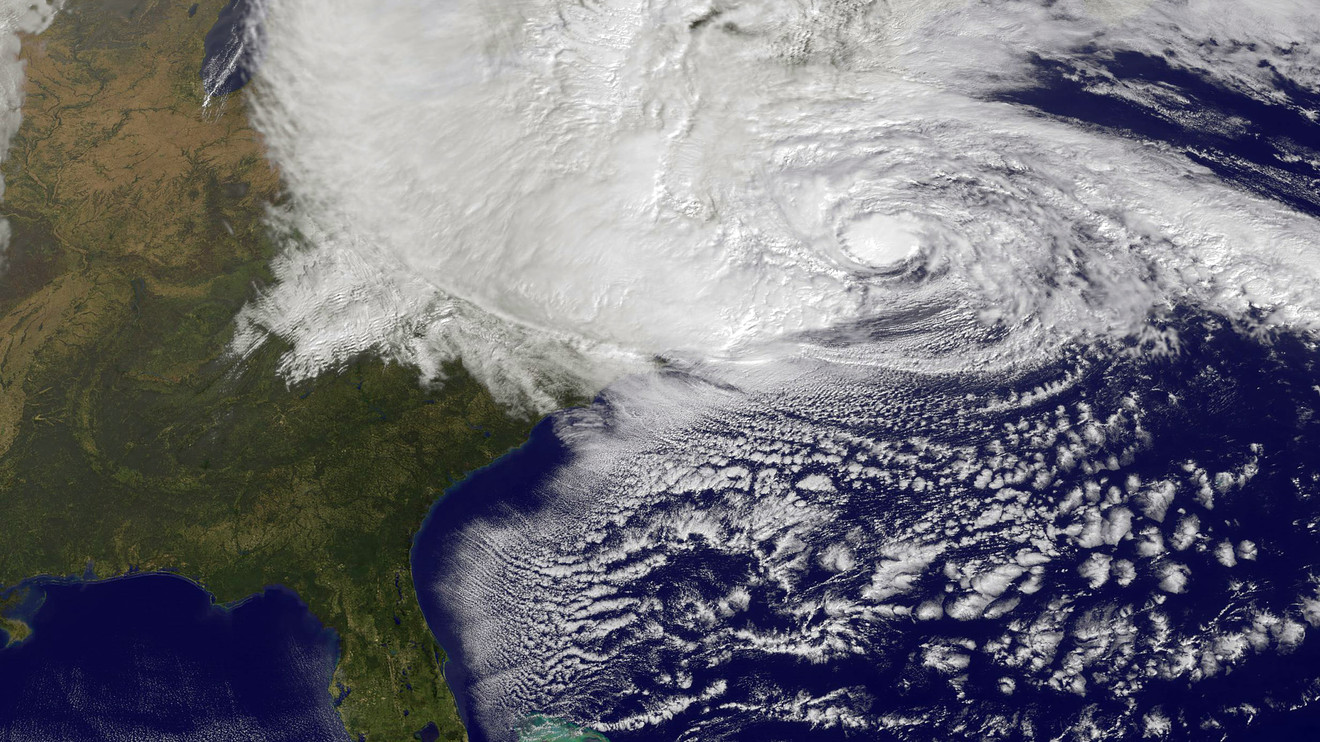

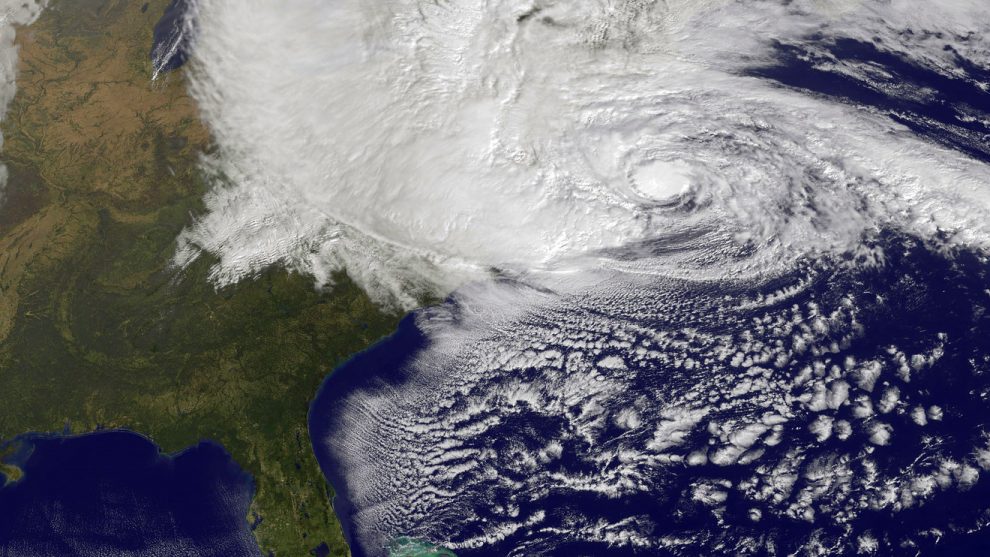

The 2019 hurricane season begins Saturday, and millions of home across the Atlantic and Gulf Coasts are at risk of being damaged by storm surge from a tropical cyclone.

More than 7.3 million single- and multi-family homes are located in areas along the Gulf and Atlantic Coasts that could be affected by storm surge if a hurricane or tropical storm were to hit, according to a recent report from property data firm CoreLogic CLGX, -2.00% . Altogether, it would cost an estimated $1.8 trillion to rebuild these properties.

Regionally, the Atlantic Coast is at a higher risk than the Gulf Coast with 57% of the total number of homes at risk of storm surge damage.

Don’t miss: What you need to know about disaster insurance

Florida has more than 2.9 million homes that are located in areas prone to storm surge damage, more than any other state. Louisiana is second, followed by New York and Texas.

Although it is located further north and rarely is hit by tropical storm, the New York City metropolitan area had the great storm-surge risk of any city, according to CoreLogic’s analysis. The region, which includes Newark and Jersey City, has over 831,000 homes at risk. The reconstruction cost value of these properties exceeds $330 billion.

Though hurricanes are categorized by their wind speeds, flooding and storm surge have caused more damage during tropical storms in recent years. For instance, the inland flooding and storm surge caused by Hurricane Florence resulted in between $19 billion and $28.5 billion in damage when it hit the Carolinas and Virginia last year, per CoreLogic.

“We cannot rely on the hurricane category alone to give us a sense of the potential loss,” Tom Jeffery, senior hazard scientist at CoreLogic, said in the recent report. “A Category 5 hurricane in an area with few structures may be far less devastating than a Category 1 hurricane in a densely populated area.”

Also see: Why Atlantic hurricane season should make commodities traders nervous

Despite the growing risk flooding poses to homeowners across the country, lawmakers have continued to punt on restructuring the National Flood Insurance Program, which provides insurance policies in parts of the country where having this protection is required by mortgage lenders.

On Thursday, Congress passed a bill that extended the program’s funding for two weeks. Had the measure not passed, the program would have expired on Friday and threatened numerous home sales nationwide. Since 2017, lawmakers have passed short-term extensions like this 10 times, according to real-estate news outlet HousingWire.

But observers say that the program needs more than just additional funding in the face of climate change. With more homes across the country at risk of severe flooding, advocates argue that Congress should shift the program’s mandate from serving as a safety net for homeowners whose homes are damaged by severe weather toward encouraging people to move away from flood-prone areas.

Add Comment