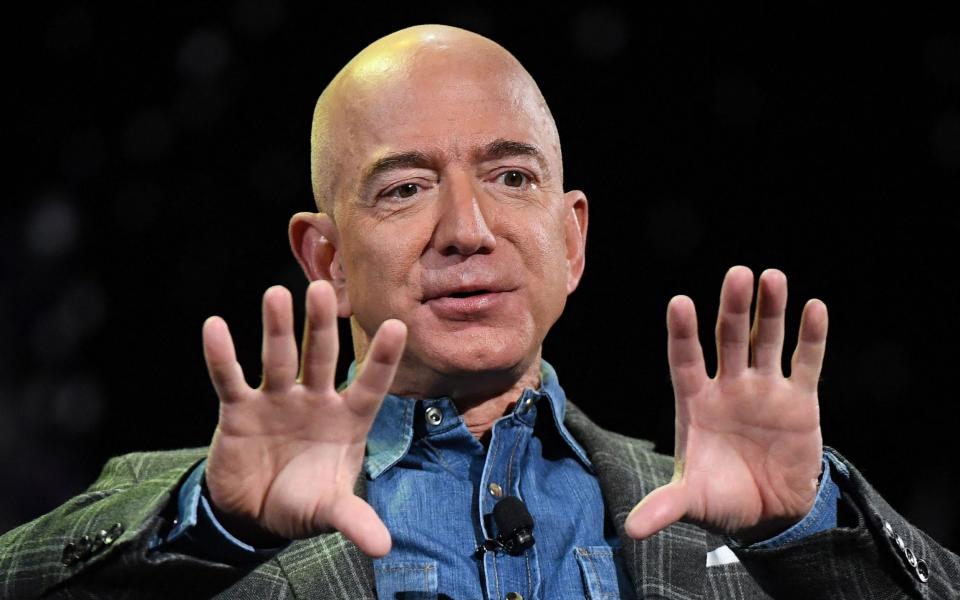

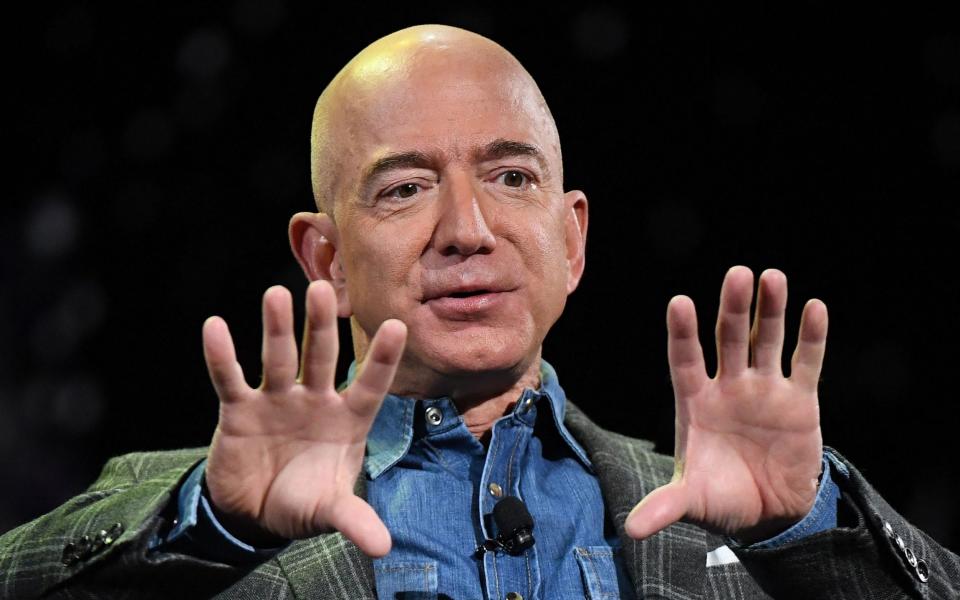

Amazon executives would have been forgiven for choking on their morning coffee when they heard Jeff Bezos speaking on CNN this week.

Asked whether consumers should “batten down the hatches”, the company’s billionaire founder issued a stark warning about the coming recession.

“My advice to people is take some risk off the table,” Bezos said in the interview.

“If you’re an individual and you’re thinking about buying a new large screen TV, maybe slow that down.

“Keep that cash, see what happens. Same thing with a refrigerator or a new car, or whatever.”

Though undeniably prudent, his suggestion may not have thrilled colleagues at Amazon, which sells more than a few televisions and fridges. The comments succinctly sum up the problems facing the online retail giant this festive season, with a chill wind blowing for retailers.

Normally Amazon could expect rip-roaring trade in the final months of the year, which cover Black Friday, Cyber Monday and Christmas.

