Nvidia’s stock went from unstoppable to nearly uninvestable in the matter of a few weeks last year and has not recovered.

The sudden drop in Nvidia’s NVDA, -3.58% stock price and a competitive ecosystem that’s hard to understand are two reasons the chipmaker has scared away growth investors, who have opted for momentum bets such as cloud-software companies. The fact that semiconductor companies are cyclical, and mired in the U.S.-China trade war, has further overshadowed Nvidia’s growth potential.

But the real story is that Nvidia is spring-loaded as its product offerings quietly gather strength in a market of enormous magnitude: artificial intelligence (AI). The path for Nvidia’s market domination in the AI economy, worth $15 trillion over the next decade, will be choppy now and exhilarating later.

Nvidia’s profits have been slammed over the past two quarters, and will require a few more quarters to return to levels before the cryptocurrency bust, which reduced demand for Nvidia’s mid-range graphics chips. A spectacular comeback is not likely when the company reports earnings Thursday after the stock market closes.

Nvidia earnings outlook: The bar for data center sales may not be low enough

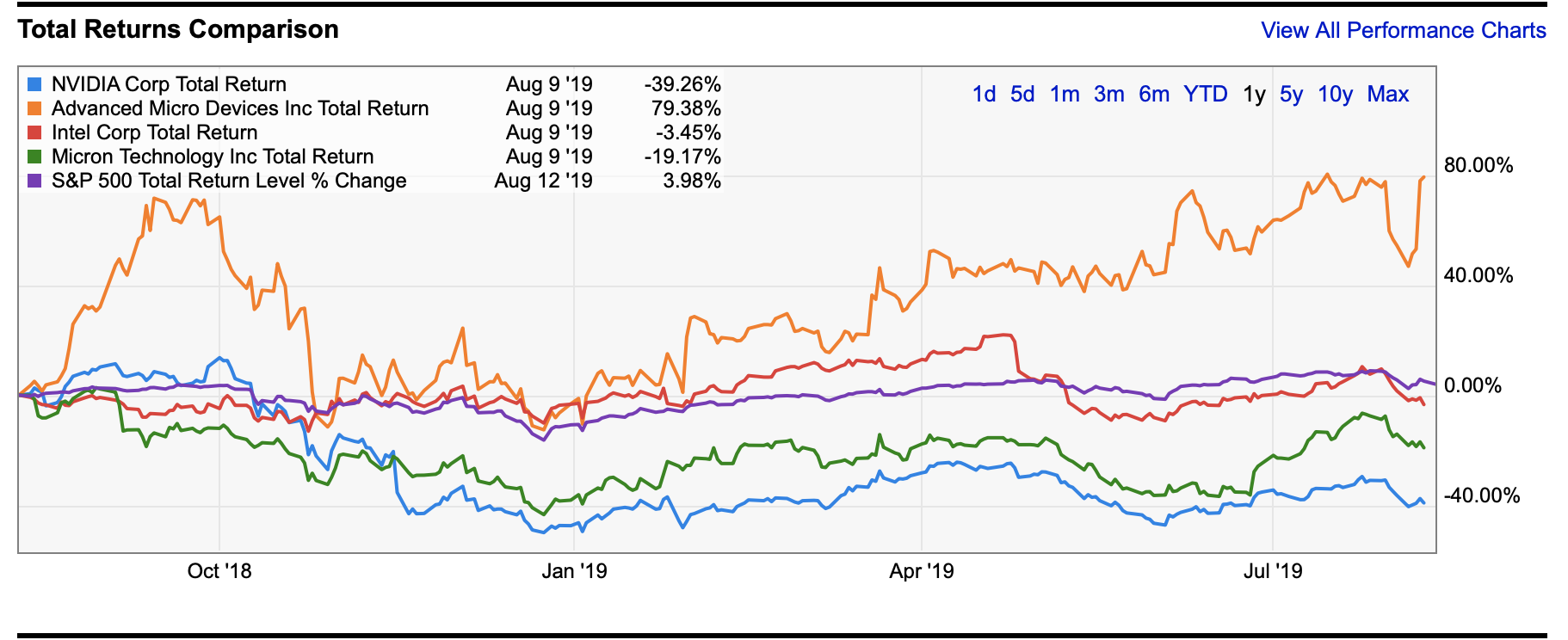

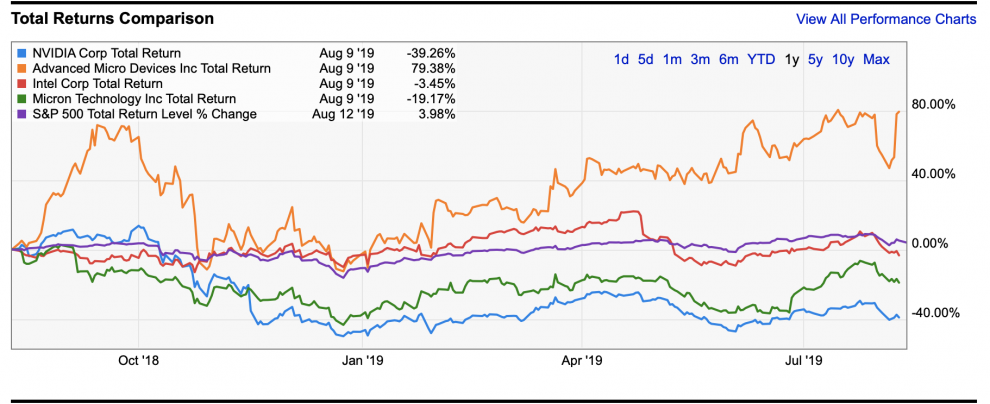

In the first quarter, Nvidia reported $394 million in net income and earnings per share (EPS) of 65 cents, down from $1.24 billion and EPS of $2.05 a year earlier. Analysts are predicting EPS of $1.07-$1.24 for the third quarter. Still, profit margins are better than those of rival AMD AMD, -5.48%, which booked net income of $35 million on revenue of 1.53 billion in the second quarter. Despite that, AMD’s stock has risen 79% over the past 12 months, compared with Nvidia’s 40% drop.

Ycharts

Ycharts

Nvidia vs AMD

Taking a somewhat contrarian stance, I do not regard AMD as Nvidia’s primary competitor. AMD is more focused on Intel INTC, -1.92% and taking market share from the CPU data center. Nvidia’s true rivals are FPGA chips from Xilinx XLNX, -3.04% and Intel/Alterra. I also believe AMD will have to choose if it plans to go against two 800-pound gorillas (Intel on CPUs and Nvidia on GPUs). It would be nearly impossible to stave off Nvidia, which is putting all of its weight into the GPU data center with the acquisition of Mellanox and new partnerships such as with Arm on AI and high-performance computing software. That will help strengthen Nvidia’s lead, which already owns over 90% of the cloud infrastructure-as-a-service market.

Chief Executive Officer Jensen Huang had an excellent quote that described Nvidia’s ongoing cooperation with CPUs as the necessary backbone to GPUs, and why his focus has been elsewhere in the data center stack. It helps to provide a glimpse into his future strategy.

“These two types of processing are going to be here to stay,” he said. “With accelerated computing, we don’t suffer from Amdahl’s Law — we obey it, and the thing that you don’t accelerate becomes the critical path. We believe in fast CPUs, and that is why we work with all of the world’s fastest CPU makers — IBM IBM, -2.90%, Intel, AMD, Arm.”

Huang went on to say he’s focused on the X factor, or what will accelerate the path forward at the highest percentages possible. Rather than compete with many players on CPUs, Huang wants Nvidia to be the leader in the highest growth piece of the data stack — parallel computing and acceleration, especially in AI. The $7 billion acquisition of Mellanox, announced in March, will help Nvidia accelerate the performance of GPUs while maintaining a low barrier to entry for developers who favor Nvidia’s CUDA platform for AI development.

Mellanox acquisition

To illustrate how Mellanox accelerates the performance of GPUs, Nvidia and Mellanox support more than 250 of the world’s top 500 super computers, including the world’s two fastest supercomputers, Sierra and Summit, operated by the U.S. Department of Energy.

