In the second quarter of this year, Americans didn’t get a stimulus check, many were prevented from collecting an additional $300 a week in unemployment benefits — but you wouldn’t know that from looking at their credit scores.

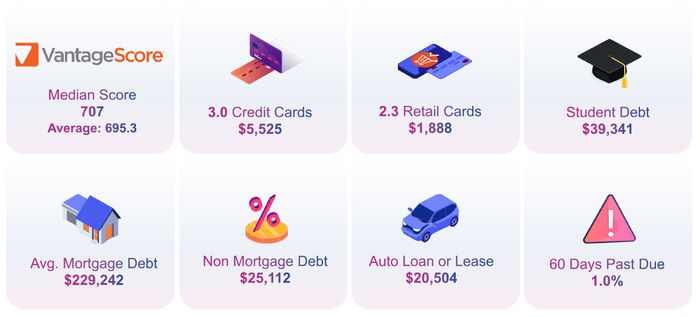

Americans’ average Vantage credit scores rose to 695 last quarter, a seven-point increase from the second quarter of 2020, according to Experian’s annual State of Credit report published on Wednesday.

Americans’ average credit scores are the highest they’ve been in over a decade, according to Experian EXPN, +2.55%. Generally speaking, a Vantage score above 670 is considered good.

Source: Experian’s annual State of Credit report

The fact that Americans’ credit scores are continuing to improve is year-over-year even during the pandemic is also “reflective of people’s awareness of their credit,” said Rod Griffin, senior director of consumer education and advocacy at Experian.

“Americans’ average Vantage credit scores rose to 695 last quarter, a seven-point increase from the second quarter of 2020”

“You can ask people now what their credit score is, and they may not know what exactly the number is, but they’ll know what a credit score is and where to find it,” Griffin told MarketWatch.

In fact, consumers are currently entitled to a free weekly credit report through annualcreditreport.com. Typically, these reports are only free once a year, but the three major credit reporting agencies (Equifax EFX, -1.09%, Experian and Transunion TRU, -0.77% ) are providing free weekly reports through April 2022.

Stimulus programs also helped Americans improve their credit scores

On top of this, during earlier phases of the pandemic, Americans improved their credit scores by paying off credit-card debts with stimulus funds they saved and by cutting down spending, naturally, while much of the economy was closed to curb the spread of COVID-19.

The student-loan repayment pause and the eviction moratorium also helped free up some cash to pay off pre-existing debts, which in turn boosted many Americans’ credit scores.

The U.S. Department of Education announced last month that the student-loan repayment pause will end in January of 2022. While the federal eviction ban is set to expire next month, though some states including New York and California have pushed the expiration date further.

The end of the student-loan repayment pause could help boost many borrowers’ credit scores, said Griffin.

“In the second quarter of 2020, Americans’ average credit-card balances were $5,897 but they now hover at $5,525.”

By January, the majority of student-loan borrowers “will be in a position to continue to pay those student loan debts on time,” Griffin said, citing the improving economic conditions and record 11 million job openings in the U.S. “That will help improve their scores.”

The end of the eviction moratorium is not likely to directly impact Americans’ credit scores given that evictions aren’t included in credit reports, Griffin said.

In the meantime, Americans are continuing to decrease their credit-card balances and non-mortgage debt using stimulus funds they saved.

In the second quarter of 2020, Americans’ average credit-card balances were $5,897, but they now hover at $5,525. While nonmortgage debt declined from $25,483 to $25,112.

Experian’s credit report “showcases the resiliency of American households,” said Joseph Mayans, principal economist at Advantage Economics LLC, a Salt Lake City-based economic analytics firm, in a statement published by Experian.

“People used their stimulus dollars to stay on top of their bills and pay down debt, which boosted average credit scores across all generations,” he added. Overall the report “shows the overwhelming success of the fiscal support packages.”

Add Comment