In this article, we take a look at 11 best long-term growth stocks for strong returns. If you want to see more best long-term growth stocks for strong returns, go directly to 5 Best Long-term Growth Stocks for Strong Returns.

It is impossible to know the future.

As such, it isn’t possible to know stocks that will generate strong returns for sure.

Nevertheless, there are leading companies that benefit from secular growth trends that could potentially generate substantial profits in the future.

Leading companies have a lot of scale and competitive advantages.

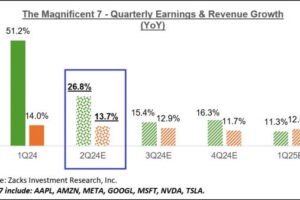

Some leading companies are tech giants that benefit from the increasing popularity of AI. Companies like Amazon.com, Inc. (NASDAQ:AMZN) and Microsoft Corporation (NASDAQ:MSFT) own leading cloud infrastructure businesses that will likely realize more demand from AI processing as AI apps grow.

Some leading companies benefit from increases in the broader market, which could increase demand for asset management services such as BlackRock, Inc. (NYSE:BLK) and Goldman Sachs Group, Inc. (NYSE:GS).

Some leading companies such as Meta Platforms, Inc. (NASDAQ:META) could benefit from the metaverse trend if it achieves the potential that some bulls think it can in the future. For those of you interested, check out 10 Most Promising Metaverse Stocks to Buy.

In the near term, things are uncertain as the economy is currently strong but inflation is higher than the U.S. central bank would like. As a result, the Federal Reserve will likely continue to raise interest rates further and this could slow economic growth.

If economic growth slows too much, demand for many companies might weaken more than expected and the job market might weaken.

On March 9, the S&P 500 fell 1.8%, the Dow Jones Industrial Average declined by 1.6%, and the Nasdaq Composite retreated 2% due to a steep drop in SVB Financial which pressured banking stocks and also the weekly report on initial filings for unemployment insurance showing 211,000 claims were filed last week, up 21,000 from the previous week.

Given the near term uncertainty and considering one company might not do well in the long term for any number of reasons, it could be a good idea for long term investors to own a well diversified portfolio of leading stocks across many different sectors.

Photo by floriane vita on Unsplash

Methodology

For our list of 11 Best Long-term Growth Stocks for Strong Returns, we picked 11 stocks with competitive advantages that have long term growth potential.

We ranked each stock based on the number of hedge funds in our database of 943 funds that owned shares of the same stock at the end of Q4.

For those of you interested check out 13 Best Annual Dividend Stocks to Buy Now.

11 Best Long-term Growth Stocks for Strong Returns

11. BlackRock, Inc. (NYSE:BLK)

Number of Hedge Fund Holders: 49

BlackRock, Inc. (NYSE:BLK) is a leading asset manager that benefits from the secular trend of the long term increase in the broader market such as the S&P 500. With inflation, productivity increases, and population growth, the broader market will likely increase in the long term, and BlackRock, Inc. (NYSE:BLK)’s AUM could potentially increase in the long term if it maintains its market share. In addition to broader market growth, BlackRock, Inc. (NYSE:BLK) has benefited from inflows as well. In January, the company reported it had $146 billion of quarterly long term net inflows.

Alongside Meta Platforms, Inc. (NASDAQ:META), Amazon.com, Inc. (NASDAQ:AMZN), and Microsoft Corporation (NASDAQ:MSFT), BlackRock, Inc. (NYSE:BLK) is one of the high quality long term growth stocks that many hedge funds in our database owned at the end of Q4.

10. The Home Depot, Inc. (NYSE:HD)

Number of Hedge Fund Holders: 62

The Home Depot, Inc. (NYSE:HD) is the world’s largest home improvement retailer that benefits from the secular growth of the home improvement market. In fiscal 2022, the Home Depot, Inc. (NYSE:HD) achieved $157.4 billion in sales, and the company’s diluted earnings per share rose 7.5% year over year. Over a three year period, the company has grown sales by more than $47 billion and delivered diluted EPS growth of over 60%. Given many homes are aging and worth on average 40% more than they were before the beginning of the pandemic, demand for home improvement could remain fairly strong in the near future. In the long term, The Home Depot, Inc. (NYSE:HD) could also potentially expand further if mortgage rates normalize.

