(Bloomberg) — With shares skyrocketing since its trading debut, Airbnb Inc.’s initial public offering was well-timed. That rally shows little sign of abating.

Most Read from Bloomberg

It has soared 140% since it went public in December 2020. The timing was auspicious: Covid-19 vaccines were just arriving, sparking a revival in travel and also demand for lodging where travelers could isolate more easily than in a hotel. Employees also embraced a work-anywhere environment, encouraging the use of temporary homes.

And investors have more reasons to stay bullish. Airbnb’s stock is expected to climb by an average of 22% over the next 12 months with a majority of the 41 analysts covering the firm recommending investors hold on to their shares or buy more, according to data compiled by Bloomberg.

“It is evolving, and becoming an interesting play with respect to work-from-home and long-term rental trends,” said Thomas George, a portfolio manager at Grizzle Investment Management, which owns the stock. “Those are additional levers it can unlock for growth.”

Brokerages on average predict the company next month will report a 64% jump in first-quarter sales. Airbnb, which was profitable on a net-income basis the past two quarters, probably lost money again in the first three months of this year, analysts say.

Its revenue grew 78% to $1.53 billion in the fourth quarter, beating analysts’ projections as people spread out over thousands of towns and cities and stayed for weeks and months with workers no longer having to be in traditional offices five days a week.

“The benefits seen over the past year or so are expected to continue, especially as traveling increases with the pandemic hopefully continuing to wane,” said Scott Kessler, an analyst at Third Bridge.

Airbnb’s stock performance also has given it the title of best performer of any IPO to raise $1 billion or more since its debut, according Bloomberg data. This comes at a time where weak trading in recent IPOs has weighed on the listings pipeline. At $105 billion in market value, it’s now the biggest online travel company, eclipsing Booking Holdings Inc., Expedia Group Inc. and Marriott International Inc.

Some caution is warranted. Its stock rally has surpassed its peers by a mile in the travel industry since it went public, which could mean its upside is minimal. Booking has climbed 5.5%, Marriott is 29% higher and Expedia is up 44% in that time period.

And it isn’t cheap. Airbnb sells for about 12 times its estimated sales. That’s well above its peers with Booking sitting at 5.3, and both Expedia’s and TripAdvisor’s are below 3.

To be sure, shares of Airbnb more than doubled in value in its blockbuster debut and seen a more moderate growth rate since. The company has, however, fared better than other growth stocks as the market navigated through multiple tech selloffs.

Tech Chart of the Day

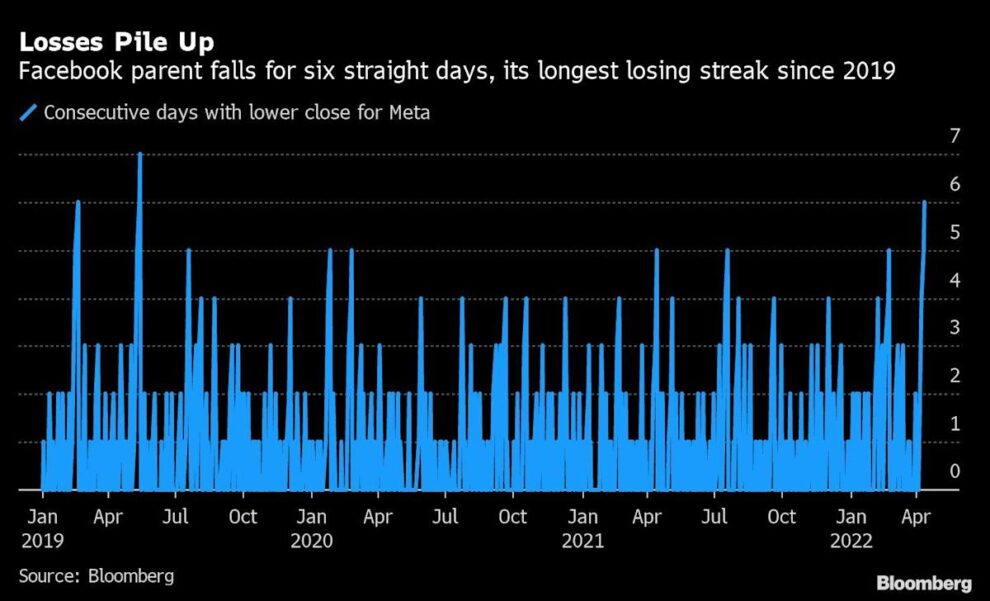

The cloud continues to darken around Facebook parent Meta Platforms Inc. Its shares fell 1.1% on Tuesday, rounding out a sixth day of losses. Its losing streak, which has erased $55 billion in market value, is its longest since May 2019. All eyes will be on the company’s quarterly results slated for April 27, where investors will be looking for any guidance on future growth and its metaverse strategy.

Top Tech Stories

-

Google said it will invest $9.5 billion in offices and data centers in the U.S. over 2022, putting money behind its bid to get more workers back in its buildings. The Alphabet Inc.-owned company based in Mountain View, California will spend on campuses across the country, and is expecting to create 12,000 new jobs as part of the investment

-

Deutsche Telekom AG paid $2.4 billion to SoftBank Group Corp.to increase its stake in T-Mobile US Inc., taking it closer to its goal of holding a majority of the U.S. division

-

More than 30 Taiwanese companies including Pegatron Corp.and Macbook maker Quanta Computer Inc. have now halted production in the electronics hubs of eastern China to comply with local Covid-related restrictions, spelling more trouble for an already fragile global tech supply chain

-

Cathie Wood added her voice to one of Wall Street’s favorite parlor games: What will Elon Musk do next with his new stake in Twitter Inc.

-

The architect of Spotify Technology SA’s podcasting strategy, including the signing of controversial commentator Joe Rogan, is leaving the company after almost five years, according to people with knowledge of matter.

-

ZujuGP, a digital football community helmed by the son of secretive Singaporean investor Peter Lim and fronted by global superstar Cristiano Ronaldo, is bringing over the employees of a gaming-technology startup to bolster the infrastructure behind its app

-

More than 60 musicians, actors and other personalities collectively offered about $87 million in crypto-payments company MoonPay’s latest round of funding

(Updates to add detail on share movement.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment