(Bloomberg Opinion) — Amazon.com Inc. scored a big victory this week when pop star Lady Gaga said she would sell her new line of cosmetics exclusively on the company’s e-commerce mall.

The deal also shines an uncomfortable light on another category of Amazon shopping that can be frustrating.

Try clicking through Amazon’s beauty products section to the pages for foundation, one of the (ahem) foundations of any makeup line. It’s a notoriously tricky item to buy online or in stores because people must match the shade to their skin tone. I found hunting for foundation on Amazon comically impossible.

There are 200 pages of products grouped seemingly with little reason. It’s not possible to narrow the product listings by liquid or powder foundation — equivalent to not giving people the choice between boxers or briefs.

There’s also not a consistent way to view each product’s different shades. You can narrow the choices to certain brand names, of course, but the search parameters also let people opt for particular Amazon storefront sellers. I want to know how many shoppers seek out only skin care products from “Cooking Marvellous,” one of the millions of Amazon marketplace sellers. Amazon users can search for underwear by color but can’t apparently do the same for lipstick — a product defined by color.

Compare that with beauty product retailer Sephora USA Inc., whose page for foundation offers a quiz to find the right shade, has more common-sense search parameters including powder versus other formulation types and gives a standardized way to see each product’s multiple skin-tone shades.

It’s not perfect, and Sephora has a leg up because it mostly sells beauty products while Amazon sells everything. But this is emblematic of one of Amazon’s greatest weakness. It can be a great place to shop if someone knows exactly what she’s looking for, or for relatively undifferentiated purchases like toothpaste. Again and again, though, Amazon can be clueless about guiding people who aren’t sure what they want, or if they care a lot about how a product looks or works.

So far, it’s tough to prove that this blind spot has hurt a company that will sell close to $350 billion worth of merchandise worldwide this year. Amazon has become the trusted first-look for many shoppers thanks to its wide range of merchandise, seamless purchases, fast delivery and good service. Edison Trends estimated that health and beauty products were the second-most purchased category on Amazon last year. (Popular purchases appear to be basics like soap, rather than products that require more subjectivity such as cosmetics.)

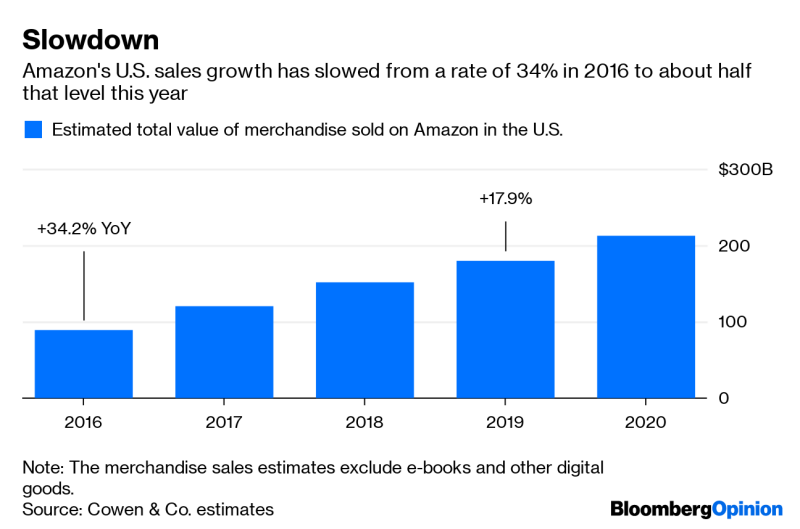

But Amazon’s sales growth is noticeably slowing now. To keep grabbing a bigger share of people’s wallets, it needs to crack the 90% of U.S. retail spending that still happens in physical stores. There are big categories such as groceries, clothing and beauty and personal care products — a $500 billion spending category globally, according to Euromonitor — that should be fertile ground for the e-commerce king. The trouble is, Amazon doesn’t always seem to know how to sell those products in ways people want or expect.

All of that makes it worth watching when Lady Gaga’s makeup line hits Amazon for pre-sale on Monday — coinciding with the company’s now two-day-long Prime Day. There are celebrities who have pleasant, easy-to-navigate shopping sections on Amazon — check out Martha Stewart. Let’s hope Lady Gaga gets this treatment and not the free-for-all that is much of the rest of Amazon.

A version of this column originally appeared in Bloomberg’s Fully Charged technology newsletter. You can sign up here.

To contact the author of this story: Shira Ovide at [email protected]

To contact the editor responsible for this story: Daniel Niemi at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shira Ovide is a Bloomberg Opinion columnist covering technology. She previously was a reporter for the Wall Street Journal.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”56″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment