(Bloomberg Opinion) — Yes Bank Ltd. has changed. In the past, the troubled Indian lender kept quiet rather than tell shareholders the truth about its bad loans. Now, under new management, it can’t stop talking about an impending rescue. If the former approach nearly destroyed the bank, this latest strategy isn’t going to help fix it.

In early September, CEO Ravneet Gill told Reuters that Yes was in “fairly advanced level of talks” with a top global technology company for a stake sale. In an interview with Press Trust of India earlier this month, Gill said the white knight would be a tech firm, a deep-pocketed family office, a financial investor, or any two out of the three. “In future banks will become technology companies with a banking licence,” he said.

On Friday night, after reporting a September quarter loss of almost $85 million, 50% more than expected by analysts, Gill said the bank has $3 billion in rescue offers, led by a $1.2 billion binding bid from a North American family office that hasn’t previously invested in India. The other eager parties include a couple of Indian mutual funds and global buyout funds that have made a $1.5 billion overture, he said. Another consortium has shown up with a smaller $350 million offer. Everyone wants a piece of Yes Bank, it seems, except those tech suitors. They may not be able to participate immediately, according to media reports of what Gill is telling journalists now. And just like that, speculation that Microsoft Corp. would invest has gone out of the window.

Gill’s hurry to close fundraising by December is understandable: Yes is skating on a dangerously thin layer of capital. Gross nonperforming loans jumped to 7.4% of total assets in September from 5% in June. The Reserve Bank of India is already getting flak for neglecting supervision of a small cooperative lender and then trapping depositors by limiting withdrawals. The central bank won’t take any chances — not with Yes losing 7% of its deposits in one quarter. If the regulator puts the private-sector bank into its correctional facility for wayward lenders, there will be limits on risk-taking. The value of the franchise to any potential investor will erode sharply.

So Yes can’t count its chickens before the eggs have hatched. Gill says he informed the local stock exchanges about the binding offer of $1.2 billion because it was price-sensitive information. However, the disclosure had no details about how many shares will be sold and at what price. The bank’s board is yet to weigh the plan. Regulatory approvals are far from certain.

Will the RBI, which doesn’t normally allow a single investor to own more than 10% of a bank, make an exception to save Yes? It did allow Canadian billionaire Prem Watsa’s Fairfax India Holdings Corp. to buy 51% of a small private bank based in the southwestern state of Kerala, the first time it had permitted a foreign investor to assume majority control. That lender, now known as CSB Bank Ltd., has nevertheless been instructed to do an IPO and dilute Watsa’s stake.

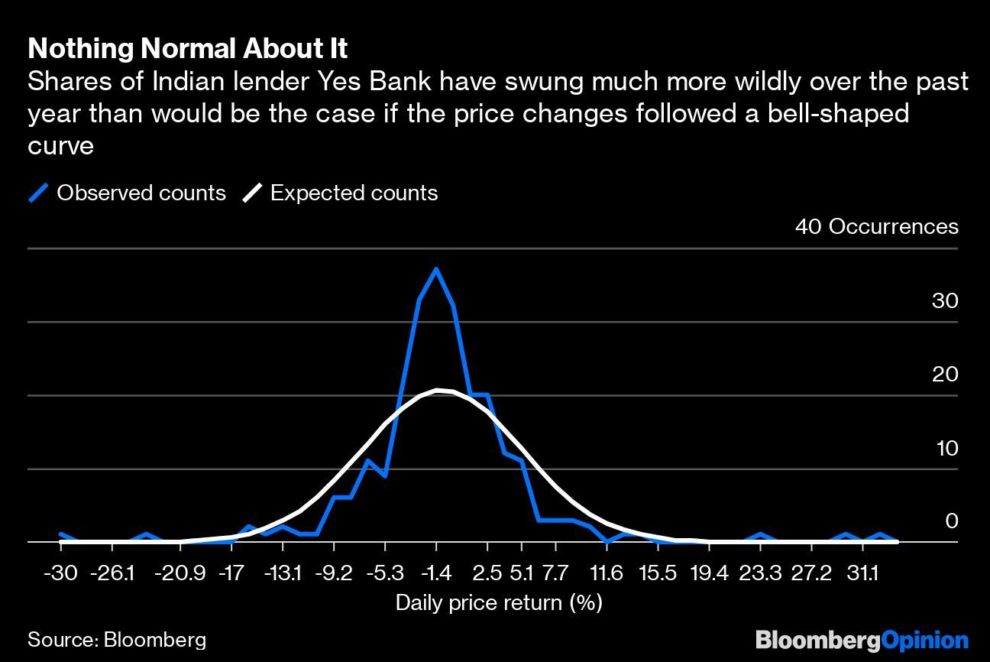

For Yes, which is already listed, the approvals will be more complicated. The central bank will assess the suitability of the acquirer and the extent of its control. Beyond this, though, the Securities and Exchange Board of India, the stock-market regulator, will have to bless the price at which new equity is sold. A two-week average of high and low prices, the floor for an institutional placement, is a meaningless number for a stock whose trading volatility is currently off the charts.

What regulators seem to be missing — or turning a blind eye to — is that volatility is being amplified by half-baked disclosures. News of the planned $1.2 billion rescue hit the market on the last Thursday of October, the day of expiry for monthly derivative contracts on the bank’s stock. Bears got trapped by a near 24% rise in Yes shares. The very next day, the shares slumped 5.4%, in anticipation of poor earnings.

If the previous management was guilty of hiding the lender’s tattered asset quality, the new lot’s premature hopefulness is thwarting orderly price discovery by giving rise to a cottage industry in loose talk. Last month it was the turn of an Alibaba Group Holding Ltd.-backed payments firm to buy Yes Bank. Speculation last week had DBS Group Holdings Ltd. writing the check. The Singapore bank denied the rumor.

This everyday excitement is unhelpful. It would be nice to have Yes’s board approve a concrete fundraising offer — one that has at least a reasonable chance of satisfying the regulators. Then Gill can talk about a rescue as much as he wants.

To contact the author of this story: Andy Mukherjee at [email protected]

To contact the editor responsible for this story: Matthew Brooker at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”64″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.