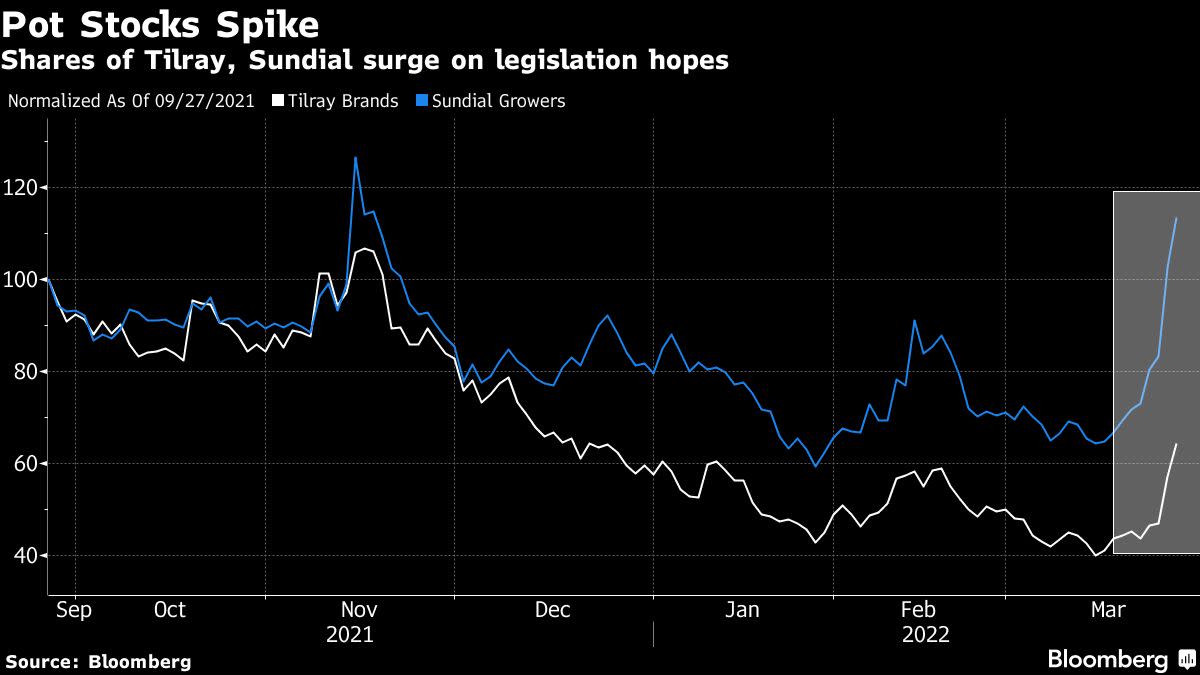

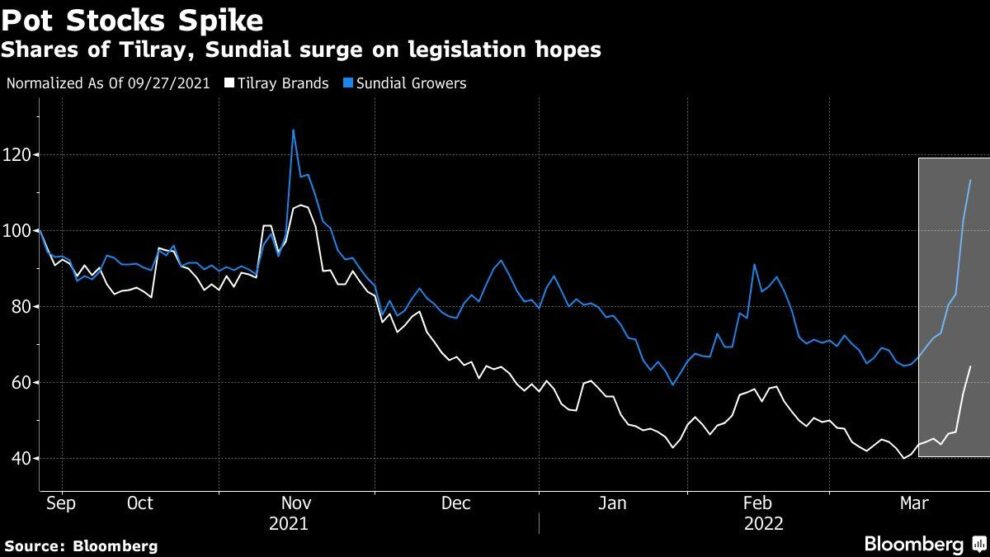

(Bloomberg) — Short sellers in cannabis stocks are feeling the squeeze as Tilray Brands Inc. and Sundial Growers Inc. soared more than 19% each, extending gains from Thursday as a House panel said it would vote next week for the second time to decriminalize marijuana.

Most Read from Bloomberg

Pot stocks, which have languished this year, also got a boost this week from deals in the sector and Senate passage of a bipartisan bill that would expand scientific and medical research on marijuana and its compounds. The global cannabis market’s growth hinges on legalization in the U.S. However, the glacial pace of federal legalization efforts in the U.S. has sowed doubts it will happen anytime soon.

Tilray jumped Friday to its highest levels since late last year while Sundial Growers Inc. and U.S. shares of Canopy Growth Corp. and Aurora Cannabis Inc., while down slightly on Friday, surged on Thursday. Short sellers in these four stocks are down more than $260 million this week, according to S3 Partners data.

With bearish bets in these stocks mounting over the past month, “this short selling will not only wane as mark-to-market losses mount but shorts will be squeezed into reducing their short exposure,” said Ihor Dusaniwsky, a managing director at S3 who covers predictive analytics.

Two microcaps in the sector, HEXO Corp. and cbdMD Inc., could also feel the pinch, Dusaniwsky said in an interview.

ETFMG Alternative Harvest ETF, or MJ, the largest fund tracking the pot industry, has climbed almost 8% over the past two sessions.

Still, shorts may not be ready to close their bets just yet as analysts seemed less enthused by the developments, saying any decriminalization would run into obstacles in the Senate.

“Cannabis legislation is not about the House or the White House. It is all about the Senate,” Cowen analyst Jaret Seiberg wrote in a note, saying that the House vote next week will be symbolic and should demonstrate how much GOP support cannabis legalization has in the chamber. Lesser measures targeting cannabis banking may have a somewhat better chance of passage, according to policy analysts.

It’s been an optimistic week for pot stocks. Two acquisition deals announced earlier in the week sparked the initial rally in the sector with Cresco Labs agreeing to buy Columbia Care for about $2 billion, and Aurora Cannabis’s purchase of TerraFarma Inc., owner of craft cultivator Thrive Cannabis.

While most marijuana stocks are still in the red this year, Tilray’s shares are now about 5.5% higher in 2022 and Sundial is up 29%.

(Updates with short interest, S3 commentary and shares throughout.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment