(Bloomberg) — Shares of e-commerce companies doing business in Brazil extended losses on Tuesday after Amazon.com Inc. said it’s bringing its popular Prime membership program to Latin America’s largest economy.

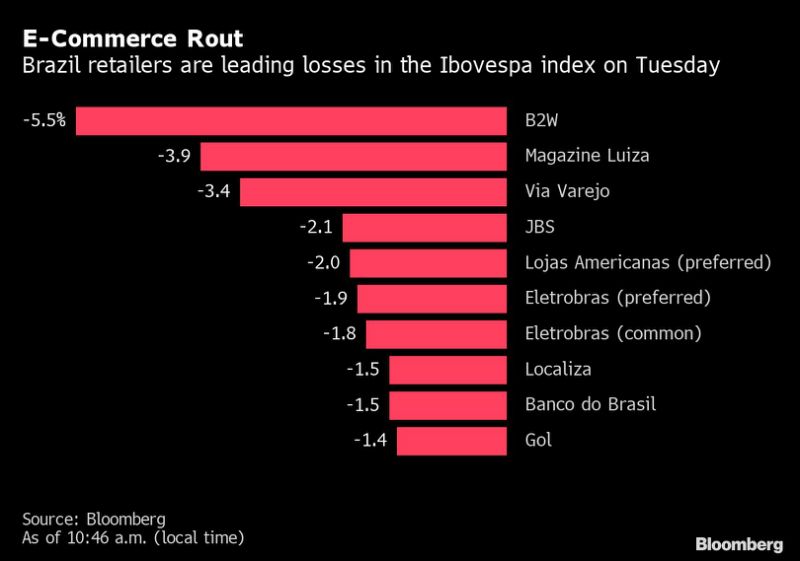

B2W Cia Digital, Magazine Luiza SA and Via Varejo SA led the losses in Brazil’s benchmark Ibovespa index, falling as much as 6% in Sao Paulo. MercadoLibre Inc., which is based in Buenos Aires but gets more than 60% of its revenue from Brazil, declined as much as 5% in New York.

Amazon, which entered Brazil in 2012, will offer unlimited free shipping for about 500,000 products out of the 20 million it sells in the country. The company also promises two-day shipping in 90 cities and perks that include access to the full content of its Prime Video streaming service.

“It is clear that Amazon continues to invest to become more competitive, and we think the launch of Amazon Prime will be an important tool in this effort,” Bradesco BBI’s analysts led by Richard Cathcart wrote. “However, we remain optimistic about the ability of the local players to compete with Amazon.”

The retail giant has been growing slowly but steadily in Brazil. The 9.90 reais ($3.63) monthly fee for unlimited free shipping and content that includes Amazon Prime Video, Prime Music, Prime Reading and Twitch Prime, as well as several local magazines, may prove a game changer in relation to its seasoned competitors.

The popularization of smartphones in Brazil has led to a 41% growth in e-commerce in the last two years, according to Nielsen’s e-commerce researcher Ebit. While other competitors offer free shipping above a certain price, none offer entertainment, which is included in the Prime Brazil program. Amazon has more than 100 million Prime members all over the world, including most of U.S. households.

Goldman Sachssaid it is “too early” to estimate the potential impact of Prime’s arrival to competitive dynamics, but expects a negative reaction of e-commerce companies.

“We believe that balance sheet flexibility to invest will be important to defend market share in a potentially more competitive e-commerce environment in Brazil,” analysts Irma Sgarz and Thiago Bortoluci wrote.

To contact the reporters on this story: Vinícius Andrade in São Paulo at [email protected];Fabiola Moura in Sao Paulo at [email protected]

To contact the editors responsible for this story: Brad Olesen at [email protected], Will Daley

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”50″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment