NVIDIA’s NVDA Q3 earnings were much anticipated as one of the 10 largest components of the Nasdaq 100. The stock also tends to have big movements after reporting. On the contrary, NVIDIA’s movement following yesterday’s report has been subtle.

Let’s take a look at what’s going on with NVDA stock post-earnings.

Q3 Results

Investor sentiment toward semiconductors stocks has been low this year as consumers strayed away from technology products during a high inflationary environment. Better than expected CPI numbers last week and Q3 earnings mostly in line with estimates from AMD earlier in the month had given NVDA stock a boost before its release.

NVDIA’s dominance as a worldwide leader in visual computing technologies and the inventor of the graphic processing unit (GPU) made its Q3 results and guidance significant to the broader outlook for chip demand.

In its Q3 results, NVDA missed earnings expectations by -17% with EPS of $0.58. This represented a -72% decline from Q3 2021 but up 4% from the previous quarter. The company was able to slightly beat top line expectations with sales of $5.93 billion. This was down -17% from a year ago and -12% from the previous quarter.

Image Source: Zacks Investment Research

Data Center, NVDA’s largest segment that offers accelerated computing solutions saw its revenue jump 31% from a year ago at $3.83 billion. However, revenue from NVIDIA’s gaming segment was down -51% at $1.57 billion. Gaming unit setbacks and an inventory charge due to low demand for data center chips in China forced its gross margins lower.

Founder and CEO Jensen Huang said the company is adapting to the macro environment, correcting inventory levels, and paving way for new products. This appeared to calm investors’ nerves and prevent a big selloff after NVDA posted its second straight earnings miss. NVDA had previously beaten expectations for 14 consecutive quarters.

The company gave guidance for Q4 sales at $6 billion, plus or minus 2%, with the Zacks Consensus Estimate at $6.23 billion. NVDA shares fell 1.4% Thursday following its after-hours report yesterday.

Outlook

Year over year, NVDA earnings are now expected to decline -23% in its current fiscal 2023 at $3.39 per share. FY24 earnings are projected to stabilize and jump 31% to $4.45 a share. Earnings estimates are trending down this week after the Q3 report.

Sales are now expected to be virtually flat in fiscal 2023 and rise 13% in FY24 to $30.64 billion. This has the company in line to almost triple its 2020 revenue of $10.9 billion. However, sales estimates have started to decline following the report as well.

Performance & Valuation

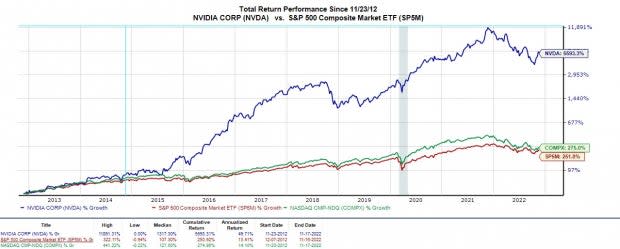

NVDA is now down -46% YTD to underperform the S&P 500’s -18% and the Nasdaq’s -29%. Over the last decade, NVDA’s total return is still an astonishing +5,593% to crush the benchmark and the broader technology sector.

Image Source: Zacks Investment Research

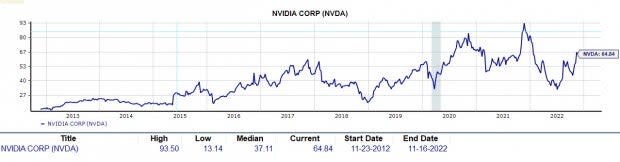

Following its Q3 report, NVDA trades at 64.8X earnings. NVDA still trades at a discount to its decade-high of 93.5X but above the median of 37.1X. Wall Street’s willingness to pay a premium for NVDA may also begin to waver after consecutive bottom-line misses.

Image Source: Zacks Investment Research

Bottom Line

NVDA currently lands a Zacks Rank #4 (Sell), in correlation with declining earnings estimate revisions after Q3 earnings. Missing EPS expectations for consecutive quarters along with underwhelming guidance may also weigh on the near-term performance of the stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Add Comment