Mellanox’s Ethernet switch systems are the most used internal system in the top 500 in a recent report released at ISC High Performance, with 247 systems, and InfiniBand is the second most-used, with 140 systems. However, InfiniBand, a computer-networking communications standard, connects the most high-powered computers where the presence of Ethernet is nearly non-existent.

This is clearly a strategic acquisition for Nvidia as Mellanox has small profits (net income of $38.4 million in the second quarter) and profit margins of 2%, and the acquisition will require all of Nvidia’s cash reserves. As a result, Nvidia may have to take on debt. Some speculate that Chinese regulators could block the acquisition, similar to what happened when Intel attempted to acquire NXP Semiconductors. This is less likely, though, as Nvidia and Mellanox are in separate categories and don’t pose security risks from communications. In addition, China is a large customer of Nvidia for AI applications and stands to benefit from the combined company.

Nvidia’s strategic goal is to close the gap between GPUs and FPGAs, a competing AI and machine-learning (ML) chip that has 10 times better power consumption and four times better general-purpose compute. FPGAs deliver better performance and lower latency. However, FPGAs are more challenging to develop as they require custom hardware development skills that are outside the scope of many software developers.

In other words, Nvidia is not acquiring Mellanox to simply own InfiniBand and Ethernet, but rather to boost its GPUs as the best data center option available. Nvidia is aligning its architecture with speed, as Mellanox supports Virtual Protocol Interconnect (VPI), which allows the ubiquitous Ethernet to provide bandwidth as cheap as possible, and InfiniBand to deliver higher throughput and fewer bottlenecks during high loads. Mellanox has done an excellent job of taking market share from Ethernet incumbents, such as Cisco CSCO, -3.74%, Arista Networks ANET, -4.67%, Juniper Networks JNP, +1.63%, Hewlett-Packard HPE, -3.47%, Dell DELL, -2.58% and Intel. Some of this is due to Ethernet, and also InfiniBand, and now a hybrid of the two.

Nvidia’s Mellanox acquisition helps increase Nvidia’s competitive lead on GPUs, while also slightly reducing the requirement for CPUs from companies like Intel and AMD. Mellanox can be leveraged to speed up GPUs while closing the gap in latency performance with FPGAs (Xlinx and Intel/Alterra). This is a strategic acquisition for Nvidia and Mellanox to become the strongest combination for artificial-intelligence and machine-learning computations.

Declining data center revenue

This thesis hinges on data center GPU revenue, which is declining quarter-over-quarter across both Nvidia and AMD. The Mellanox acquisition won’t close until the end of the year. Plus, rumor has it, China may delay trade talks through the 2020 election. Therefore, timing remains a primary challenge for Nvidia investors to capture this forward-looking opportunity.

Nvidia’s data center sales have fallen over the past two quarters. According to MarketWatch, some analysts predict data center revenue will continue to decline through the third quarter of this year.

AMD reported its average GPU sales price was down slightly quarter over quarter due to lower data center GPU sales. Still, sales rose year over year.

Nvidia’s singular focus is GPU-powered cloud and artificial intelligence applications, and FPGAs are the second runner-up rather than AMD’s GPUs. According to Liftr Cloud Insights, 97.4% of cloud infrastructure-as-a-service (IaaS) compute instances deploy Nvidia’s GPUs across the top four cloud providers. The top four cloud providers are Amazon AMZN, -3.06%, Microsoft MSFT, -2.48%, Google GOOG, -2.28% GOOGL, -2.31% and Alibaba BABA, -0.84%, and account for 62.3% of the IaaS and platform-as-a-service markets. According to the insights report, AMD accounts for only 1% of the cloud IaaS market.

As with many of the best growth opportunities, the current earnings outlook does not accurately portray Nvidia’s potential. This will be true for a few quarters. It may require sniper-like timing (or a generous trailing stop), but betting on Nvidia and AI will have recoil-like gains when there are clearer skies for semiconductors and hyper growth in the $15 trillion AI economy.

Beth Kindig is a San Francisco-based technology analyst. She publishes a free newsletter on tech stocks at Beth.Technology and runs a premium research service.

Add Comment