But with consumers and businesses tightening their belts in the face of rising energy and food costs, not to mention looming recessions, Amazon faces a lean festive season this year.

It has lowered expectations for the fourth quarter of 2022, predicting sales of between $140bn and $148bn – well below the $155bn expected by analysts.

That would represent sales growth of between 2pc and 8pc when compared to 2021, below the 9pc achieved a year earlier.

Amazon itself appears to be taking its founder’s advice and battening down the hatches.

Andy Jassy, the former Amazon Web Services boss who succeeded Bezos as chief executive last year, has vowed to slash costs across the business while remaining laser-focused on “value and convenience”.

On Monday it was claimed the company is preparing to lay off some 10,000 staff, just days after Facebook owner Meta also announced it was cutting 11,000 jobs and Twitter axed more than 3,000 roles.

While just a fraction of Amazon’s 1.5m workforce around the world, the cuts signify that Jassy is worried about the prospects for the month ahead.

The worsening economic picture is an added headache as Jassy seeks to fend off demands for higher pay from UK and US workers, who are seeking to unionise.

Clive Black, a retail analyst at Shore Capital, says the problems facing Amazon are common to the whole e-commerce sector, as shoppers become more cautious and selective.

Growing pressure has led online clothing retailers Boohoo and Asos to issue recent sales and profit warnings, while furniture seller Made.com collapsed into administration this month despite strong growth during the pandemic.

“The tide has gone out and Amazon is going to have to respond to that,” says Black.

“Shoppers have started saving money, they are going to be more savvy, more selective. Retailers will have to be disciplined and they are going to have to get out of anything that is only ‘nice to do’.

“This year is simply not going to be as big as it has been in the past.”

As with rivals, the roots of some of Amazon’s current problems lie in the coronavirus pandemic. A boom in online shopping prompted the internet giant to go on a hiring spree that, with hindsight, now looks like over expansion.

With millions of consumers stuck indoors due to lockdowns, many people spent more money than ever on the internet.

In 2019, Amazon’s annual sales came to $281bn. By 2021, that figure had rocketed 67pc higher to $470bn.

To meet the extraordinary surge in demand, the company scrambled to invest in its logistics network and added an astonishing 800,000 workers, mainly in its warehouses. Amazon’s total spending on “fulfilment” – the delivery of goods bought online – rose from $43bn to $75bn during the pandemic.

However, after coronavirus restrictions were lifted, online sales sagged as people spent money on “experiences” such as eating out, going on holiday or shopping in person on high streets.

The picture has only got worse, as galloping inflation has pushed up costs for businesses and left shoppers with less money to spend.

The threat of a looming recession in the US is now poised to blunt demand even more, during what is normally the busiest period for all retailers.

Next year is scarcely expected to be better, with economists forecasting recessions in the UK, US and in the eurozone.

Reflecting these concerns, and rising interest rates, Amazon’s shares have plunged more than 40pc this year.

Jassy has responded with plans to trim the fat. No parts of the business are to be spared from scrutiny, according to reports.

Under the chief executive, the company has already abruptly shut physical grocery stores and bookshops that are not profitable, instituted a hiring freeze and closed its telehealth business, Amazon Care.

Even the division responsible for the Alexa voice assistant – one of Bezos’s pet projects – is being subjected to a review and could face cuts, according to the Wall Street Journal.

On the ground, Amazon is also pushing to make its warehouse and logistics operations more productive.

Those efforts are running into resistance, with the company’s warehouse workforces on both sides of the Atlantic in open revolt.

Staff are demanding higher wages and complaining about working conditions, which they say have led to high levels of injuries. Amazon has so far fought off their attempts to unionise and refused to formally recognise them.

A recent ballot by workers in New York failed after the company flew in “union avoidance” consultants to persuade them to reject unionisation, but another ballot is soon planned in Moreno Valley, California.

In the UK, MPs rounded on Amazon on Tuesday for its attempts to track worker productivity using technology.

A 63-year-old man was among staff told he was not packing goods quickly enough, said Darren Jones, the Labour MP who chairs the business select committee.

“That is surveilling the worker, not the goods,” he told company bosses. “Do you not see there’s a problem?”

The GMB union, which is seeking to represent Amazon warehouse workers officially, has also warned that staff who are unhappy with pay the company are willing to stage more walkouts after they downed tools in August. They are demanding £15 an hour.

Amazon insists it already offers a “comprehensive benefits package”.

Even if it does head off brewing discontent among its own staff, union action elsewhere poses a threat. Royal Mail staff are set to stage a 48-hour strike around Black Friday and Cyber Monday, which could put off shoppers and will at the very least cause disruption.

“Try to reduce some risk in your business or your life,” Bezos advised the public. “Let’s take some risk off the table.”

For the business that made him a billionaire, that may prove easier said than done.

Add Comment