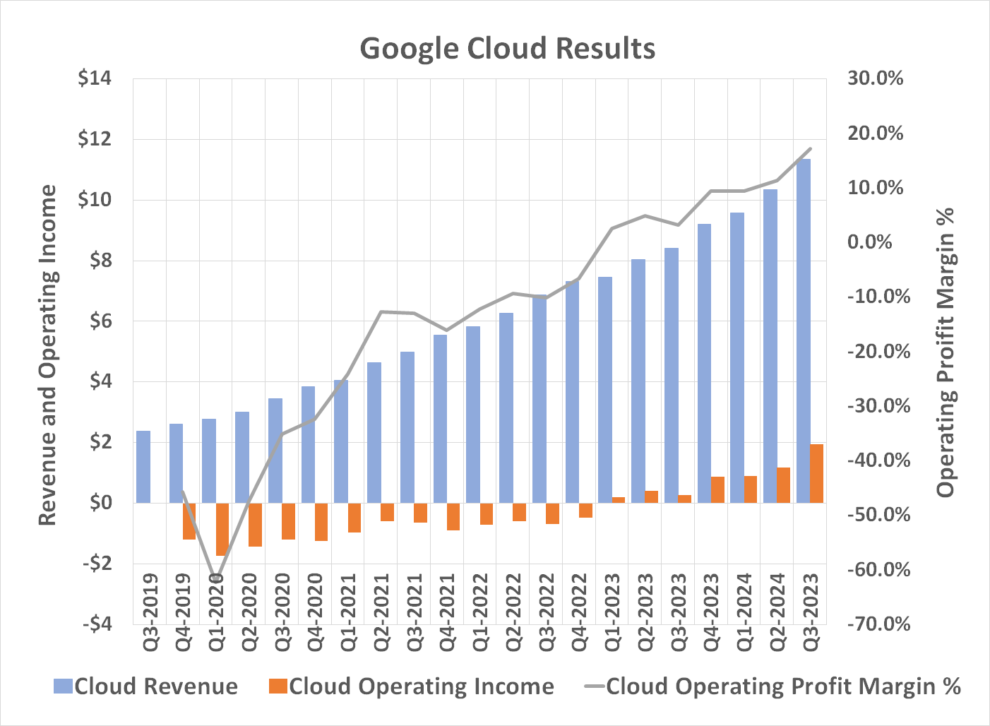

There’s a mostly overlooked profit center that simply exploded last quarter, however. That’s Google’s cloud computing arm. Its revenue improved 35% year over year to $11.6 billion, driving operating income up an incredible 632% to $1.95 billion.

Data source: Alphabet Inc. Chart by author. Dollar figures are in billions.

Almost needless to say, the technology giant’s cloud business is (finally) reaching critical mass.

Don’t misunderstand. In the grand scheme of things Google Cloud isn’t exactly making a massive contribution to the bottom line. At least not yet. Cloud computing only accounts for about 13% of Alphabet’s third-quarter revenue, and only 7% of its operating income. Every dollar helps, but it’s clearly not as important to the company as its search-advertising business is.

Data source: Alphabet Inc. Chart by author. Dollar figures are in billions.

However, take a closer look at Google Cloud’s accelerating profit trajectory and extend it out for a couple of years (or more). Given this unit’s accelerating profit growth paired with Mordor Intelligence’s forecast for annualized growth of 16.4% for the global cloud computing market through 2029, Google Cloud could certainly evolve into a serious profit center in the foreseeable future.

Underscoring this idea is how modest Google Cloud’s operating profit margins still are compared to its peers. Although 17% of sales is another new record for this Alphabet arm, it also pales in comparison to Amazon Web Services’ current operating margin of 36% and Microsoft‘s cloud business’s operational profit margin in the ballpark of 45%.

What are these rivals doing that Alphabet isn’t? Nothing. They simply have more scale, which allows for these wider margins.

Google Cloud is quickly gaining that scale, however. It’s not inconceivable that within the next five years, Alphabet’s cloud computing arm could be generating annual operating income on the order of $30 billion per year, if not more.

Alphabet stock still brings more reward than risk to the table

Does any of this outright guarantee Alphabet stock won’t fall back under its current price at some point in the future? Certainly not. Technology stocks like this one are inherently volatile. Moreover, even though Google dominates the world’s search market, it faces respectable direct and indirect competition on multiple fronts. The price of an ad “click” is also constantly under pressure, as alternative advertising mediums like streaming TV and in-app promotions increasingly appeal to advertisers. These are all factors that can weigh on Alphabet stock, even if only by virtue of weighing on investors’ perception of Alphabet itself.

On balance though, Google’s search business is growing about as well as it ever has, while its cloud business seems to be on the verge of becoming a major profit center. Even with the stock’s recent rally it still doesn’t fully reflect the potential of this growth prospect.

Bottom line? The bigger risk here remains the risk of missing out on more upside, as more and more investors begin recognizing Google Cloud’s potential.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.