9. Lowe’s Companies, Inc. (NYSE:LOW)

Number of Hedge Fund Holders: 68

Lowe’s Companies, Inc. (NYSE:LOW) ranks #9 on our list of 11 Best Long-term Growth Stocks for Strong Returns given 68 hedge funds in our database owned shares of the leading home improvement retailer at the end of Q4. Although shares of Lowe’s Companies, Inc. (NYSE:LOW) are down slightly year to date, they trade for a forward P/E of 13.44 as of March 9 and the company also benefits from secular tailwinds.

Lowe’s Companies, Inc. (NYSE:LOW) management described its tailwinds in March of this year, “Consumer savings are still roughly $1.5 trillion higher than pre-pandemic, with 85% concentrated in the top 40% of income owners who are more likely to be homeowners. Homeowners continue to enjoy record levels of equity in their homes, nearly $330,000 on average. Even if there is a modest decline in home prices, the level of equity built up during the pandemic would not be meaningfully eroded. And the housing stock continues to age with 50% of U.S. homes over 41 years old, the oldest since World War II. These factors, along with strong millennial household formation, baby boomers’ increasing preference to age in place, and more widespread remote work will continue to be tailwinds for our business.”

8. NIKE, Inc. (NYSE:NKE)

Number of Hedge Fund Holders: 71

NIKE, Inc. (NYSE:NKE) is a leading sport apparel maker that benefits from the secular popularity in sports such as the NBA. As the NBA grows in popularity, the athletes in the league that NIKE, Inc. (NYSE:NKE) sponsors could also grow in popularity and potentially generate more business for the company. NIKE, Inc. (NYSE:NKE) also benefits from the secular growth in incomes which helps more consumers be able to afford its apparel. As of March 9, shares trade for a forward P/E of 29.65, indicating that the market expects more earnings growth in the future. Although a recession or economic slowdown could be near term headwinds, the company has long term growth potential.

7. Goldman Sachs Group, Inc. (NYSE:GS)

Number of Hedge Fund Holders: 74

Goldman Sachs Group, Inc. (NYSE:GS) is the most prestigious investment bank on Wall Street that could benefit from the secular growth in the broader market. If the broader market is bigger in the long term, demand for investment banking services and asset management could increase, and Goldman Sachs Group, Inc. (NYSE:GS) could potentially benefit given its leading reputation and world class workforce. For 2022, the company maintained its number one league table position in completed M&A as it has for 23 of the last 24 years. The company also ranked second in equity and equity related underwriting.

74 hedge funds in our database owned shares of Goldman Sachs Group, Inc. (NYSE:GS) at the end of Q4, ranking the stock #7 on our list of 11 Best Long-term Growth Stocks for Strong Returns. For those of you interested check out 17 Biggest Finance Companies in the World.

6. Johnson & Johnson (NYSE:JNJ)

Number of Hedge Fund Holders: 84

Johnson & Johnson (NYSE:JNJ) is a leading healthcare giant that benefits from the secular growth in healthcare given a growing older population and rising incomes. Given it is the largest and most diversified healthcare products company in the world, Johnson & Johnson (NYSE:JNJ) has substantial resources to continue to innovate and deliver in demand healthcare products.

In 2022, the company invested almost $15 billion or over 15% of sales into R&D, which could help it with long term growth and value creation. As of March 9, the stock has a forward P/E ratio of 13.88 and a dividend yield of 2.99%.

Like Johnson & Johnson (NYSE:JNJ), Meta Platforms, Inc. (NASDAQ:META), Amazon.com, Inc. (NASDAQ:AMZN), and Microsoft Corporation (NASDAQ:MSFT) are high quality long term growth stocks that many hedge funds in our database owned at the end of Q4.

Click to continue reading and see 5 Best Long-term Growth Stocks for Strong Returns.

Suggested articles:

Disclosure: None. 11 Best Long-term Growth Stocks for Strong Returns is originally published on Insider Monkey.

Add Comment