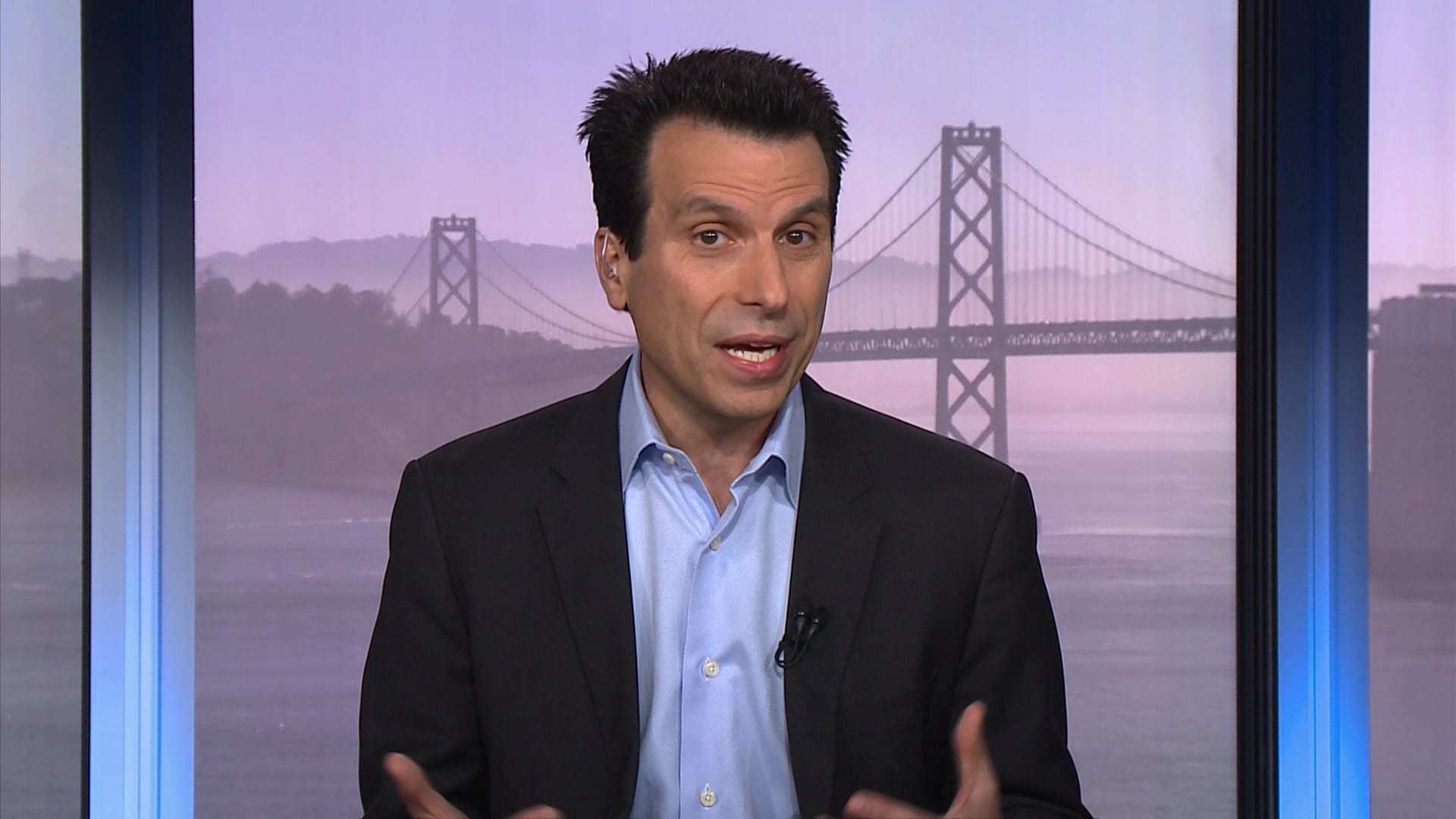

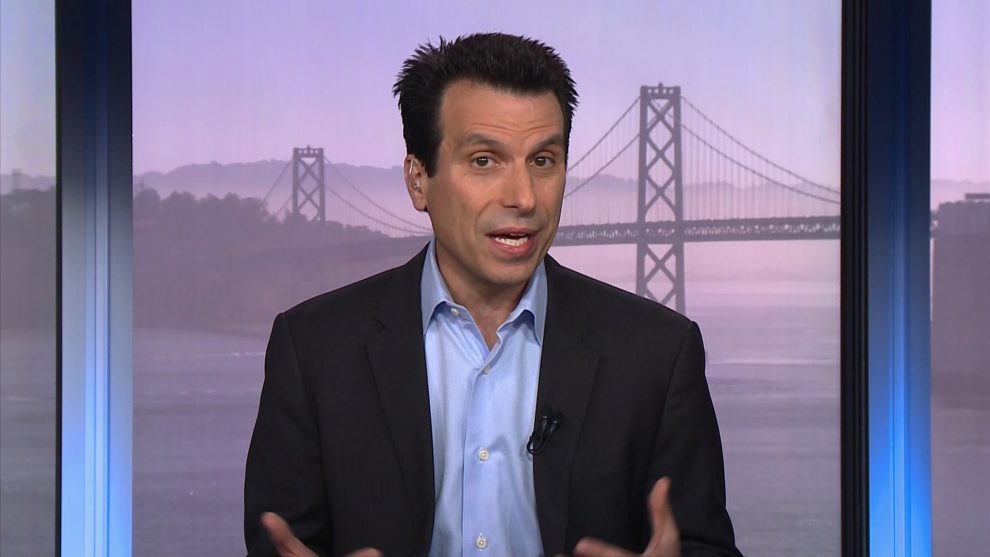

Autodesk president and CEO Andrew Anagnost in June 2017.

CNBC

Autodesk shares plunged more than 11% in extended trading on Tuesday after the software company said that the trade war could hurt its financials in the second half of the fiscal year.

“While we continue to execute well and are not materially impacted by current trade tensions and macro uncertainty, we are taking a prudent stance to our second half fiscal 2020 outlook,” Autodesk said in its second-quarter earnings report.

The company said it expects annualized recurring revenue for fiscal 2020 of $3.43 billion to $3.49 billion, down from its previous prediction of $3.5 billion to $3.55 billion.

For the quarter ended July 31, the company reported earnings of 65 cents per share excluding certain items, and GAAP revenue of 18 cents per share, on revenue of $797 million. Revenue was up 30% from the year before.

Autodesk’s stock has gained 17% so far in 2019, outperforming the S&P 500, which is up just under 15%. The company, whose software is used by architects and engineers as well as people in the media and entertainment industry, has pushed its offerings to the cloud in recent years, establishing a business built more on subscriptions.

Fears around the U.S.-China trade war have dragged down the broader market over the past month and have led some economists to predict a recession is on the horizon. In its earnings statement, Autodesk didn’t say what specific concerns it has about a slowing economy and added that its “recurring revenue model is much more resilient than in prior cycles.”

However, uncertainty about what President Donald Trump may do next is leading to cautious expectations for the next couple quarters.

“Autodesk’s business outlook for the third quarter and full year fiscal 2020 takes into consideration the current economic environment and foreign exchange currency rate environment,” the company said.

The stock dropped as much as 11% to $133.94 after rising 1.6% during regular trading to close at $150.21.

WATCH: Trump may have learned his lesson from Friday sell-off

Add Comment