To give yourself the best shot at stock market success, invest early and stick it out for the long term.

If you were able to identify in advance the rare stocks that could turn $1,000 into a cool million, you wouldn’t have to do much to be set for life. But no one has a crystal ball, which is why diversification is just as important as picking top stocks. There are all sorts of factors that could send any given stock plummeting or skyrocketing, and you can never know which ones will carry the day (or week, or month, or year).

The hard part of investing isn’t necessarily coming up with the funds to invest or agonizing over corporate financial statements. Often, the hardest part is maintaining the fortitude to hang on to your investments through the tough times and let the magic of compound growth do its work.

Consider Amazon (AMZN -0.17%), Walmart (WMT 0.83%), and Home Depot (HD -0.55%). Each of these stocks has had major downswings at times, but if you’d invested $1,000 in any of them when they went public, you’d have more than $1 million today.

The Amazon of e-commerce

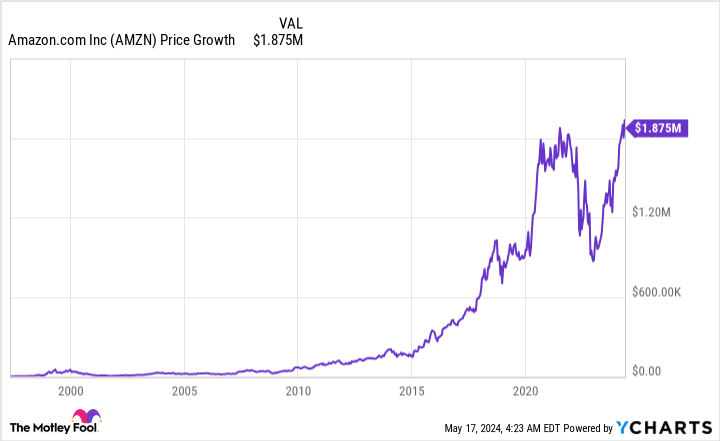

Amazon’s overall returns have been some of the highest in the history of the stock market. If you’d invested $1,000 in Amazon stock at the time of its initial public offering (IPO), you’d have almost $1.9 million today.

As you can see in the chart, that includes a major downturn in 2022, in addition to other bumps along the road. What’s happening today? Amazon is still reporting double-digit percentage growth, a truly remarkable feat given the size of the base it’s building on. Even more, it still has incredible opportunities in artificial intelligence on top of strong potential in its core e-commerce business.

The largest retailer in the world

Walmart isn’t a growth stock anymore, but even though it keeps looking like Amazon is growing fast enough to take over as the world’s largest retailer, the e-commerce powerhouse hasn’t been able to knock it from the top spot. The discount chain is still growing at about mid-single-digit percentage rates, which is truly impressive considering its gargantuan size. Walmart has been a public company a lot longer than Amazon, and if you’d invested $1,000 in it in 1970 with dividends reinvested, you’d have more than $4.6 million today.

WMT Total Return Level data by YCharts

It does appear that Amazon will dethrone it one of these days, but Walmart has been doing all kinds of things to generate growth and stay on top. It’s joining the streaming space to leverage an advertising business and fine-tuning its merchandise in different locations to better meet regional demand. It may eventually lose the world’s largest retailer title, but it won’t lose its status as an excellent business. Plus, it pays a growing dividend.

A millionaire-maker that might surprise you

You might have expected to see Amazon and Walmart on this list, but you might be surprised that Home Depot is here. After all, it’s a niche retailer. But if you’d invested $1,000 in its stock early enough, your Home Depot holding would be worth much more now than if you’d invested in the IPOs of either Amazon or Walmart.

HD Total Return Level data by YCharts

Home Depot is an excellent business, and today it enjoys a strong moat thanks to its investments in technology and its dominant position within its niche. It’s feeling some pressure in the current macroeconomic environment, and its stock price — after some ups and downs — is close to flat so far this year, so this could be an excellent time to buy in. In the meantime, it pays a competitive and growing dividend, and reinvesting it accounts for $12 million of the total return.

Can they still make you millionaires?

From their current massive sizes, it’s more or less impossible for these three companies to increase in value again by 1,000 times or more, so $1,000 invested in these companies today won’t make you a millionaire. However, they’ve all demonstrated that they have great business models, and they could still create plenty of additional value for their shareholders over time. Not every stock will make you a millionaire, but diversification in your portfolio can help you get there.

I want to finish by clarifying that this is an exercise to bring home the value of long-term investing. Most retail investors don’t get to invest in any companies at their IPOs, and few stocks have achieved the accomplishment of turning $1,000 into $1 million. But investors who start early, invest in great companies, and hold onto their investments for the long haul so that their growth can compound over time can definitely create wealth and become millionaires.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Home Depot, and Walmart. The Motley Fool has a disclosure policy.

Add Comment